Register for a CI Markets account for FREE! No credit card required: https://completeintel.com/markets

Welcome to “The Week Ahead” with your host, Tony Nash https://twitter.com/tonynashnerd. In this episode, we’re joined by a panel of seasoned experts:

🔵 Markets & Mayhem – https://twitter.com/Mayhem4Markets

🔵 Tracy Shuchart – https://twitter.com/chigrl

🔵 Albert Marko – https://twitter.com/amlivemon

Join us as we dig deep into three important topics in markets:

- Reacceleration of Inflation & Its Impacts: Mayhem takes the lead in discussing the resurgence of inflation, impacting sectors, and the broader economy. With retail sales surging and job openings dwindling, what lies ahead? Are we missing critical signals from the bond market?

- Peak Oil by 2030? LOL 🤣: Tracy Shuchart tackles the eyebrow-raising prediction that fossil fuel demand will peak by 2030, as stated in the recent IEA report. Amidst rising crude consumption, OPEC’s response, and soaring energy prices, we scrutinize the report’s assumptions and the history of peak oil predictions.

- Beneficiaries of US Election Year Largesse: Albert Marko explores the intriguing dynamics of election-year spending. From corn to other sectors, we discuss which industries may benefit from politicians’ efforts to woo voters with taxpayer dollars.

Join us for an engaging and insightful discussion that simplifies complex economic topics for everyone to understand.

Key themes:

- Reacceleration of inflation & its impacts

- Peak oil by 2030? LOL

- Election year investments

Transcript

Tony Nash

Hi, everybody. Welcome to the week ahead. I’m Tony Nash. Today, we’re joined by Markets & Mayhem, Tracy Shuchart, and Albert Marko, guys, thanks so much for joining us. We’ve got a lot to talk about today. The first is the reacceleration of inflation we saw at CPI, and we want to talk about that reacceleration and the impacts on markets and other things. We’ll talk about that with Mayhem. Next, we want to talk about peak oil. There’s a note out this week about peak oil by 2030. We want to talk with Tracy about that and how realistic that is. Then finally, we want to talk with about investments that you need to keep an eye on going into an election here. Albert’s obviously well-versed in both elections and in markets, and it’ll be important to have that discussion with him. So before we get started, I want to let you know about a new free tier we have within CI Markets, our global market forecasting platform. We want to share the power of CI markets with everyone. So we’ve made a few things free. First, economics. We share all of our global economics forecasts for the top 50 economies.

Tony Nash

We also share our major currency forecasts as well as Nikkei 100 stocks. So you can get a look at what do our stock forecast look like. There is no credit card required. You can just sign up on our website and get started right away. Check it out. CI Market’s Free. Look at the link below and get started ASAP. Thank you.

Tony Nash

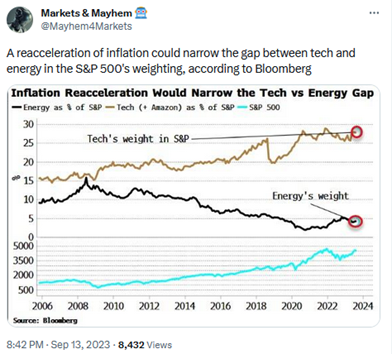

Guys, thanks everyone for joining us. Mayhem, I want to talk with you first. We’ve talked about the reacceleration of inflation in Q3 for a long time on this show, and we’ve started to see it again, most acutely with energy prices, of course. Retail sales came in stronger than expected. CPI came in line. At the same time, we’re seeing Jolt’s say down below nine million, which it’s still eight and a half something, still pretty good. We’re seeing pressure on things like residential real estate. We all know about the pain in commercial real estate. So a few questions for you. First, how do you expect the reacceleration of inflation to impact the sector rotation? You tweeted a chart out about this. So can you talk us through that?

Markets & Mayhem

Yeah, sure. I mean, we’re in the early stages of what might be a reacceleration of inflation. We’re seeing a little bit of that. Of course, commodity prices are leading the way, but the PPI print we got yesterday, the biggest contributor was energy, and the biggest contributor from energy was diesel fuel. Diesel is used to move everything everywhere, so it’s a pretty big deal. When that price starts to go up, it has secondary impacts that can boost prices elsewhere. I think that’s something to keep an eye on. We got import prices today. They came up 0.5% month over month, which was greater than the 0.3% expected and much higher than last month at a 10th of a %. You annualize that, that would be a 6% run rate, which would be unacceptable for import cost rising. This is all in the back of a rising dollar. It’d be interesting to see what that looks like if that wasn’t the case. Nevertheless, I think that in terms of the rotation that it could spark, I think that old economy companies come back into favor, particularly energy stocks. We’ve had a really robust run in crude.

Markets & Mayhem

I want to say it’s up above, it’s at 52 week highs or close to 52 week highs. It’s certainly at 2023 highs yesterday with the pricing that we saw. I think that we’re starting to see some areas where supply in elasticity is becoming a bigger problem because demand is starting to creep up. I think for energy stocks who had a pretty bad quarter two in terms of their earnings, we’re seeing the exact opposite backdrop this quarter, where prices of energy are rising. So margins for these companies should be rising and I think that presents an attractive opportunity for some of the better run companies, for investors to look at the ones that have better margins, clean balance sheets as an opportunity here moving forward.

Tony Nash

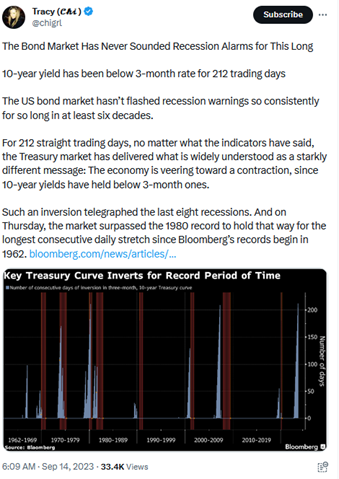

Great. It’s interesting. I think this is the third week in a row where people have talked about the rotation into energy. Of course, Tracy and Albert have been saying this for a long time that we’d see prices reaccelerating Q Three and that we’d see energy rise into the end of the year. This is really, it’s really consistent and it’s what we’re seeing out there. I want to understand your expectation of, say, a recession. Tracy put a tweet out about this earlier this week around bonds. Is a recession your baseline view? How would that impact some of the credit risks we see out there, meaning real estate and other things? Can we talk through this with respect to say, the 10-year and then around recession. Then what are your expectations around credit risks?

Markets & Mayhem

Sure. In terms of the 10-year, there’s a pretty decent positive correlation between the 10-year note yield and the price of oil. I think as long as the price of oil is moving higher and people are becoming more concerned about forward risks for inflation, there is some upward pressure on rates that can still exist and still push these rates higher from where they are right now. Now, if that view starts to shift to one where people are more concerned about a recession, about a looming economic slowdown, and they are about the rate of inflation, then we can start to see a bit of a different dynamic there. We also have some big unknowns. We have a huge basis trade with the largest amount of net short exposure to treasuries, which could add some fireworks into the mix. Now, granted, these folks are all long fixed income, but they have some positions that could work against them, that could add some volume, and the Fed and Treasury are looking at this with a little bit of concern. Now, moving into the idea of a recession, I think it’s something that becomes more likely. It’s like a it’s for stalled, but not canceled scenario.

Markets & Mayhem

I don’t believe that the soft landing is the most likely outcome for how this credit cycle resolves. I still think we’re still in that older credit cycle that the Fed and other central banks are doing what they can to end. I don’t think that we can get rid of the inflation bogeyman without some of that pain. I think central bankers are motivated. I don’t know that we’re going to see a hike next week, but I think November, December is likely. In terms of what that looks like, I’m going to have to look at really first quarter next year, where I think we start to see more evidence of that becoming a scenario that plays out. I think we’ll see some tell-tale signs in the fourth quarter leading into that. What that looks like to me is actually a slowdown in the economy that amplifies credit risks. I don’t think it’s going to be the other way around. I think it’s going to be that the economic slowing that we’re seeing is going to boost up delinquency and default rates across a variety of different instruments. That’s going to increase pressure, and that’s where you’re going to start to see some of those problems percolate.

Markets & Mayhem

If we look at, for example, the bank term funding program, we can see that it’s now surging again, that borrowing by banks is on the rise because longer duration has lost value. We’ve seen bond yields creep up to the highest levels this year, and in some cases, the highest level in decades. There’s a lot of pain on regional balance sheets, and they’re going to that window again, telling the Fed, Look, we need 100 cents on the dollar because we’re in a situation where we might have a bit of a liquidity crunch. But on the other side of it, the terms of borrowing from that window are actually somewhat favorable in an environment where they can lend out at 7 % mortgage or 10 % auto loan or credit cards or otherwise on even higher interest rates. So we do see bank lending actually coming back in an environment where the bottom 50 % of consumers don’t even have a thousand dollars or even 400 dollars in a rainy day fund. So if things slow down more, I think that’s where you start to see that domino effect that can hit credit markets. But I think it’s going to be more of the unemployment rate rising, the jobless claims rising, and the services industry breaking that really leads us down that path.

Markets & Mayhem

So my roadmap is I’m looking for jobless claims at 300K a week. I’m looking for unemployment to rise meaningfully above 4%, and I’m looking for the services industry to go into some multi-month contraction. We don’t have any of those things in play yet. That’s why I’m looking forward towards the first quarter of next year with some eye on whether this path has manifested or not to qualify the probabilities of that playing out. But if you look at the yield curve inversion, if you look at leading economic indicators and other things that have been pretty accurate in forecasting prior recessions, all of them still say game on.

Tony Nash

Right. Tracy, that was your tweet. Do you think about that in terms of Mayhem’s order of events?

Tracy Shuchart

As far as what? The yield curve inversion? I know that everybody’s looking at that. What I think that we should at least keep in mind here is that this time may be different because the last… I mean, it’s forecasted pretty much every recession to 2008, but the 2008, right after that is really when we put the pedal to the metal as far as quantitative easing and printing all of this money. We’ve never had a balance sheet this large and dealing with the yield curve inversion at the same time. This really is not my forte, to be honest with you, but I’m just thinking maybe that’s why it’s been prolonged for over 200 days or what it is the longest in history. Or perhaps maybe this time it is different and we do get a soft landing. We’ll have to see.

Albert Marko

Yeah, Tony, the one piece of data that I actually looked at today, this morning and just smirked was the import prices increasing. Because the entire argument for some people criticizing our re-inflation argument for months now has been, Oh, well, we’ll just import deflation. Well, that’s just certainly how not happening at the moment. Prices across the world are increasing. Price of oil across the globe is increasing, demand is increasing everywhere. The notion that we’re going to be able to import deflation for the next two years is absolutely ludicrous and completely wrong.

Tony Nash

Right. I think- Go ahead, Tracey. I also.

Tracy Shuchart

Think we need to pay close attention as far as the inflation scenario goes right now is this United Auto Workers strike, because really, depending on how long that lasts, that puts 24,000 cars at risk of production a day. We all know what happened in 2020 when we had the COVID shutdowns that led to automobile shortages, which led to run up in prices. I would just be keeping an eye on that to see how long this actually lasts. A week, fine, but if this goes into some prolonged strike, that also could be automobiles could be another inflation factor.

Albert Marko

That’s also assuming that they make cars that don’t get recalled every month.

Markets & Mayhem

But that’s a good point on cars too, because cars have become unaffordable for a lot of people where they are at current pricing because people don’t look at cars by price. They look at cars by monthly payment. Monthly payments have never been this high. So most people are already priced out of this market. You add in that scarcity that Tracy is talking about from a supply disruption, and that gets a lot worse and it definitely passes through to inflation as well.

Albert Marko

It’s interesting because I paid less for my G-Wagon than I know that some people pay for a Hyundai Sonata, which is absurd. Absolutely absurd.

Tony Nash

Yeah, if you’ve got a loan- You’ve got a great deal.

Albert Marko

-if you’ve got a loan within the last year, I think you’re paying closer or slightly above what I pay for my payments.

Tony Nash

Mayhem, you made an interesting comment about cars. You said people are priced out of the market. I’m hearing that more and more that people are priced out of the market. But then we see things like retail sales and consumption numbers that are higher. Are those numbers really just coming in based on nominal price increases? Or is it really a volume of transactions? Because at these levels, I really do get worried about a lot of people being priced out of markets.

Markets & Mayhem

Yeah, I think that’s a great question. I think we have a pretty staggering chasm between the bottom 50 % and the top 20 %. And I think that accounts for some of what we’re seeing. You’ve got some folks who have never been doing better and they have no constraints on their consumption. They’re the minority. But then you have the majority and they’re priced out of housing, and they’re priced out of automobiles, and they’re priced out of the lifestyle they used to enjoy. I think that that’s the dichotomy, the K-shaped, if you can even call it recovery, at least outcome, is playing a big role here. I think that’s something that we have to keep an eye on because that bottom half, that’s where the risk is and that’s where the risk continues to be amplified. You see it in auto dealers. They’re continuing to make concessions to sell cars. They continue to cut prices. They continue to do whatever they can. They’ll also buy your car at a higher price, just whatever they can do to massage the numbers to keep cash flow coming in. And the same thing is happening with home builders. They’re making massive concessions.

Tony Nash

So if you’re the Fed and you’re seeing that the bottom 50 % are being kept out of market, what can you do?

Markets & Mayhem

I mean, Powell has spoke to this repeatedly saying that the Fed’s price stability mandate compels them to keep rates high for a long period of time to try to ameliorate that pressure. I think that there is some truth to the fact that you’re not going to be able to quell inflation by just destroying demand, but you can temporarily subduit. So the Fed can sit there with the limited set of tools they have, and they can try to induce below trend economic growth, which is a polite way of we’re running a higher risk of a recession to try to get the monetary policy outcome that we want to happen. On the other side of that, though, longer term, they don’t have any tools to fix this. Once we get into inevitably a new credit cycle and structural inelasticity is still out there, as demand firms up, prices too will firm up and from probably a higher baseline. I think that that sets us up for a bit of a vicious cycle of the Fed having to come in earlier and tighter, but also not ease as much into the next credit cycle full well being aware of those dynamics, unless and until we have some, and good luck with this, but legislative and executive sanity on the matter of supply.

Tony Nash

I’m sorry to laugh.

Markets & Mayhem

About that. No, we have to laugh or we’re going to cry.

Tony Nash

Right, that’s true. Zerp is dead in our lifetimes.

Markets & Mayhem

I don’t know that it’s dead in our lifetimes, but I think it’s dead for the next five or ten years unless things go really abysmally wrong.

Tony Nash

Okay. Albert, do you think the Fed is out of tools?

Albert Marko

No. Do I think they’re out of tools? No. Are they running out of runway? Yeah, I do think they’re running out of runway.

Tony Nash

When you say running out of runway, what do you mean?

Albert Marko

Well, the tools that they can use are diminishing at the moment. For instance, oil, I know that they use futures options, SPR releases to manipulate the price of oil to bring down CPI numbers. Obviously, the SPR is being drained over and over again. They come up with a 2.9 million-barrel purchase, and then a week later, the Biden administration says, Oh, well, we might release some more SPR. They’re running out of runway at the moment. This is mainly because they’ve misjudged pretty much everything from day one. The accumulation of wealth, specifically from the boomers in terms of housing and whatnot, just runs ruin for all Fed policy. They can’t account for it.

Markets & Mayhem

That’s actually an interesting point, too, in terms of labor scarcity because the boomers have been the biggest component of the labor workforce. Just during COVID, they said, I’m not going to go to work anymore, and many never went back. The whole tightness in the labor supply, it’s not really that tight. If those folks came off the bench and really, sadly, there have to be some wealth destruction to encourage them to do that, the labor force scarcity issue would be largely ameliorated for at least three to five years.

Tony Nash

Okay, interesting. Albert, are you also looking for a session that’s going to come? Are you also looking at, say, Q1 of ’24?

Albert Marko

I would say the latest of Q1 of ’24, and It don’t think it’s… I do actually think it’s going to be a soft landing in terms of just the data alone. I don’t know about the reality of the situation, but in terms of data, I think it’ll be a soft landing and pretty brief going into an election year.

AI

Heads up for a short break.

AI

Are you using the potential of AI in your portfolio management strategies? With an impressive 94.7% forecast accuracy on average, you can confidently integrate AI into your approach with CI Markets. Visualize the potential volatility of your portfolio over the next 12 months and gain insights into specific assets that might experience fluctuations. This empowers you to make informed decisions on when to buy, sell, or hold. CI Markets covers a wide range of over 1,600 assets, including stocks, commodities, forex, indices, and economic indicators. Imagine running limitless portfolio scenarios to optimize optimize your gains. Curious about the outcome of removing or adding certain assets? Wondering how your portfolio might evolve in the next 3, 6, or 12 months? CI Markets equips you with answers to these crucial questions. Whether you seek a streamlined portfolio analysis, wish to explore diverse scenarios, or aspire to track your investments with precision, CI Markets is the ultimate tool for you. Ready to learn more? Visit us at completeintel. com/markets.

AI

Thank you and now back to the show.

Tony Nash

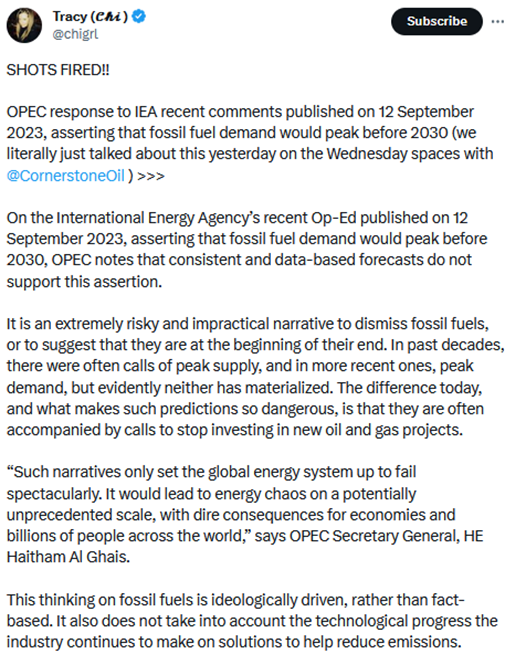

Interesting. Okay, great. Let’s move on to crude markets. Tracy, you put a tweet out about peak oil or peak fossil fuel demand by 2030. We had an IA report recently saying that the world would hit peak fossil fuel demand by 2030. It’s hard, given the demand that we’re seeing, it’s hard to say that with a straight face, but they actually published it. We’ve got crude growth consumption, we’ve got OPEC supply cuts, we’ve got high crude and petrol prices. OPEC responded this week. It wasn’t pretty. It included words like, quote, such narratives only set the global energy system up to fail spectacularly, which is, as you say, shots fired. Can you walk us through this? Are there realistic assumptions underlying the IA assertion that fossil fuels will peak by 2030?

Tracy Shuchart

No, absolutely not. They’ve been wildly wrong for the last 10 years.

Tony Nash

What assumptions are they using? Let’s figure.

Tracy Shuchart

That out. They’ve been wildly wrong about demand numbers for literally the last 10 years and supply numbers for even longer than that. They’ve always had supply way higher than it’s ever been, and they’ve always misjudged demand numbers. Now, this really came into play during the Paris Accords when the IEA decoupled itself from being an independent actual energy agency and latched itself onto the bureaucrats that run Europe and the United States essentially. That was at the Paris Accords. Then became an affiliate or allied with the WEF in 2016. Since then, obviously, their demeanor has been towards Green Energy Clush. A lot of their reports of, I think they said EVs would be 50% of global consumption by now, back in 2016.

Tony Nash

By now?

Tracy Shuchart

Yeah, which was wildly often. They go back and they make revisions, but you never hear about the revisions because they quietly make their revisions. Right now, I think they’re not credible right now. I think they have an agenda and they’re pushing that agenda. I think, unfortunately, even OPEC last year basically kicked them out of being a secondary source of information, demand information in their monthly reports and said, You’re just not a credible agency anymore. We can’t have you as a secondary source.

Tony Nash

OPEC doesn’t trust the IAEA anymore.

Tracy Shuchart

Correct. 100%.

Tracy Shuchart

If you look at this last report where they said, We’re going to hit peak demand, basically their assumption was global oil demand is only going to grow by three million barrels per day out to, I think it was 2028 or 2030 is when they said that we were going to hit the peak demand. However, if you look at the historical norms, oil demand has been growing at over 6 million barrels a day. To suggest that from here on out, we’re going to be at half of that in global growth is a little bit unbelievable. Because you’re just cutting oil demand in half for no real reason, especially when we look at emerging markets and where we’re still seeing demand growing. In fact, as a whole, if we look at emerging markets, it’s starting to surpass developing nations.

Tony Nash

If 2030 really was peak oil, what would we be seeing by now?

Tracy Shuchart

Well, you would have to see not a breakdown in green energy technology that we’re having right now. You just had a bunch of wind companies say, This is not feasible, economically feasible for us to do, or said in the United States to big wind farms. They said, We can’t do this unless we raise our prices by 63%, which obviously goes to the consumer. They also said they’re willing to walk away from that project. No problem. It can’t be some solution. That solution, i. E, would be a bunch of government subsidies, i. E, your tax dollars. You have that. Then you just have Germany come out and say that over 15% of their solar panels are in severe degradation. That’s quicker than they initially thought it was going to be. We’re seeing these problems, and this is what I’ve been talking about this whole time. You can’t frog leap technology. You can’t just make a leap to technology that’s just not there yet. We’re finding out now that this technology is more expensive than we thought, and it’s in degradation a lot sooner than we thought. We’re going to have to need to see a huge technology shift or fusion to come into light, really to be able to change this narrative at this point.

Tracy Shuchart

Because it’s just we’re not there yet. They’re trying to push something and it’s just not there yet.

Tony Nash

We talked last week about NatGas in Asia and how that’s becoming a preferred feedstock in Asia. We saw this week about how in Niger, the government there is changing the basis price of selling uranium to France. It’s going to be up, I don’t know, 300 times or something because France was getting just a heck of a deal. Some of these things, the demand is increasing rapidly, say, for NatGas, and the basis price for some of the nuclear because of this Niger development could be changing for some of these countries. Does that help us get beyond peak oil or does that prolong it because we already have the installed base for peak oil.

Tracy Shuchart

Yeah, I know. I think in peak oil, they include NatGas in that. They include NatGas in that. They take fossil fuels as a whole. So yeah, nuclear would be fantastic. We are seeing more nuclear projects come online. We’re seeing a lot of muffled, particularly in Japan, a lot of muffled facilities come back online. That’s great news. Except for if you’re talking about new projects, you’re talking about giga projects, major nuclear projects, those take years. You’re not really going to see those in the West where you already have projects that started years ago coming into use case within over this next decade, particularly in Asia, there’s a lot of buzz about the new SMRs. That technology is great. They’re faster to build. That’s excellent. It’s really-

Tony Nash

Sorry, what’s an SMR?

Tracy Shuchart

The small nuclear reactors. Okay. A small modular reactor.

Tony Nash

Okay.

Tracy Shuchart

Actually the acronym. That’s great, but still those projects still take time to come online. You’re still not getting away from fossil fuels, particularly as you’re trying to win a lot of these emerging markets off a pole. You’re going to go to NatGas, you’re going to go to… Because again, you can’t leapfrog to technology. Yeah, they want to build wind and solar, but they’re going to run into the same problems that the west is coming and so on.

Tony Nash

Can’t subsidize as much. What does that mean for markets? We’ve talked for a long time about how there’s under-investment in the upstream. We really haven’t had upstream investment since what, 2014 or something? I can’t remember the year that you’ve told us. Do predictions like this just serve as justification for upstream companies to delay investment in the upstream?

Tracy Shuchart

I don’t think that it serves as an incentive to delay. But again, you’re facing these problems that you’re having governments tell them, We don’t want you to be around in five years. Why are you going to invest all of this capital in something that the government keeps telling you we want to get rid of? There’s a ton of obstacles that the Biden administration and the EU Commission has set on fossil fuels in Europe and in the US. It’s just becoming more and more difficult. These companies want to keep investors. How do you keep investors? Dividends, stock buybacks. And things of that nature. They want to keep investors around. There’s just not a lot of incentive right now to vote for CaPEx.

Tony Nash

Okay. Short term impact or shorter term impact. Short to medium term impact on, say, energy companies or energy prices. Do you think this IAA prediction has any impact in, say, the short to medium term, meaning one month to, say, three years. Will this have any impact over the next one month to three years on crude prices, net gas prices, the value of XLE or something like that?

Tracy Shuchart

No, absolutely not.

Tony Nash

Okay. Albert, what do you think?

Albert Marko

I don’t really have much more to add, so Tracy pretty much nailed that one. For me, it’s just like the notion that we’re going to be in some peak oil demand is just silly. I don’t think it’s.

Tony Nash

Yeah, we have to talk about these things, though, right? Because this is what’s out there in markets and we have to… Is this real or is this. Just a desirable-

Albert Marko

But, I mean, like Tracy says, a lot of it’s political nonsense that they just spit out there because they have a narrative to tell. But saying that peak oil is going to be 2030 is just… I mean, that’s years and years away. We don’t know what’s going to happen after the US election. A lot of it has to deal with how policy gets implemented from here on out. If we have a conservative government in the United States, things change drastically. At that point.

Tony Nash

Having been in forecasting businesses for almost 30 years, if you’re going to make a forecast or prediction that’s that far off of reality, you typically want to make it 15-20 years out so nobody remembers it when it happens. They’re saying 2030, which everyone’s going to remember, and in 2030, they’re going to point back and go, Oh, those guys were crazy.

Albert Marko

It’s silly. We have no idea who’s going to won the US elections. The policy can change on a dime.

Tony Nash

Right, Mayhem. What do you think about this? Kind of these long or well, not even longer term, peak oil by 2030. Are you seeing any reflection of this in markets?

Markets & Mayhem

I think it’s a fantasy. I think the peak oil we have to be concerned about is supply, not demand. I think that the biggest problem that we’re confronting here is that policymakers are leading with fantasy and not reality. We want a green revolution. That’s great. Let’s see how we can make that happen without enough oil. Every single part of everything they’re talking about involves using hydrocarbons. I mean, even solar panels, they need quartz mined out of the earth. They need coal mined out of the earth. You’ve got to combine these in really hot furnaces just to make that silicon surface. Everything. I mean, the components of the wind turbines, the magnets, the metals, the sheer magnitude of this stuff. There’s so much hydrocarbons involved with building any of this so-called bridge to a renewable future that it’s pure fantasy to say that we’re going to be seeing peak oil within the next decade or two, in my opinion.

Tony Nash

Okay, so I’ve had this belief for a while, but I want you guys to tell me if I’m wrong. Seems to me that a lot of these fantasy visions of the green future are largely driven by zero interest rate policy and negative interest rate policy. When there’s no cost of money, we have subsidies and we have investments going into things that don’t have a near-term payout. If we continue to have an interest rate environment like we have now, do you think that these green energy plans will continue? Or is my thesis completely wrong?

Tracy Shuchart

No.

Albert Marko

No, It’s not wrong. They pile up debt for research, development and implementation. Anything from wind to solar to name your green technology is just laden with debt, and they can’t take that on if we have interest rates this high.

Markets & Mayhem

I think it’s an interesting burden when we’re looking at solar technology that takes less than a quarter of the photonic energy that is exposed to and converts it into electricity. That right there is a huge problem that we’re not more efficient because we can’t hope to power anything from solar, given how intermittent it is, how far the storage technology has to go, and how we’d have to build really a modular grid. You can’t really have centralized solar power at any conceivable scale that you’re not going to start dealing with impedance issues for the amount that… Because then you start saying, Okay, we’re getting less than 25 %. Well, by the time you get to the end user, maybe you’re getting 12 % of that photonic energy into electricity.

Tracy Shuchart

Maybe.

Albert Marko

That’s exactly- I used to run a solar cell research firm out of the Republic of Georgia years and years ago, and opened my eyes to a lot of the nonsense that comes out there. We have not made any headway and solar technology. We still use silicon cells, which are 22% theoretical max. Once you put on the filters and all the degradation, you’re at anywhere between 10 and 15% at max when it comes to commercialized products. The stuff that you see that come out and say, Oh, well, we got 44% in the lab. Yeah, that’s for two milliseconds under 300 suns before the thing gets blown up. You know what I mean? It’s just complete nonsense. If we really want to get into the whole solar thing, we really need to put in a lot of money and a lot of subsidies, which I don’t think is feasible at the moment.

Tony Nash

It’s just not affordable anymore, right? No. It’s real money. Money costs money now. Money used to not cost money, and now money costs money. Okay, great. Thanks, guys. Let’s move on to the beneficiaries of election year, Larges. Albert, you are the man to talk to you about this.

Albert Marko

My favorite topic, Tony.

Tony Nash

That’s right. Of course, we’ve got election coming up here in the US. I’ve been told that maybe, just maybe some US politicians like to use legislation to give money to key voting blocks, allegedly.

Tony Nash

As we head into an election year, what sectors can we expect to benefit from legislators spending the American taxpayers money to get re-elected?

Albert Marko

Well, this is interesting because it only happens really in the set circumstances when there is a majority of senators in a certain area being up for re-election like we have in 2024, like we had in 2020 at the same time, actually, we had sorry, 2018 in the midterms. But in the Rust Belt, pretty much actually all the way from Montana to Pennsylvania, up north, there’s a lot of senators that are up for re-election. And in those areas, if you want to win a Senate seat, you have to address the rural vote. To address the rural vote, you need votes from the oil sector, and you need votes from the agricultural sector. And Corn, I’ve been on here before, and I’ve mentioned, Corn is one of my favorite plays, is if you want to get the rural vote, you better make sure that those corn fields are profitable at the moment. They’ve done a good job of suppressing corn, but going into 2024, you’ll start seeing a lot of legislation with a lot of subsidies, perhaps ethanol waivers, which is one of the favorite, which boosts up corn prices. That’ll get done probably in March, April, May of next year.

Albert Marko

At least they’ll start talking about it. That’s one of my favorite trades in an election years. Wait till corn gets absolutely crushed in early February, March of 2024, and put a play on a position for a long position going into September, October, November.

Tony Nash

Interesting. Okay, so Corn is number one. What else are you looking at?

Albert Marko

Honestly, probably the auto industry at the moment because it’s such a big headline and there’s a lot of demographic voters in those areas. I think that they’ll get some subsidies going forward into next year. I don’t like playing the actual manufacturers. What I do like to play is the logistics. As long as the parts have to get delivered to get the cars made, I think ParkOhio is one of my favorite little companies that does that. I think that’s where I would position myself in.

Tony Nash

Great. Okay. We’ll revisit this from time to time. Mayhem, do you have any thoughts on favorite investments or favorite sectors that politicians are going to goose going into the election?

Markets & Mayhem

I don’t. I haven’t spent a lot of time thinking about this, but if I had one area that I think may be a potential beneficiary, it might be digital advertisers that will see a surge in demand during that period of time.

Tony Nash

Okay, that’s really interesting. Okay. And, Tracy, I would assume, I could be wrong, that there’s going to be a lot of political pressure to reduce energy prices, especially gasoline prices here in the US before the election. First of all, is my assumption true? And second of all, could that harm some of these refiners?

Tracy Shuchart

Obviously, they’re going to try. Now, the thing is that the Republicans have no incentive to really help them in that situation. They love to see high gas prices going into an election, so they obviously can say. I think it’s going to be really difficult. Again, what Albert was talking about is they’re running out of runway. There’s really not a lot that they can do right now. You’re really going to have to suppress oil prices, which actually is better for refiners. That’s actually better. They are able to… Because if you reduce oil prices, that’s less that they have to pay, and then they’ll charge you more. I just think it’s nice and all for Biden to come out last night and say, I will reduce gasoline prices. Okay, well, give me a solid plan for that, because there’s just not a lot of options out there. I think going through this election, I think oil companies are still going to remain… I think oil companies are going to remain strong because, again, like I said, there’s just no incentive from the opposite, from the other side of the aisle to really help on that.

Albert Marko

Yeah, I think their best chance for getting oil prices down back into the mid-70s is for recession fares to start popping up, and that’s not until Q1 really.

Tracy Shuchart

And that doesn’t help them either, right?

Markets & Mayhem

And it’s funny too, because with all this draining of the SPR to levels we haven’t seen since 1985, the price of gasoline for the average American consumer is up over a buck and a half during the Biden presidency, from just about two bucks to over 350.

Albert Marko

This is mainly due to policy problems. They sit there and cut off pipelines. They agitate domestic production. They push and they scream and yell narratives against the oil industry. I don’t know what they expected.

Markets & Mayhem

They tell the oil industry, We don’t want you anymore, but we need your fuel.

Tracy Shuchart

I know, right? Yeah.

Tony Nash

Well, so the one thing we can guarantee is that politicians will spend the American people’s money to get reelected.

Markets & Mayhem

Absolutely, yes. 100%.

Albert Marko

I guess they will.

Markets & Mayhem

If there is a way to bet on that, we’d all be millionaires for sure. Right?

Tracy Shuchart

I don’t know. Maybe predicted, I’ll have it.

Albert Marko

Yeah, corn. Corn. You want to do it? Play corn.

Tony Nash

Perfect, guys. Thank you so much for this. This has been an excellent show. Thank you so much. Thanks for your time. And guys, have a great weekend and have a great week ahead. Thank you. Thanks, guys. Thank you.

Markets & Mayhem

Thanks, everyone. Take care.

AI

That’s it for this week’s episode of the week ahead. Please don’t forget to rate us and review on whatever platform you are watching or listening to this. Thank you.