The Ultimate Guide to AI in Corporate Finance: Strategy, Auditing, and Budgeting

A 2026 playbook for CFOs, Controllers, FP&A leaders, and Internal Audit Directors moving from “testing AI” to embedding agentic AI into core finance workflows.

Contents

- The New Era of Autonomous Finance

- AI for Corporate Auditing: From Sampling to 100% Coverage

- AI-Driven Budgeting and Forecasting: The Weather Satellite Analogy

- Solving the Trust Gap: Governance and Human Oversight

- The CFO’s 90-Day AI Roadmap

- FAQ: What Finance Leaders Ask Before Embedding AI

The New Era of Augmented Finance

Augmented finance is the evolution from analytics and automation toward agentic workflows – AI systems that can recommend, initiate, and document finance actions (with human approval gates) across close, audit, and planning.

In 2026, the question is no longer whether AI “works.” The question is whether your data architecture is ready for autonomy and whether your governance is strong enough to trust actions, not just insights.

The last three years were the era of AI pilots: disconnected proofs of concept, scattered copilots, and bolt-on automations that made a few tasks faster. The CFO’s 2026 reality is different. Labor remains tight, audit and regulatory expectations are rising, and the business expects finance to deliver answers faster, not after the close. That combination forces a shift from testing AI to embedding AI into the finance operating system.

Here is the distinction finance leaders need to internalize:

- Tool AI helps a person do a task (for example, draft a memo or summarize variance commentary).

- Workflow AI runs inside the process (for example, flags a high-risk account before close).

- Agentic AI operates across processes (for example, detects an anomaly, proposes a correction, routes it for approval, logs evidence, and monitors recurrence).

Most organizations are still stuck in Tool AI. They add generative AI on top of messy data, and the result is predictable: fast outputs with inconsistent trust. The leaders are moving toward a Zero-Touch Finance Ops model: routine detection, reconciliation, and draft outputs happen automatically, and humans focus on judgment, exception handling, and strategic decisions.

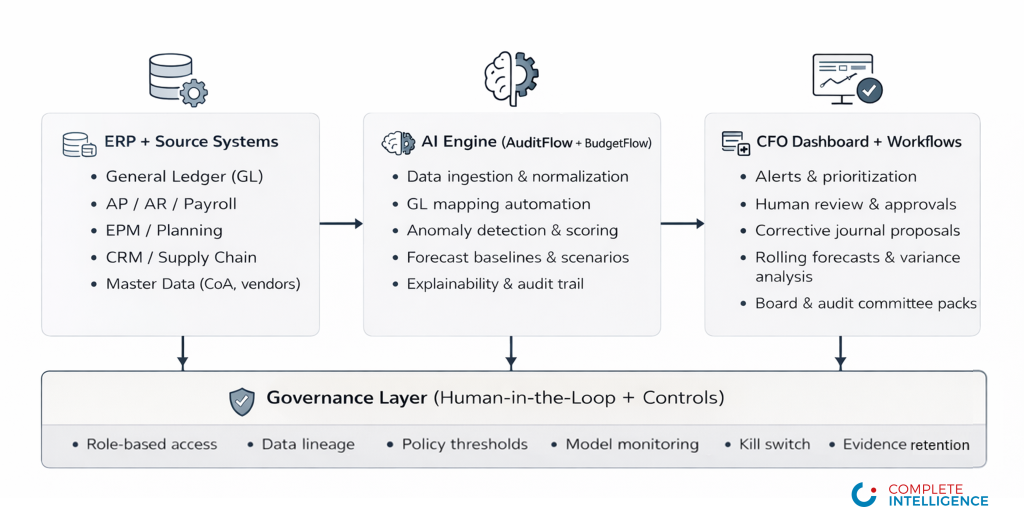

Flowchart: How data moves from ERP → AI Engine → CFO Dashboard (Agentic, governed workflow)

The autonomy is real only when the governance layer is real.

Callout: The 94.7% Accuracy Benchmark

Finance leaders should demand an evidence-based accuracy benchmark – not a marketing promise.

Complete Intelligence’s forecasting engine has been publicly positioned with a 94.7% accuracy benchmark in its CI Markets forecasting product, reflecting the “Accountant AI” mindset: calculate, validate, and document—don’t guess.

In corporate finance, the parallel benchmark is not a single number. It is a repeatable process: accuracy + auditability + governance.

If you are evaluating AI for audit and planning: start with the two implementation artifacts CFOs actually use—the AuditFlow whitepaper and the “Weather Satellite” budgeting framework in Turning Data Into Trust (PDF).

AI for Corporate Auditing: From Sampling to 100% Coverage

AI for auditing replaces periodic, sample-based assurance with continuous, automated testing across 100% of transactions, accounts, and periods—while preserving human oversight for judgment and materiality.

The outcome is not “fewer auditors.” The outcome is fewer surprises: earlier detection, faster remediation, stronger internal controls, and an audit narrative built continuously instead of assembled under deadline pressure.

Traditional auditing relies on sampling. Sampling is rational when the limiting factor is human time: you cannot manually review every transaction, so you select a subset and accept residual risk. That approach made sense in a paper world. It is fragile in a world where transactions are high-volume and multi-system, process drift is constant, and errors are rarely one big thing—they are patterns across time, entities, and accounts.

AI-driven auditing changes the constraint. When machine learning can review 100% of transactions, the question shifts from “what should we sample?” to “what should we do about what we found?”

AuditFlow methodology: mapping the General Ledger to operational reality

AuditFlow is built around a simple premise: the General Ledger is not just a record of the past—it is a map of how the business behaves. If you can map GL data against operational reality (and against how the data should behave), you can detect risks earlier and with better context.

In practical terms, AI-driven auditing with GL mapping automation follows four stages:

- Ingestion and normalization: pull multi-year GL and subledger data from your ERP and standardize formats, time periods, and entity structures.

- GL mapping automation: build an account crosswalk that can detect miscodings, inconsistent account usage, and structurally similar accounts across entities.

- Anomaly detection and risk scoring: identify outliers, unusual patterns, and relationships that change over time.

- Remediation workflow and evidence trail: route anomalies to owners, document explanations, propose corrections, and retain auditable evidence as the issue is resolved.

GL mapping automation is the foundation for augmented finance because it creates a repeatable way to interpret transactions consistently across time, entities, and departments.

Comparison table: Legacy audit vs AI-driven audit

| Dimension | Legacy Audit | AI-Driven Audit |

|---|---|---|

| Coverage | Sampling | 100% transaction screening |

| Timing | Post-close | Pre-close & continuous |

| Method | Checklists & spreadsheets | ML anomaly detection + workflows |

| Evidence | Assembled under deadline | Captured continuously |

| Controls | Periodic testing | Continuous monitoring |

| Remediation | Manual spikes | Managed exception queues |

| Fraud detection | Retrospective | Pattern-based early signals |

For more detail on remediation economics and workflow design, see the AuditFlow whitepaper: https://completeintel.com/auditflow-whitepaper/

AI-Driven Budgeting and Forecasting: The Weather Satellite Analogy

AI-driven budgeting replaces static, annual planning with continuous budgeting: rolling forecasts that update automatically as actuals arrive, scenarios change, and external drivers shift.

The goal is not perfect prediction. The goal is a forecasting system that updates like a weather satellite: always scanning, always recalibrating, and always explaining what changed.

Every CFO knows the annual budget problem: it is expensive, political, and obsolete the moment assumptions break. Many teams still rely on the ritual because they have not seen a credible alternative that satisfies speed, auditability, and trust at the same time.

The Weather Satellite analogy is a practical way to describe what changes in a finance transformation 2026 roadmap:

- Static budgeting (the map): a snapshot that assumes the terrain will not change.

- AI budgeting (the weather satellite): a live sensing system that updates as conditions shift.

External data integration: the CFO advantage in 2026

In 2026, the firms with the best forecasting discipline treat external data as a first-class input. Depending on your business, external drivers may include macroeconomics, supply chain indicators, market pricing signals, and FX or energy volatility. When those drivers are integrated, variance analysis becomes an early warning system.

The 1:20 ratio CFOs should plan for

A common failure mode in AI finance transformation is spending on models while starving the foundation. A practical rule: for every $1 spent on AI capabilities, be prepared to allocate outsized effort to data integrity, governance, and adoption.

For the Weather Satellite analogy in a shareable format, see Turning Data Into Trust (PDF): https://completeintel.com/wp-content/uploads/2025/12/20251210-CI_WoodlandsOnline.pdf

Solving the Trust Gap: Governance and Human Oversight

AI governance in corporate finance is the control system that ensures AI outputs are explainable, auditable, and safe to operationalize—with clear human accountability for material decisions.

The CFO’s job is to turn AI from a black box into a governed agent of action that operates under documented policies, approvals, and evidence retention.

The biggest barrier to embedding AI in finance is trust. Finance is a system of accountability, and accountability requires transparency. “Because the model said so” is not an audit defense, not a board narrative, and not a regulator-friendly stance.

AI is not your system of record

Your ERP remains the system of record. AI is an agent of action—it proposes, prioritizes, and drafts. Humans approve, and the system records the decision. This separation is what makes autonomy safe.

Judgmental AI: splitting grunt work from jury work

Judgmental AI means AI does the work that should not require a CPA’s time, and humans do the work that should not be delegated to a model.

The CFO’s 90-Day AI Roadmap

An AI roadmap for finance should be short, measurable, and anchored in data reality—not a multi-year transformation deck that never ships.

In 90 days, a CFO can move from AI curiosity to an initial agentic deployment by focusing on data readiness, high-ROI use cases, and governed rollout.

Days 1–30: Data audit (Reality vs. ambition)

- System inventory and ownership

- Data lineage map

- Definition alignment

- Top data defects list

- Autonomy readiness score

Days 31–60: Use case selection (High ROI focus)

Prioritize workflows with high frequency, high cost of failure, and clear metrics. Two strong starting points: an AuditFlow pilot and a BudgetFlow pilot.

Days 61–90: Agentic deployment (AuditFlow/BudgetFlow implementation)

- Integrate with your finance tech stack

- Establish governance thresholds and approvals

- Run in parallel for one cycle

- Operationalize the exception queue

- Publish outcomes for leadership and audit committee

FAQ: What finance leaders ask before embedding AI

What is agentic AI in finance?

Agentic AI in finance refers to AI systems that can execute multi-step workflows—such as detecting an anomaly, proposing a correction, routing it for approval, and documenting evidence—instead of producing a one-off output. The agentic part only matters when it operates under governance: approvals, thresholds, and traceability.

Will AI replace internal audit or FP&A roles?

In most organizations, AI shifts the labor mix rather than eliminating the function. Internal audit and FP&A become more strategic because routine testing, data wrangling, and baseline forecasting are automated.

Do we need a new ERP or a data lake to embed AI?

Not necessarily. The practical requirement is reliable, governed access to finance and operational data (often via APIs or a well-managed data warehouse). The larger requirement is consistent definitions and ownership.

How do we keep financial reporting integrity if AI is involved?

Keep the ERP as the system of record, require human approval for material actions, and maintain an auditable evidence trail for every recommendation, override, and correction.

What is the fastest way to prove AI ROI to the CFO and audit committee?

Start with a narrow pilot that produces measurable outcomes in one reporting cycle: reduced remediation hours, earlier detection of exceptions, fewer late-cycle surprises, and improved forecast stability. Then scale the governance and workflow, not just the model.

This guide is provided for education and planning. It is not accounting advice and does not replace your audit, compliance, or reporting obligations.