Explore your CI Futures options: https://completeintel.com/futures

In this episode, we’re joined by experts Dan McNamara, Tracy Shuchart, and Mackinley Ross to discuss three key themes: CRE vs WFH, Asian crude demand, and inflation vs earnings.

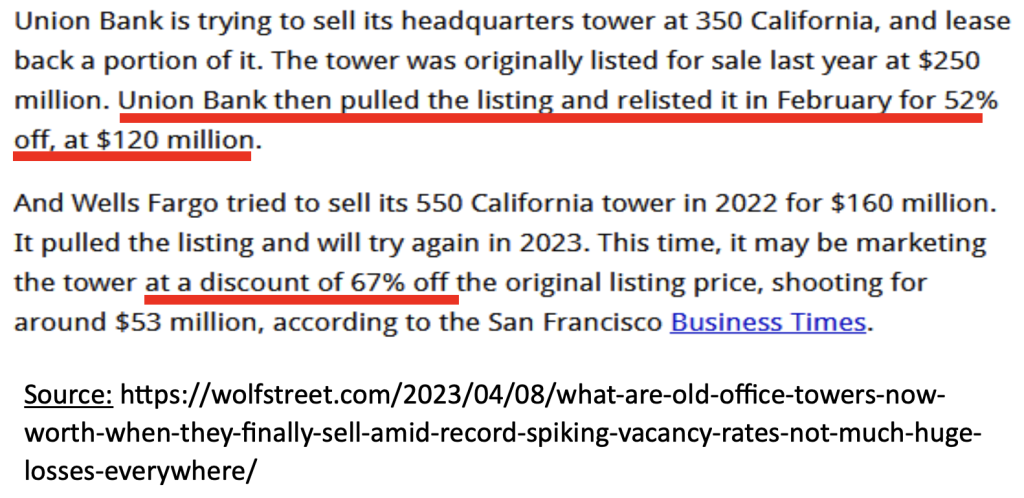

Dan kicks off the discussion with the latest news of Salesforce leaving their headquarters in San Francisco, the largest employer in the city, and giving up 1 million square feet of office space. Other high-profile CRE issues in the city include two major banks – Union Bank and Wells Fargo – discounting their building sales by 52% and 67%, respectively. The cause seems to be Work From Home (WFH) and rising rates, with empty offices and rising rates forcing ZIRP-era prices down. Dan explores the drivers and impacts of this trend, how it could accelerate, and what other markets it could hit. He also examines the potential impact on local tax revenues and whether taxes on CRE are low compared to other revenue sources.

Moving on to Asian crude demand, Tracy highlights the recent rally in crude prices and the focus on Asian crude demand. Refineries in the region are aggressively buying for June deliveries, and China’s imports are up. She delves into what’s driving this demand and whether Asian economies are really coming back that quickly.

Finally, Mac talks about inflation vs earnings, with the recent headline CPI coming down slightly but core CPI going up. The Fed has said several times they watch core, not headline, so we don’t seem to have the makings of a Fed pause or a pivot yet. With positive bank earnings, does this reinforce the case for a 25 bps rise in May, and will we see talk of a June rise too?

Key themes:

1. CRE vs WFH

2. Asian crude demand

3. Inflation vs earnings

This is the 61st episode of The Week Ahead, where experts talk about the week that just happened and what will most likely happen in the coming week.

Follow The Week Ahead panel on Twitter:

Tony: https://twitter.com/TonyNashNerd

Dan: https://twitter.com/danjmcnamara

Tracy: https://twitter.com/chigrl

Transcript

Tony

Everyone, and welcome to The Week Ahead. I’m Tony Nash. Today we’re joined by Dan McNamara. Dan is with Polpo Capital and he’ll be with us talking about commercial real estate. Dan, thanks so much for joining us. Really appreciate this. We’ve also got Tracy Schucart. Obviously, Tracy is with Hilltower Resource Advisors and we’ve got Mackinley Ross. Mac is a portfolio manager and he’s been with family offices. And he’ll be talking to us about inflation and earnings.

Tony

So guys, thanks again for taking the time on this Friday afternoon. We’ve got some key themes this week. Dan’s been talking about CRE, kind of CRE versus work from home. And so that’ll be an interesting discussion to get into. Tracy, there’s been a lot of focus on Asian crude demand, so she’ll get into that a little bit with us. And then, Mac, we’re going to talk about inflation versus earnings and kind of what will the Fed ultimately do?

Tony

So, Dan, you’re up first. So again, thanks for joining us. I really appreciate your time. I know there’s been a lot going on this week and you’ve really informed a lot of kind of my thinking about commercial real estate this week.

Tony

So one of the big stories out this week is about Salesforce leaving their headquarters in San Francisco. Salesforce is obviously the largest employer in San Francisco, and they’re giving up about a million square feet in the city center, which already has very low capacity occupancy, I think it’s around 33% or something.

Tony

We also saw Whole Foods leaving their retail space and San Francisco is a really interesting case study. And you brought this up in several retreats this week about I think you highlighted a story where Union Bank and Wells Fargo Bank have both discounted their retail space by, I think, over 50% and almost 70%, respectively for each of those.

Tony

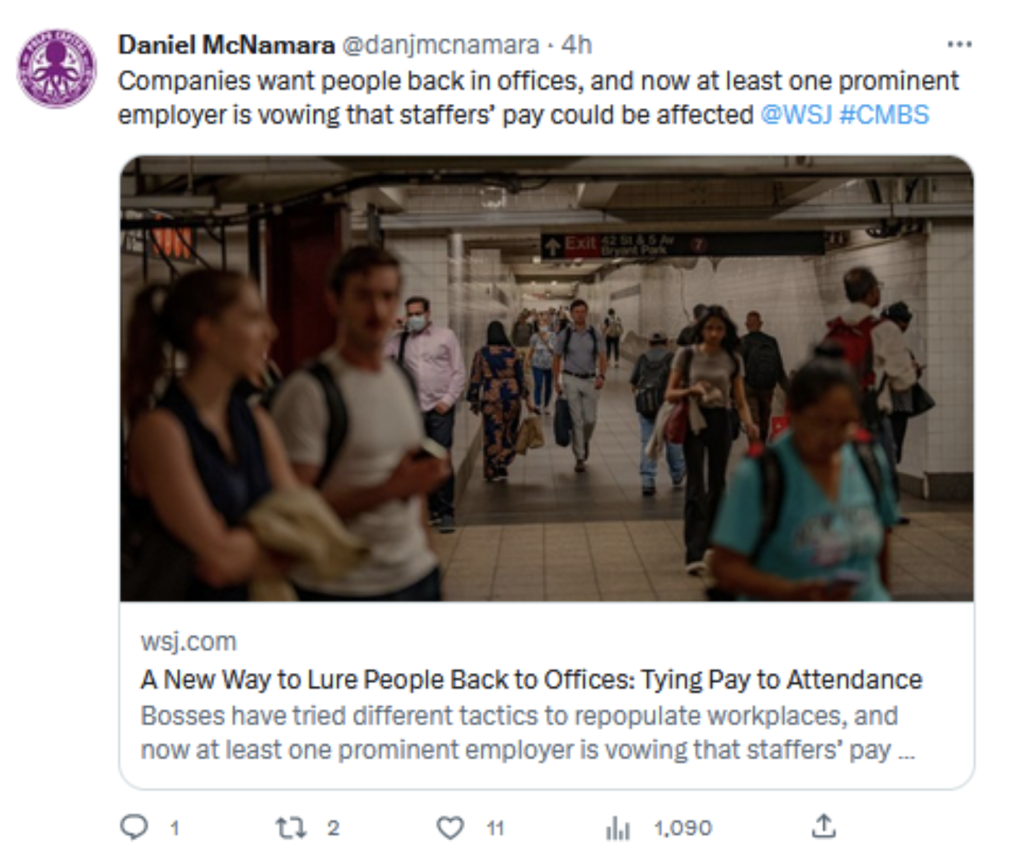

So I guess San Francisco isn’t the only place. Of course, Houston is pretty bad. Work from home has had a lot of industrial centers or commercial centers. And you posted a story about companies wanting people back in the office and about a company paying staffers to actually work back in the office.

So there’s a lot to think about here. And for those of us who don’t really understand commercial real estate, can you help walk us through kind of what some of these drivers are?

Tony

First of all, what is this happening? How bad is it? And second of all, what are some of the things driving this? Is it primarily work from home or is it other things as well?

Dan

Yeah, Tony, thanks for having me. You hit it on the head there. It started… Every city is a little different, right? To take a step back. And we thought you mentioned Houston briefly. I mean, Houston was having major office issues even prior to COVID. It was overbuilt. We obviously had some overhang from oil and gas and that sector in general, but COVID was kind of the game changer for office space. For the most part, going pre-COVID commercial real estate had R1 sector that we were over-retailed for a very long time. Pre-COVID, unfortunately, COVID kind of threw gasoline on that fire and killed some of the regional malls. But in a post-COVID world, the way we kind of started to look at the world now and what was changing, and our focus shifted kind of from the issues with being over-retailed in the United States, and kind of the way we shop is shifting towards ecommerce, we then kind of looked at, okay, well, what is now the themes in this new world? Do we believe that work-from-home or a hybrid model is here to stay? And it was difficult to say in 2020.

Dan

There were a lot of talks… COVID hit in March of 2020, and there were a lot of talks everything got shut down, but there was a lot of talk about everyone going back after Labor Day. Labor Day of 2020, which today seems kind of crazy thinking about where we are with occupancy numbers in office space. And then there was a lot of talk about everyone going back after the holidays in early ’21, and then it was Labor Day of 21, and yada, yada, yada, over and over again.

Dan

But the one thing that doesn’t budge is while occupancy has been up slightly, we seem to have plateaued. And every city is a little different, right? You’ve got the Austins of the world, they’re doing a little bit better. Occupancy is probably hovering around 60%, but in some of the other cities we’re talking about specifically like San Francisco, you’re really settling into kind of this 40% to 50% occupancy, which is devastating in the commercial real estate market, because you have to remember that these buildings were underwritten with 90 plus percent occupancy. And commercial real estate is an inherently levered market. So when you get very small drops in occupancy, given the leverage that’s in the commercial real estate market, there are very large price drops.

Dan

We’re not even talking about occupancy. 50% is devastation, you know, because you’re starting to see a few offices trade now. You know, we’ve seen some in LA, where, you know, you’re down 50 plus percent. And, and and I think that’s just the beginning, because as you sit back here, there’s not many people I’m talking to in my space that say, “hey, you know, what we really think is a great opportunity? Office space.” right now. So the question is what happens to this where we are wildly oversupplied in office space and what happens? And I think that’s a tough question to answer.

Tony

Is it kind of like the 70s where the downtowns were kind of hollowed out and people moved out to the suburbs and their offices moved out to the suburbs as well? Is it a little bit like that 70s going into the early 80s?

Dan

I think it’s city dependent, but, yeah, I feel let’s just take New York where I am for an example. You’re definitely seeing crime is up. You’re seeing obviously less people who are willing or wanting to commute to the office. So, yeah, you do get a bit of a 70s feel to it. I think that from a crime perspective, hopefully we don’t get fully there. I don’t think we’re there now, but from a valuation perspective, what we need to take a step back is for the last 40 years, interest rates have been declining and interest rates are the most important thing in commercial real estate. So our loans generally are about ten year loans. So if you own a building or your family or your company has owned a building for 40 years, you’ve come to the banks about four times, and every single time you come to the bank, you’ve basically gotten a lower loan, a lower rate on your loan, and you’ve gotten more proceeds. And now we’ve completely flipped that on its head. And now you’re coming to whether it’s your regional bank or your commercial CMBS lender or your insurance company, whoever’s giving you that loan.

Dan

And not only are they saying you’re going to have to pay 3-400 basis points more, but you’re going to have to kick in $25 million of equity to get that same loan that you used to get. So it’s an ominous time for the office sector. Right now.

Tony

CI Futures is our subscription platform for global markets and economics. We forecast hundreds of assets across currencies, commodities, equity indices and economics. We have new forecasts for currencies, commodities and equity indices every Monday morning. We do new economics forecasts for 50 countries once a month. Within CI Futures, we show you our error rates. So every forecast every month, we give you the one and three month error rate for our previous forecast. We also show you the top correlations and allow you to download charts and data. You can find out more or get a demo on completeintel.com. Thank you.

Tony

So who becomes the investor? Over the past, say, 10-20 years? The commercial real estate investors. I would assume those are, say, lower or shorter-horizon investors. I don’t know if that’s a safe thing to say, but I would assume those would be shorter-horizon investors. Are we now looking at longer-horizon investors or how is that investor makeup changing?

Dan

Well, the investor base in commercial real estate broadly, it’s very institutionalized. That has probably changed since the 70s. It has definitely changed since the 70s. Commercial real estate has become much more of an institutional asset class. So I think the pain that’s going to be felt, it’s broad-based in pension funds and money managers in all sorts of different pockets. Private equity firms, they got very large in the commercial real estate and there’s talk of, yes, there is dry powder. But the question is and why? I don’t think you don’t hear anybody talking about really diving into office today is nobody knows where we’re going to end up. It’s very difficult to figure out where this stops. We’re seeing a plateau. Do we continue to climb a little bit? Maybe?

Dan

I mean, I for one, never, you know, I don’t think we’re ever going back to 2019, the ways we work, just like I don’t think that ecommerce is going to slow down on the retail side of things.

Tony

Right.

Dan

So it does seem like kind of a one way train here. And I think that we’re all going to have to get used to this new paradigm where valuations will have to come down, losses will be taken, and some of those losses will be taken in bond form by investors. Some of them will be taken by regional banks. And for the most part, a lot of these loans are non recourse. So when your equity is wiped out, if you own a building and your equity is basically zero, you’re going to hand the keys back in most cases because you have no incentive to put any more money into this building anymore.

Tony

Well, there was a building in San Francisco or no, sorry, St. Louis, I think that was valued at like $400 million 10 years ago and now sold for like $5 million or something.

Dan

I think it’s sold for four, at one AT&T. That’s a great case example. And this building was having issues. AT& left St. Louis years ago. This was a single-tenant building. So to re-tenant this building to a multitenant building also would be massively expensive. But also we’re talking about downtown St. Louis where basically the majority of the companies have left due to crime. So this thing, the work from home, just kind of officially just threw this thing into basically, it’s an obsolete building. It probably needs to be teared down. I don’t know. We have had people throw out crazy ideas on what to do with it, but in the end, you’re talking about a building that was worth three or $400 million at one point and sold for four or $5 million, and there’s still nothing going on with it. So I think this is going to be one of those situations where the city of St. Louis is going to need to step in here because they don’t want this huge, massive, empty building sitting there in downtown St. Louis.

Tony

Right. It’s interesting, like when people think their house price can’t really decline that much or their stocks can’t go to zero. That’s an amazing case study of a building that was once worth almost half a billion dollars is now worth…

Dan

It was in a 2007 Bear Stearns CMBS private label deal and it took over 100% severity. Meaning, given the fees, that. What happens is when these things default, they sit in special servicing in CMBS and fees accrue. So even though it did sell for something, managing this property for three years, this vacant property, which was what the Special Servicer did and paying the taxes and all these other things, it lost more money than the loan was even for. So it’s kind of crazy.

Tracy

Fuller in St. Louis as well?

Dan

Sorry, Tracy?

Tracy

Didn’t we see that at Sticks, Baron Fuller as well when they collapsed?

Dan

Yes, but I would say this one AT&T Center is going to set a record. It’s a bit of a bygone past that you have a massive tenant who can take such a big space and and then they leave the city and and the city just doesn’t know what to do with it. And it’s just it…

Tony

Just like salesforce.

Tracy

Right. I had one more question. Sorry, Tony. What are you seeing in Chicago right now? Because I’ve lived there for a very long time, we have this Nordstrom problem. What is your kind of view on what’s going on there, especially at Miracle Mile?

Dan

Yeah, Miracle Mile is a mess. I was talking about that with an investor yesterday, actually. Overall, Chicago outside of San Francisco, I would say Chicago is probably number two on our cities to avoid list. When you see Citadel, which was based in Chicago, leave that city, that is an awful sign. That is like the final nail on the coffin. I mean, they were Chicago for many years. So for me, Chicago is almost uninvestible right now. There’s just a complete fleeing from Chicago, and I don’t know when it actually stops, and I don’t know if it does stop. Right. You’ve seen two of the four of us are sitting in South Florida right now. Unfortunately, not me, but that’s probably the only place where office is actually investable right now. And I say that not because there won’t be opportunities down the road in other cities. We haven’t quantified when this stops. It’s going to be painful. 99.9% of the commercial real estate market, they all want to talk up their books because everybody’s long. And so that’s why I think the information actually coming out, and when you hear someone actually speaking the truth, it hurts because nobody wants commercial real estate prices to go down.

Dan

I think people peg me as a bear, but in general, I’m looking at the data and just speaking the truth. It’s not fun for me either, because it’s a lot easier to make money being long CMBS than it is shorting CMBS. It really is. I would have a lot less gray hairs if I could just buy CMBS and play golf, but unfortunately, we’re not in a market for that right now. But it is a wildly interesting market, and it’s a good credit pickers market. Long and short.

Tony

Great. Dan, you mentioned something when you’re talking about St. Louis, and I’m curious about that. You said the city of St. Louis may have to get involved and so on and so forth. So for these cities like San Francisco, St. Louis, Chicago, how do they derive taxes from commercial real estate? Because it almost seems like this circle of doom where the workers flee, the buildings are vacant, the commercial real estate investors are stuck, the value goes down. Does that also affect the tax base and then the way cities raise money, and then they don’t have the ability to even service this stuff? Is it this kind of declining, vicious circle?

Dan

Yeah, there’s been some stories out, and I’ve read one maybe a month ago about New York City. And the percentage of New York City’s budget that comes from commercial real estate taxes is very large, and it’s based on the valuations of the buildings. Right. So as valuations drop, even if people can pay, you’re paying less in real estate taxes. So these budgets in the city, they’ve relied so much on these rising asset prices that there’s going to need to be cutbacks because obviously valuations are down dramatically. So even the sponsors that can afford to pay, they’re going to be paying less, and there’s going to be plenty that can’t afford to pay, and that’s going to be an issue.

Dan

When I said that the city will need to step in with one AT&T, I don’t remember off the top of my head, I remember looking at that deal a couple of years ago. But the taxes on that thing, I’m sure were a couple of million dollars a year. I mean, you’re talking about a building they just traded for four or $5 million. So obviously taxes are dropping dramatically. Just the insurance and the security that you still have to pay even though it’s a vacant building.

Dan

There’s a lot of expenses that go into commercial real estate. And when you have asset prices that are dropping dramatically and owners who are stressed because their values are dropping but their expenses are rising, it’s a combination for getting really ugly.

Tony

Yeah, I remember when COVID started and I just threw an idea up, somebody and I said, this is going to be really bad for commercial real estate. And a lot of people are like, no, it’ll be fine. It’s all going to be fine. Everyone’s going to go back to work. And it just has not felt right since then.

Dan

No, and I think you’re absolutely right. Even today on Twitter, and someone had jumped into your feed and something I was in, and they had mentioned interest rates and the Fed cutting interest rates. And honestly, I usually don’t reply to those things, but I was kind of like, you know what? I hear this too much, that everyone’s thinking the Fed can bail us out. First off, Jerome Powell has made it very clear that he’s fighting inflation, number one. And I’m not saying that if something horrific happens in the economy that he’s not going to cut rates because clearly we will. But if we’re cutting rates later this year, it’s Armageddon. I mean, something has broken. The idea that..

Tony

Something else has broken, because regional banks are already broken.

Dan

I mean, interest rates going down is going to help commercial real estate because the Fed is cutting? We’re dealing with a very significant recession if the Fed is cutting rates this year. And I hope they don’t, because I don’t want to see what that releases. I believe, to be honest with you, that there’s probably a lot of people that wanted them to pause last month. And if they paused, I think the market would attend because I think eventually people coming around like, well, what do they know, right?

Tony

Exactly. That’s pretty ominous. Dan, I know so little about commercial real estate, and I have so many questions. We could talk for a couple of hours on this, I think. So thanks for this. Sounds pretty ominous to me, and I’d love to come back in a couple of months and just see where things are, if you don’t mind.

Dan

And this has been really absolutely, Tony. Anytime. Great.

Tony

Okay, so let’s move on to Tracy. Tracy, we’ve seen some activity with Asian crude demand this week. As we started to see Asia become more active, we saw China imports up, and refineries in the region seem to be aggressively buying for June. Thai refineries, Japanese refineries, Chinese refineries, and so on.

So what’s happening? Are Asian economies really coming back that quickly, or what else is driving this demand?

Tracy

Well, I think we need to look at a couple of things. After the OPEC cut, right? We saw prices go up $5. Now, $8 at this point. But what I think we have to take into consideration is if you’re looking at Asian markets, yes, they’re buying in anticipation of demand, but we really need to look at it as in are they buying because they expect oil prices now to go higher? And they want, we all know China loves lower oil prices, right? So are they just buying now between Russia lower oil prices and maybe that spike up really spooked them, and so they’re now buying it on the spot market? So I think what we really need to watch is really the data. And I’m not saying that the data is not improving mobility-wise, and all the promises that China is talking about on stimulating the economy, as far as looking at domestic construction is concerned, yes, all that should be taken into account. However, none of that has actually come to fruition yet. So we just need to be a little bit careful on getting too excited that this is China demands all of a sudden take it off in the month of March and they’re buying in June. There are really a lot of factors involved. My particular worry is that it’s because this spike in prices has caused them to panic buy.

Tony

Okay, so what factors do you look at with, say, China, Japan, Southeast Asia? What are you looking at in terms of, say, their economy coming back or them buying?

Tracy

Well, I think those are three very separate instances. If you look at Japan right now, Japan is basically a fossil fuel importer. They don’t have fossil fuels, so they are interested in energy security. That’s why they’re having problems with the G7 right now, because they want to include natural gas, coal. Their nuclear plants are two thirds of their nuclear plants are down right now. They’re not looking to really reengage those plants quickly. That also takes a lot of time. This is a lagging from the Fukushima disaster. So right now, Japan is on “I want to buy everything I possibly can at this point because we rely on fossil fuels”. And again, with the G7, they’re having a problem right now because they would include natural gas, the G7 doesn’t, et cetera, et cetera. If you look at South Korea, South Korea demand is definitely increasing because a lot of production is moving over there. A lot of manufacturing is moving over there as far as, like, chips are concerned or whatever.

Tony

From China?

Tracy

Yes. And we’re seeing that. You just saw Samsung, what was it, 2022? We saw Samsung come out of China a little bit, put everything back in Korea. Right. I think that that’s growing. Vietnam is growing. Thailand is growing as far as that market is concerned. So we’re seeing increase in demand there. If we’re looking at China, then again, we have to go look at are they panic buying because they expect prices to go higher? Are they buying ahead of what they really need at this juncture?

Tony

But China has a huge amount in reserves, right. Amount of crude already in their SPR. Right?

Tracy

Correct. Well, we can see yes.

Tony

Okay. Tracy, we always hear about China importing crude, but do they actually have domestic onshore production, or is it all offshore? South China Sea.

Tracy

It’s all offshore. They’re huge offshore, and they’re expanding.

Tony

Okay. There are reserves onshore, though, right?

Tracy

There are reserves onshore and offshore. Absolutely. And underground, which is why we don’t really know the extent to what their reserves are. We definitely know that they’re a lot more than the US.

Tony

Okay. And how much of a factor does India play? Because I know there’s been a lot of talk about them buying Russian crude, as everyone has, but for some reason, it’s notable when India does it. So how much of a factor is India in overall Asian crude demand?

Tracy

Well, I think India is looking at their neighbor, Pakistan that can’t even afford to import natural gas. Right. It’s thinking, oh, my God, I need to buy as much as I can. We’ve got Russian crude oil below $60. It’s a little bit above now, but below $60. And the rest of the world is at $80. So it’s every country for themselves when you’re in an energy crisis. It doesn’t really matter. And the US pretty much gave them a go ahead, because when the US, we just saw the US go visit India, and basically they said, “as long as you keep it below the price cap, buy whatever you want.”

Tony

Right. I feel like on some level, global economies still haven’t moved beyond the hoarding mentality that we all developed in 2020. It just seems that way, especially with commodities. People, just when the prices hit a certain point, below that point, they hoard and just stock it. Are we still there?

Tracy

Yes. I think the natural gas spike in summer of 2022 freaked every country out, for lack of a better word. Every country went, “oh, my God.” Especially for a country like Japan, that is the largest importer of natural gas in the world. And so to them, when prices spiked 85% over where they are today, that scares people. And people are like, “oh, my God, what do we do? We need to start hoarding.” And especially when you have the west saying we want to cut natural gas and oil. Right. And you have all these Western banks saying, we’re not going to fund these projects anymore. Everybody’s we’re seeing decline in shale. And so that means supply is coming down globally, and demand is still exponentially going up.

Tony

But it’s going up where? Is Asia pretty much always that market where it’s growing pretty fast? Or Europe is not really growing that fast?

Tracy

No, Europe is not at all. US is steady. We’ve always been the largest consumer in the entire world, at least for the last ten years, 10-20 years. Europe is not because they’re telling people not to consume energy.

Tony

Right.

Tracy

And then we’re seeing manufacturing go to China because they don’t have to cut back on their energy consumption. But I digress.

Tony

If Ukrain, if Ukrainethat were to stop, let’s say, by July, how would that impact global energy prices?

Tracy

I actually think that we would see Europe go back to buying cheap Russian natural gas pipes in, to be honest. And that has nothing to do with anything else. Put your feelings aside about Putin. He’s a criminal, we all know that. But it’s a matter of energy security. It’s a matter of they’re losing manufacturing, especially Germany, because manufacturing is Germany, right. And so we’re already seeing companies like BASF, Mercedes move to China because prices are too expensive there. You have to realize that even though energy prices have come down, or natural gas prices have come down from the peak at June, July of 2022 that summer, they’re still, by historical norms, twice as high. This is still affecting businesses. This is still affecting consumers.

Tony

So we could see, if things were settled, we could see energy prices decline pretty dramatically, continue to decline?

Tracy

I think we could see Europe yes, Europe kind of go back a little bit to piping in more cheap Russian natural gas. And that also has to do with the fact that they haven’t signed any long term contracts because they are still at that mindset that by 2030 we’re getting rid of fossil fuels altogether.

Tony

Okay? So they want the optionality.

Tracy

So they’re literally buying on the spot market, which is a lot higher. And the problem is that if we get to a point where they were very lucky that weather was great this winter and they had people stopped using as much, they got their usage down. Now, it’s all fine and dandy, but if the summer is really hot and we start to see we need more energy for air conditioning, if next winter is horrible, that could put them in a very bad situation because that would put them fighting for spots cargoes with Asia. Everything’s being diverted to Asia right now where they’re paying more money. So that could put a squeeze on energy prices in general, particularly in the EU.

Tony

Yeah, Europe saw that with Qatari National Gas like six, nine months ago, right where they were squeezed out of the market. They tried to get cargoes from Qatar.

Tracy

And they said no. And so Qatar finally, eventually said, all right, we’ll give you cargoes, but you have to cost you, but you have to give us a long term contract. And Germany was like, okay.

Tony

Very good. All right, Tracy, thank you for that.

Tony

Mac, good afternoon. Thanks for coming on today. Hey, I want to talk about inflation and earnings. We saw headline CPI come down a bit this week, but core was up. So of course the Fed has said they’re looking at Core and that’s their touchstone, at least in that area. We don’t seem to have the makings of a Fed pause or a pivot just yet.

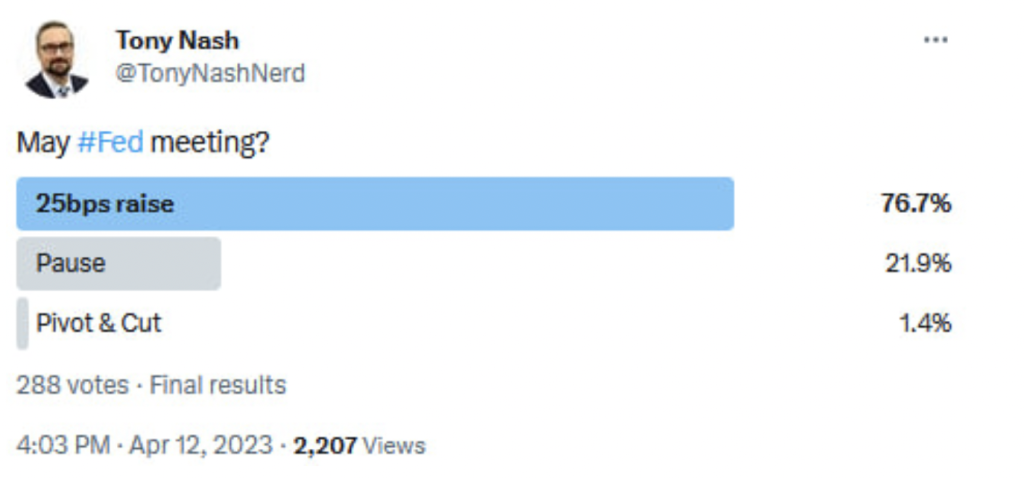

I did a quick survey on Wednesday after CPI came out, before bank earnings came out on Friday regarding a likely Fed action for the May 3 announcement. Overwhelmingly at the time, people told me a 25 basis point rise. So only 288 votes, but still it’s pretty resounding result for me.

On Friday morning, we saw some pretty positive bank earnings with JPMorgan giving a huge relief, largely based on net interest income. And so I think people breathed a real side relief around the health of the systemically important banks. So that’s good.

But with consumer strength, with industrial production numbers which came out today, which were pretty positive and so on. Does this reinforce the case for a 25 basis point rise in early May? Or do you think people are still on the fence about a pause or a pivot?

Mac

So just looking at the Fed futures market and what the market is looking at, it appears that as of an hour ago, you have a 78% chance of a May 25 bips hike and then there is a 17% chance, up from zero last week of then another June move. And I think that what’s actually telling is July because the highest probability there is no longer no hike. It was kind of a bit of a 33, 33, 33 blend of what was going on. Today, your highest probability is that you’re going to have a hike at one of those two meetings, and now you have an actual chance in being priced in of two hikes at each meeting recurring. And also the odds of rate cuts in the back of the year are falling. So let’s just take a look at what happened since March. Basically, you had a bunch of people saying the Fed should pause or cut based on the SVB and Credit Suisse fiasco, and then the Fed decided to go ahead with 25 bips at the March meeting. And that’s very telling. Unless you get another systemic shock, they are not going to pause and they’re certainly not going to cut, at least in the short term.

Mac

So in March, they enacted that 700 billion in a one time injection to basically backstop the banks. And while the Fed has seen lending standards, sorry, lending amounts drop off considerably and that should cool things off, that takes time. And in the short term, they’re really not equipped to fight that type of liquidity injection with anything else than increasing QT, which I don’t know how they’re going to justify doing that. So they’re going to have to go with 25 bips in May unless there’s…

Tony

There’s been a lot of talk over the past month or so where people have said, you know, the Fed just doesn’t understand the impact of lags. You know, they, they keep raising these interest rates, they keep making these policy changes, but they just don’t understand the impact of lags. So SVB blows up, Credit Suisse blows up, corporate real estate blows up. Other things, and these guys are just too dumb to understand lags. What do you think about that?

Mac

I think it’s best to understand that the Fed isn’t that slow. They’ve come out and said that they know that OER, their metric for rents, does in fact, lag. I think they’re very aware that each rate hike takes around nine months to reach the actual consumer. And look, the short term, from a market’s perspective, you could say that things are good because they’ve had that liquidity injection and a 25 bip hike is not the worst thing in the world because that net, it’s going to take a while to actually get into the economy. But when you look at inflation, there are lagging things that are on both sides. So for example, everybody knows that OER is a lagging indicator. And that’s why the Fed has said that they know that it’s a lagging indicator. That way the market knows that they’re aware, and we’re facing pretty easy comps for CPI to cool off. And that’s why the Fed has been so adamant about super core inflation. That’s their favorite metric, and much like core PCE was their favorite metric for years in the prior cycle, they were very hung up on it.

Mac

Once you see a Fed get very interested in one particular metric, you can know that they’re going to stay on that metric very much. So if you look at Lags, you say, okay, well, gas and food prices are coming down, and the assumption is that they’re going to continue to drop. But if you look at gasoline futures on the front end, they’re up 27% year to date and 37% off lows, and their highest in September of 2022. I don’t know how long that’s going to take to hit pricing at the pump. And you’ve seen that it has actually increased a little bit over the past few weeks. But when these metrics were taken, they were around the lows. So if you do have an uptick in food and gas prices, then it could ruin the entire narrative of inflation coming down. You’re benefiting from easy comps, and I think everybody kind of knows that. And it’s more about will the Fed be able to cut rates? And if so, will it be for a reason that is not systemic risk?

Tony

Yes, I think that’s a great that’s a great point. Dan, in real estate, you know, Mac just said it takes nine months for Fed policy to flow through to consumers. Do you find it takes nine months in real estate, or does it happen quicker than that?

Dan

I mean, in some cases, it’s a little bit quicker only because there’s, without no doubt, a lag. I mean, commercial real estate is a very slow moving market. It operates at its own speed, and most of that’s due to the length of leases in certain sectors. But, yeah, the fact that we have a floating rate market, for example, I think that’s probably the easiest way to kind of use this as an example. When the Fed raises rates 25 basis points, everyone that has a floating rate mortgage in commercial real estate, their rate next month when they go to pay their mortgage is 25 basis points higher. So that right there, that hurts. There’s a lot of pain in the floating rate market right now.

Tony

How much of commercial real estate is floating rates?

Dan

Just the majority of it is fixed rate. It is, but what happened was what’s happened over the years, actually, is that the floating rate market kind of started to blossom. People were getting higher LTVs shadow lenders were actually really pushing the floating rate market more than your traditional banks. Your traditional banks are more likely to give you a fixed rate ten year loan. So it’s grown. It’s still the majority of its fixed rate, but there’s multiple issues there in the floating rate market right now.

Tony

Interesting. Okay, Tracy, when we see. So crude topped out in July, like 130 or something like that, right? You’re on mute. Mac talked about base effects. So once we see crude past that, say, July high, is it possible we start to see kind of deflationary or disinflationary moves in crude on base effects? I’m just not sure what to expect there.

Tracy

Sorry, you’re cutting out a little bit. Look, I think that we’re at the beginning of a commodity super cycle. I think metals are next, but I don’t think that necessarily means oil has to go to 130, 140, 200 again at all by any means. I think it’s higher for longer, right? And higher input costs for mining in general, which is fossil fuels, is going to fuel that next leg up in that, aside from, to get into the whole metals thing, you need a whole nother episode for but higher for longer does not mean we spike to what everybody’s like, are we going to spike? Probably not. This is exactly why they’re still letting Russian crude on the oil on the market. Because Russia knows that if they literally cut them off, which they could by well, not entirely, but they definitely could put the squeeze on them with secondary sanctions, like we’ve done with Iran, et cetera. But we haven’t because the west knows that this will put a squeeze on energy. This will cause energy prices to spike again. This is politically horrible for all of these nations and nobody wants to see this happening, especially United States, in front of an election year.

Tracy

That’s just not going to happen. So we just have to keep this in mind that even though energy prices may not spike higher, it’s still higher for longer, which puts a strain on everything that involves fossil fuels.

Tony

Okay, very good. Thank you. So, as we see those base effects roll off in August of this year, what message do you think that Fed sends to markets if we see CPI spike up again? Because a lot of those base prices came down in August, September of 22, do you think there could be a fear of, say, a third inflationary spike and people freak out again, or do you think people will take it in stride?

Mac

I don’t know if the market would necessarily front run that type of change. I think that the focus is probably going to be if inflation does continue to come down due to the easy comps, I think that you’re probably going to have a bit of a focus on systemic risk and GDP getting weaker and those lending contractions ending up as a bad thing for the overall economy. That said, if the Fed does in fact pause, and if they end up actually cutting rates like the market thinks in Q3 or Q4, while inflation does have a bit of a jump later on in the year due to those base effects. I would assume that it wouldn’t be the best thing for overall markets because you would have the market just price in more rate hikes down the curve. So you would have probably a five-year, ten-year, 20-30, they would probably see higher rates priced in over there, so you would have a steepening yield curve, which wouldn’t be the best thing for megacap equities, which are kind of viewed as a safe haven in this type of situation.

Mac

I don’t think that the Fed wants to see any sort of jump in inflation at the end of Q3 or Q4. I think that they would love to see it just go straight down. But if there’s systemic risk and they’re forced to pause, I’m not sure if it would cause the ten-year yield to collapse to 2%. And I think that the most dangerous assumption right now, and it might not be an assumption that you have to worry about today, is that inflation is going to drop all the way to 2% and then stay there, because I don’t know if it actually will. And if it drops to 3%, that might be viewed as fine. We can is that a victory? Yeah, but it’s not a total victory. And if it stays there is a big question.

Tony

Right.

Mac

So it’s tough to say. I would say that for the short term, equities are kind of an equities person commodities as well. I would have to say that those markets are probably sitting pretty in the next few months, but later on in the year, you’re going to have some tough questions. I don’t know if the market is going to necessarily front run that type of concern. If inflation is coming down, it’ll be the soft landing narrative.

Tony

Do you expect chopping Q3 on some of those mixed results?

Mac

Yes. I would say the big worry is probably going to be the second half of the year, which is ironically, when everybody is starting to price in a rebound, I don’t know. But earnings are going to be very interesting. And if there’s systemic risk, then that entire forecast might come off the table. So we’re going to have to take it in stride.

Tony

Yes. So our expectation of Complete Intelligence is for really deteriorating GDP in Q2 and Q3 on tight credit conditions, and it’s going to be rough. We don’t think we’ll get into a recession, at least at this point. We don’t think we’ll be in a recession in those quarters. But we do think that economic growth will really cut back on credit conditions and other things.

Tony

So hey, guys, I just want to thank you for a great show. I want to thank you for your time, and I want to just wish you all a great week ahead. Thank you so much.