Register for a CI Markets account for FREE! No credit card required: https://completeintel.com/markets

In this episode of The Week Ahead, we’re joined by Dr. Anas Alhajji, Michael Belkin, and Tracy Shuchart. Dr. Anas starts by tackling the intriguing question of oil prices. Despite ongoing supply constraints, including OPEC’s cuts, Dr. Anas argues that there’s currently no compelling case for $100/b oil. He’ll walk us through his reasoning.

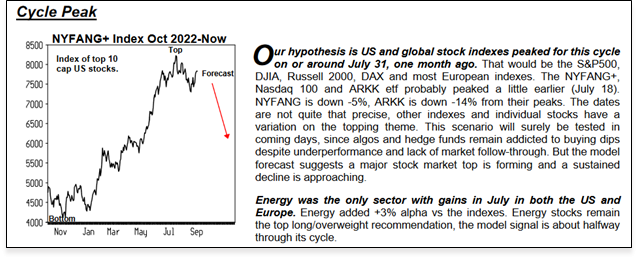

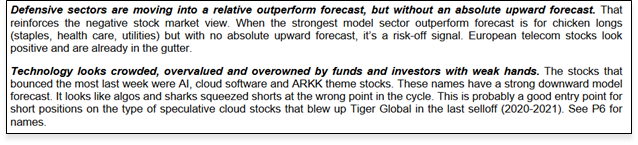

Next, we turn to Michael Belkin who shares his perspective on the equity market. Michael believes that we’ve reached the peak of the current cycle, and recent market turbulence seems to support his view. He also provides insights into energy trends and discusses his thoughts on sector rotation, particularly as it pertains to defensive sectors.

Finally, Tracy Shuchart takes the stage to explore LNG and electric vehicles in Asia. Her analysis highlights Asia’s growing dependence on LNG as the largest energy-importing region, with projections indicating a potential doubling by 2050. Tracy also gets into how gas may outperform green technologies like wind, solar, and batteries, shedding light on the future of electric vehicles in Asia.

Key themes:

1. No case for $100 oil

2. Equities have peaked

3. LNG & EVs in Asia

This is the 79th episode of The Week Ahead, where experts talk about the week that just happened and what will most likely happen in the coming week.

Follow The Week Ahead panel on Twitter:

Tony: https://twitter.com/TonyNashNerd

Anas: https://twitter.com/anasalhajji

Michael: https://twitter.com/BelkinReport

Tracy: https://twitter.com/chigrl

Transcript

Tony Nash

Hi, and welcome to the week ahead. I’m Tony Nash. Today, we are joined by Dr. Anas Alhajji, for the first time. We’re really glad to have you here, Dr. Anas. We’re also joined by Michael Belkin and Tracy Shuchart. There’s a lot to cover today. First, we’re going to talk to Dr. Anas about $100 oil. We’re then going to talk to Michael about equities and sector rotations that are happening in markets. And then we’re going to talk to Tracey about LNG in Asia, which has been a story building over probably a decade, but it’s really starting to break out.

Tony Nash

So before we get started, I want to let you know about a new free tier we have within CI Markets, our Global Market Forecasting Platform. We want to share the power of CI Markets with everyone. So we’ve made a few things free. First, economics. We share all of our global economics forecasts for the top 50 economies. We also share our major currency forecasts, as well as Nikkei 100 stocks. So you can get a look at what do our stock forecast look like. There is no credit card required. You can just sign up on our website and get started right away. So check it out. CI Markets Free. Look at the link below and get started ASAP. Thank you.

Tony Nash

Guys, thanks so much for joining us at the end of this week. I know there’s been a lot happening this week, and I’m really, really grateful whenever you take your time here. Dr. Anas, let’s start talking about the case for $100 oil. Obviously, we’ve seen a lot of movement in crude prices over the last couple of months. There are supply constraints, of course, with Saudi and OPEC supply cuts and the extension of those cuts. But you put in a tweet earlier this week saying that there is no case for $100 oil, which sounds surprising a little bit. I’d really like to hear your reasoning through that if you can walk us through that. I’m sure there are a lot of items that go into that calculation. If you don’t mind, can you walk us through that, please?

Dr. Anas Alhajji

Sure. When we worked on our 2023 oil market outlook in December, and we published it on the third of January, we made 23 predictions in that outlook. It is available on the web for those who would like to check it out. We made those predictions, basically, most of them were against the grain. The title of it was, 2023 is going to be the tail of two-halves. That’s what the title. And the title tells the whole story about the two-halves. The increase in oil prices, etc, all was predicted. We were very bullish on the fourth quarter of 2023. We expected the Chinese economy to be very weak. You and I exchanged few tweets on this throughout the previous month. We expected that. We expected Russia in order to continue to go to the market. But what we did not expect, despite the 23 successes of those predictions, we failed to see that Chinese are going to increase their oil inventories, and they increased this substantially. We failed to see that. And given their history that we studied over the years, it was very clear that they are going to use this bill when prices go up, and they already started doing this.

Dr. Anas Alhajji

That’s messed up our very bullish fourth quarter. We are no longer very bullish, we are just bullish. If you look at all the factors that determine supply and demand in the market at this stage, and I repeat here because some people take this word and in 2025, you said no 100 in 2025. I did not say that at this stage. I think, Tracey got burnt several times with the same matter that I was burnt with. When you say something and people put it in a different time frame. At this stage, there is no case for 100 simply because if you look at supply and demand and the fact that the Chinese are releasing a lot of oil from their inventories, they already released about 35 million and we expect them to release another 45 million in the next few weeks. That’s one issue. There are many other issues that people do not know about. Now, I understand what speculators do and algorithms and all that stuff, but they need a trigger. One of the things, just to give you an idea how much people do not know those who are especially very bullish, the Russians promised the Saudi to cut production by 300,000 barrels a day.

Dr. Anas Alhajji

The Russians are cutting and people see the numbers. What people do not see is that the Russians are playing the game of what is crude because they shifted to NGLs and they reclassified the crude as NGLs. Their NGLs exports went up by 300,000, the same number they decided to cut.

Tony Nash

It’s all a statistical game, right?

Dr. Anas Alhajji

Absolutely. When we look at crude, absolutely. When we look at OPEC and people show, Look, Saudi production is declining, UAE production is declining. Look, OPEC production is declining, OPEC Plus production is declining. We’ve been saying for a long time that production does not matter, exports do, because supplies are what matter to the market. But after they build those massive refineries, what matters right now is the net exports, not the exports. Once you count the net exports, the decline is way lower. Therefore, of course, I mentioned 23 prediction, there are many things to talk about. We don’t have enough time. But the idea here is you start looking at those details, people saying, What if Iran does not deliver? Well, no one counted Iran in the first place.

Dr. Anas Alhajji

No one counted Venezuela in the first place. Why you guys are counting them when you want to?

Tony Nash

Just a very quick clarification. When you talk about exports versus net exports, for people who aren’t energy market experts, why does that matter?

Dr. Anas Alhajji

There are countries that have massive refineries that they take the oil from Russia or they take their own oil and they export it as products. If you don’t count that in the equation, you are missing something from the equation.

Dr. Anas Alhajji

Because they are exporting both. I’m just making up numbers. Let’s say if a country exports 1 million barrels of crude and their product exports go from 100-300, their exports went up. Although if you look at the crude alone, it did not change.

Tony Nash

Right.

Dr. Anas Alhajji

So you have to count that. The other issue that we fail to see, because we have two failures in our forecast. The first one is we did not see the build in the Chinese inventories. Although we know the Chinese story about releasing oil, but we did not realize that in 2023 they will build. The other related issue is we did predict that other OPEC members will buy Russian crude and Russian products. What we felt to see is the increase was fourfold our forecast.

Tony Nash

Okay.

Dr. Anas Alhajji

That changed the whole dynamics because the country can cut production, but they can still consume the oil anyway.

Tony Nash

Right. Okay. Has Russia been hurt by any of these cuts? By any of the energy cuts? It seems like it’s just train diversion more than really harm from these cuts.

Dr. Anas Alhajji

Let me put it differently. Are they being affected by what’s happening? Are they getting less money, etc, Yes, there is no doubt they are hurting. But definitely it’s not what Janet is saying. Okay, they keep talking about… Let me give the audience just one example about this. The price cab and the sanctions were imposed on December fifth, 2022. Two weeks later, Janet Yellen’s office was talking about the price cab is working and it’s reducing Russian exports, although the impact has not been done yet. Between the time the companies sell the oil, get the money, pay their taxes, the government collect the taxes, and reach the level of revenues, it take 6-9 months. Those guys were talking about it two weeks later.

Tony Nash

Right. Statistically, theoretically, it made an impact, but in fact, it hadn’t made an impact yet.

Dr. Anas Alhajji

The price cap never had an impact at all. We have a history of sanctions for the last 200 years, let’s say 120, because most of the studies are done for the last 120 years. Every single study on sanctions in the last 120 years concluded that sanctions do not work and there are always ways for the product to find its way to the market.

Dr. Anas Alhajji

This is a fact of life. The Russians were lucky because the Iranians were on their side and the top expert in the world on this are the Iranians. They took a page from the Iranian book and they made a thousand books out of it. They perfected the game on their own.

Tony Nash

I’m really relieved to see your statement about no $100 oil in 2023. Our CI Markets Forecast product does not have $100 oil in 2023. We see things peaking in October and then slightly deteriorating into the end of the year. That may or may not happen. But what you’re saying very much agrees with what we’ve forecast for months. As we go into 2024, what are the dynamics that you’re looking at? And do you see pressure for higher crude prices going into 2024?

Dr. Anas Alhajji

We published a report on 2024, and then we updated that we are still bullish. But we have a serious problem that we are still struggling with. We have the worst data, quality or records. We never had… I mean, the quality of the data deteriorated substantially to the level that we are really… I mean, we have to work extra hard trying to sort it out. We never had this problem before. It’s coming from all over. Today, we published a report on the EIA adjustment and crude quality and shale. The last statement, the conclusion was the US, with its might, it can send a rocket across the world and hit its target and cannot fix the adjustment in the data. That’s how bad it is. And what happened is, supposedly on the first of August, the EIA published a warning or a press release saying that we fixed the problem, we found the blending things, and we are adding the NGLs, etc. We were happy to see the decline, and the adjustment just declined to the usual 200,000 a day a week later, it multiplied by five. A week later. That shows you that we do have a serious problem in the United States.

Dr. Anas Alhajji

Now imagine with the dark Russian fleet, with the dark Russian, with the dark, Iranian fleet, with the Syrians, the Sudanese, the the Venezuelans, etc, how bad the data is. Then China basically is playing a game where one day the Iranian oil is coming to China from Malaysia and the other day is coming directly and the third day is coming from the UAE. I mean, it takes a lot of effort even to do that, and it’s becoming too expensive for any analysts even to do the analysis right now.

AI

Heads up for a short break.

AI

Are you using the potential of AI in your portfolio management strategies?With an impressive 94.7% forecast accuracy on average, you can confidently integrate AI into your approach with CI Markets. Visualize the potential volatility of your portfolio over the next 12 months and gain insights into specific assets that might experience fluctuations. This empowers you to make informed decisions on when to buy, sell, or hold. CI Markets covers a wide range of over 1,600 assets, including stocks, commodities, forex, indices, and economic indicators. Imagine running limitless portfolio scenarios to optimize your gains. Curious about the outcome of removing or adding certain assets? Wondering how your portfolio might evolve in the next 3, 6, or 12 months? CI Markets equips you with answers to these crucial questions. Whether you seek a streamlined portfolio analysis, wish to explore diverse scenarios, or aspire to track your investments with precision, CI markets is the ultimate tool for you. Ready to learn more? Visit us at completeintel.com/markets.

AI

Thank you and now back to the show.

Tony Nash

Okay, so there’s a lot of great data. For people who are looking at that data, is there a decent proxy data to look at to understand what’s going on? Or is it just a guess at this point?

Dr. Anas Alhajji

This is mostly when it comes right now to the Russian crew, because whatever I say about Russian crew, and I’m convinced of anyone can come in and say another number, and both of us are correct.

Tony Nash

Right.

Dr. Anas Alhajji

Okay, both of us are correct. But one point about the data quality here. Just to show you how bad the situation is, we are coming to the situation. For example, yesterday there was a major report published, I’m not going to name the agency, talking about the CO2 emissions between Europe and India and saying that India permanently now outpaces Europe. It’s a complete nonsense because Europe is in a recession, and in a recession, you use more renewable energy and less fossil fuel. Just show you how data deteriorates. The other data deterioration is related to the fact I know you are going to talk about EV, so I will mention it, and then we talk about it later. About how they report the EV growth in percentages, not the numbers.

Tony Nash

Right. Tell me what that means. You’re saying… Sorry, let me interpret that and make sure that’s what… You’re saying the EV installed base is pretty low. Because it’s pretty low, they’re telling you about percentage growth to make it seem more important when, in fact, the installed base of EVs is just pretty low. If they just told you the numbers, it would be a yawner.

Dr. Anas Alhajji

Is that fair to say? Correct. For example, this is a true case where the number of trucks sold jumped from 400 to 900. Around those numbers, but the report was, Oh, the sales of this truck increased by 154%.

Tony Nash

Right.

Dr. Anas Alhajji

But they did not mention the numbers.

Tony Nash

Right. Okay, that makes sense. Our observation is that macroeconomic data quality has deteriorated pretty bad in the past few years. It makes sense to me also that oil, crude trade and crude quality data has deteriorated as well. There’s just some fuzziness in the past few years, and I just can’t quite put my finger on it. Anas, before we move on to the next topic, can you help us understand the supply-side dynamics? We’ve seen Saudi Arabia continue their supply cuts into October. Do you think we’ll continue to see OPEC pull supply off the market? Let’s say if Europe continues to deteriorate, if Europe’s economy deteriorates, if let’s say, US consumers deteriorate and the US economy deteriorates, do you think we could see OPEC extend their supply cuts and even grow the supply cuts into ’24 if we see economies continue to deteriorate?

Dr. Anas Alhajji

There is one fact that we have to realize here that for Saudi Arabia in particular, they’ve been proven to be true on the demand side. Opec was wrong. If you look at OPEC forecast, you look at the IAEA was wrong. And so what? Because the Saudi are adopting a policy of two legs. The policy is every month they ask Aramco and they say, Look, tell me about what people are asking you for. They have their own clients. So what are the amounts that your clients are asking you for? And they tell them. I am convinced that they have a contract with a company. It’s an artificial intelligence company that measures sentiment. They take the sentiment from the market from the AI company and they take the data from Aramco and decide what to do. They get the first orders before you and I. And if any trader knows anything about the market, they have field before anyone else. The data for the forecast for OPEC and IA and everyone else, it comes later. They have a field of market before anyone else. Therefore, they really nailed it when it comes to the demand. The demand is not as strong as people predicted earlier this year.

Dr. Anas Alhajji

Because we already have this cut and we see where we are right now. They have a few. This is the first fact. The second fact is what do Saudi’s want? Because people really need to understand what they say, Well, they need to balance the budget. Look, this is just one tiny objective among many. There are many objectives. The budget and the money is just one part of it. It is extremely important for the Saudi to control the narrative. It is extremely important for the Saudi to be in the driver’s seat. That’s why they get angry when the speculators after the banking crisis in the US, the recent one, the speculators basically took over and then the media start publishing those weird, some of them fake news. Tracey and I basically are familiar with those news that becoming really annoying from time to time where it’s either fake news or, for example, it is part of corporate planning to study all scenarios. It’s natural. If they are discussing seven issues and one of them mentioned we discussed this issue, does not mean they are going to adopt that issue. But all of a sudden it’s a headline news and the market is reacting to it.

Dr. Anas Alhajji

But the fact is they want to control the narrative. They want to, yes, they want more money, yes, they want some political gains out of it. Yes, they want some strategic gains out of it, yes. But one important element this year that did not exist before that they are going to be a super active participant in COP28. Cop28 is going to start at the end of November for about 12 days in December, and it is in Dubai. This is in their backyard. They want to go there and be a hero. The reason why they want to be a hero, because they cannot be… Remember that this is the first time the oil companies are part of those meetings. They were barred before. They are going with the rest of the old industry, trying to convince the other side to change the narrative.

Dr. Anas Alhajji

And you cannot change the narrative unless you are active participant and you are ahead of everyone. You lowered CO2, you build those big mega wind farms, and you build those solar, and you are using hydrogen, and you are planting trees. They are going to come in full force to show all those good things that I am as good as any European country. Now you listen to me. This is part of it too, because a reduction in output for three months bring us to COP28. Reduction output means a reduction in CO2. At the same time, they are changing the narrative on the consumption side because for over 40 years, the data from VP and NA and all the others, now if you go to the web and search for the top 10 consumers of oil, Saudi Arabia is always there. But that’s a mistake because they did not count the export, the product’s exports. They count them as consumption. Saudi Arabia is not among the top 10 consumers, and therefore they count them as big emitter because they are consuming that oil while they are not consuming it.

Tony Nash

Well, it’s like looking at Singapore as a consumer, right? I mean, Singapore has massive refineries. They couldn’t possibly use all the oil they import.

Dr. Anas Alhajji

Absolutely.

Tony Nash

They import it, process it, re-export it. All these things make a lot of sense. They’re going to get involved in COP28 really to have more control over the narrative going forward. The vilification of oil and gas and the vilification of fossil fuel.

Dr. Anas Alhajji

With the cooperation of others. This is very important. They are going in with the rest of OPEC, China, India, the African nations with the oil majors, especially the Europeans. They are going there, armed with all the facts of 2022, where they show that you, Europeans, you reenact on everything you promised.

Tony Nash

That’ll be very interesting to watch. I can’t wait. Perfect. Anas, this is great. Just conclusions. No $100 oil in 2023. You’re still bullish going into 2024, but you’re not super bullish. The Saudi and OPEC will get more involved in COP28. Over time, we’ll say maybe a more friendly narrative to some of these traditionally fossil fuel-producing nations. Is that fair to say?

Dr. Anas Alhajji

Yes. On 2024, basically, the major issue we are facing is I mentioned one, but I’m going to mention something else since you are going to talk about LNG and EV and Tracy is going to talk about that, so this is a segue to it. One of the big lessons that we learned in 2022 is that we’ve seen substitution among energy sources in a way that we never seen in history, where wind stops, natural gas prices go up, people cannot afford them. Now they want LNG, LNG goes up, and now they go back to coal. It rains, there is no coal. It goes back to wood, and then from wood goes back to oil. We never seen this before, and it’s really quick. This is missing up our efforts to sort things out because we need to know the degree of substitution between all of those. This is a big problem right now in the analysis of the future.

Tony Nash

Yeah, I wouldn’t have expected to see wood as a substitutional feedstock in 2022. that’s really-

Dr. Anas Alhajji

Our regional basis, it is.

Tony Nash

Yeah.

Dr. Anas Alhajji

Or local, if you want to. But on a regional basis, we’ve seen that change.

Tony Nash

Very interesting. This is perfect. Thank you so much. You’re welcome. Let’s go from energy to energy with Michael. A little bit of energy. Michael Belkin, thanks for coming back this week. You mentioned last month when you were on the show that you thought equities had hit the cycle peak, and we’ve seen headwinds in equity markets ever since. Your view is that equities have peaked, which is great. And we’ve got a screenshot of your newsletter. You also thought energy would start picking up, and you covered that a bit in your newsletter as well. Can you talk us through the cycle peak and energy, as you’ve outlined in your newsletter?

Michael Belkin

Sure. Thanks for having me, Tony. Just to review what I do. The Belkin Report is a forecasting service. I was a graduate of UC Berkeley Business School in the staff department. I study time series analysis. What I do is forecasting based on time series analysis. I developed my own proprietary model. It’s similar to what I studied in Fourier analysis in Box-Jenkins on a regressive integrated moving averages, but I came up with my own way. My model gives direction, position, and intensity in a 12-period forward forecast. It works particularly well on sector rotation. We used it in proprietary trading. I was the quant strategist in equity trading back in the early 90s at Solomon Brothers. Anyway, that’s what I do. My clients are big hedge funds, private-family offices, big asset managers all over the world. Basically, I’m looking for what’s going to happen next. Again, direction, position, intensity. Is something going to go up, down? That’s first thing, direction. Second is position. Where are we? Beginning middle and how strong is the signal? With that in mind, let me give you a forward look. Sometimes my forecast sound very contrarian because the model basically likes to buy low and sell high.

Michael Belkin

It’s basically trying to pick bottoms and tops and things. Not just in markets, but in ratios, the way sector rotation works. Okay, so having said that, let’s just say where are we? July 31st, that was the peak for the S&P, Dow Jones, Russell 2000, and DAX. The NICA peaked a little bit earlier, actually July third. So we’re not down a lot from there. We’re down like 3 % for the US indexes, 8 % for the Russell 2000 from their peaks, DAX down 5 %. The stuff that people like the most actually peaked earlier and is down more. So New York-Fang, which is the best measure of all these Magic Seven stocks or whatever, it’s an index you can follow. It’s the top 10 large cap stocks in the US. That’s down 5%, peak July 18th. So we’re good six, seven weeks past the peak in the stuff. But has that changed the appetite among buyers? Not a bit. It’s funny. I was thinking before I came on here, I think I’d dubbed this the Hunter Biden market. It feels so good at first. You know the pictures of Hunter Biden in his underwear, with a cigarette in his mouth, and then a prostitute in the background, and he’s smoking crack.

Michael Belkin

So that’s my facetious view of the people who are addicted to buying these AI stocks and tech stocks which have already peaked. So it feels good at first. And I’m not a permabar, while I was on this stuff, my model turned very bullish last October. It’s almost a year ago. Anyways, but these peaked the first beginning of the third quarter into the end of the second quarter. Just one little side, one little digression on that. If you look at the flows, Deutsche Bank puts out this cumulative flows chart and it shows over the last year, tech is off the top of the chart. That’s all that people are buying and energy is off the bottom of the chart. But that hasn’t been working right. So tech is underperforming now, energy is going up. So, for instance, energy sectors were the only positive gains in the US and in Europe last month, August. Again, this week. So the S&P is down 1 %, the XLE is up 2 %, 3 % positive alpha. And is anybody getting this? I mean, a little bit, maybe, but this is not a consensus popular trade by energy. This is not something that’s wildly popular by any stretch of the time.

Tony Nash

On us and Tracy would have told us the same months ago, just like you. I mean, it’s really interesting to hear you say this, Michael, because this on energy is what Tracy has been telling us to wait for several months. So it’s great to hear this.

Michael Belkin

So it’s working. Again, the model forecast, it looks like a sine wave where the left tail is the beginning of something, the middle is the beginning, the middle is the middle, and the right tail is the end of something, time is on the bottom axis. So where are we in the oil? I might differ a little bit from your previous speaker. I’d say we’re about half to two thirds of the way through this move. So where are we? About $90 a barrel on Brent crude, a little bit below that for US crude. I could think it could go for another month or so. And energy stocks have not really become wildly popular yet. So basically, SEC in the fifth, sixth, dealing. If you think of a baseball game, nine innings, that’s where we are. We’re halfway, we’re not to the seventh-inning stretch yet. So it could keep going. So now what is this doing to the economy? So the market is peak. The market is the best leading forward indicator, economic indicator. So I was driving down the… I live on this island outside of Seattle. Gas is now five dollars a gallon here.

Michael Belkin

That’s probably more around here than it is in other parts of the country. So what is this doing? I think the higher oil price is applying the coup de gross to the US economic expansion. So think about it. Where are we? We had all that stimulus. The COVID hit, they freaked out in Y2K back in 2000. The Fed printed trillions of dollars of money. The US government spent trillions of dollars in all this fiscal stimulus. Then they pulled the plug on that a while back. Not fiscal so much, but the Fed has been doing QT. It’s been draining raised interest rates by 550 basis points, I believe. I think we’re dealing with the lagged effects of all this monetary tiding and pulling the plug on stimulus. I think the oil price typically going into a recession, the oil, not always, but typically you get a rise in the oil price while the recession is already starting and the stock market’s going down. Then the oil price peaks after a few months into it and starts going down when everything goes down together, commodities. That’s where I think we are. I think the oil price is squeezing the economy.

Michael Belkin

It’s squeezing the US consumer for sure. Let me just go through some of the sector rotation stuff. I do a stronger and weaker US industry group forecast. It’s longs and shorts basically, page six of the Belcom report. Until about a month or two ago, I had autos, airlines, all that stuff as out-perform prospects. It was working. Consumer groups, restaurants, retailers, they were all working as longs. That completely changed about the last time you had me on. Now I have for out-perform, I have energy service, oil and gas, energy MLPs, which yield a huge amount, seven %, these pipeline operators. I think they’re still a nice conservative way to play the energy thing. Coal. But after that, what is flipped into the sector rotation is flipped into defensive outperform. So that’s consumer staples, utilities, which nobody likes. These are the most hated. But these are risk off sectors and groups. And when big portfolio managers get nervous about the market, they basically sell all their tech and cyclicals, and they rotate into consumer staples, utilities, health care, and maybe REITs. That’s maybe bottom for list. So that’s what I’m starting to get. And so what is the sell?

Michael Belkin

The market is like the top of my sell list is New York-Fang. So Tesla, Meta, AMD, and NVIDIA. By the way, NVIDIA is down 5% this week. Anybody noticed that? I mean, the favorite AI stock. So to me, this AI boom is… Yeah, it’s real, of course, but it will amount to something, but not the way people expect now. Free market economy, everything changes. The competitors come out of left field. So anyways, the video is down 5% this week. Semiconductors, these are my shorts, software. Also, by the way, software stocks, the same stocks that were in the bubble that Tiger Global was long, everybody has jammed back into these things. These are now my top shorts. So Broadcom, NVIDIA, AMD, ASML. You go down the list… Wait a minute, those are semiconductors, Data Dog, TTD, I mean, Monster, Shopify, Coin, Hubs. These are the tickers. These are the stocks that blew up Tiger Global. And here we are back again. These people are loaded up to the gills in these things. There’s an old saying, a dog who turns to his vomit, I hate to be too-

Tracy Shuchart

Have loves dogs.

Tony Nash

Yeah.

Michael Belkin

So these are my shorts. This is not like me thinking some… This is not a subjective thing. This is what the model is coming up with, internet stocks.

Tony Nash

The sense I get, Michael, is that for a lot of these portfolio investors, they can’t not be in these things right now. They have to. They’re limited and their investors are asking them why they’re not in these things because the perception is that they’re doing so well on the tech side.

Michael Belkin

Sadly. Yeah. So I won’t mention any names, but even one of my clients whose household name, Hedge Fund Manager, I saw his letter saying, Oh, yeah, we covered all our shorts and now we’re long and all these fang stocks because it’s the only game in town. This was like right at the top six weeks ago. So, sadly, that’s how sentiment is the market is like this big vice. It tightens, squeeze you in the vice and makes you capitulate. So sentiment is a big part. One of my smartest other clients is a big sentiment fan, and they always want to know when sentiment is leaning too far one way or the other. And so does anybody like defensive stuff now? No. Do people like energy? Maybe a little, not so much. And there’s no big flows into it or anything. And do people love tap? Absolutely. So I think that’s basically what’s going to… There’s going to be this big squeeze out of this stuff. If I could just go a little bit further globally. So in the context of a global top for equity markets and the economic cycle, there were huge inflows into EM, right?

Michael Belkin

And one of the biggest was Mexico. So Mexico, for some reason, the Japanese retail investors, maybe no more or somebody, pushed these things into the Mexican cash, so Mexican bonds. If you look at charts of Mexico, the Peso got incredibly strong and the Mexican stock market went to the moon. It’s been falling apart. So it’s down four % this week. Same thing with Brazil. So we’re getting this flush, global flush. And if you’ve been around as long as I have, been through a few cycles. When EM starts getting cold feet, basically the currency start weakening, the bonds interest rates start going up, there’s capital outflows, the stock market starts going down. It’s all part of the same risk of global move. So I see this big risk-off global move just starting. So where are we? Beginning of September. The three-month view for the US market points down. So I would be short. A couple of things that are nice trades, VIX. The VIX looks incredibly depressed to me right now. So VIX call options. There’s a big game. There are big vol sellers. Don’t ask me who they are. I don’t know if it’s a conspiracy or what.

Michael Belkin

I mean, it’s part of the zero-day-option thing. People just sell options and it depresses volatility. But if we start getting big moves… Right now, volatility has been depressed, realized the vol is low. It’s like you barely get 1% moves in the market. That’s a big move. But if we start getting 2, 3% moves, those can be up and down by the way, in a bear market. It’s treacherous. So the danger is to sell them in the hall, get bearish, Oh, it’s breaking down. Sell them, get squeezed. You buy it, you short them in the hall, then it goes up four % in your face, you buy them back at the top. So that’s not the way to operate. Sell the rallies. So that’s why I’m telling clients we’re going into a higher volatility market, like the intraday rallies. Like today we’re up a little bit, sell them, short them. Buy VIX when it’s down, when they’re crushing it. Look out for tech. And there’s this big… Retail investors, it’s hard for… They might not be aware of some of these trades, but there’s… For instance, one of my clients is an Alpha Capture Fund. They’ve got almost 200 contributors, sell-side, buy-side brokers, independent guys like me.

Michael Belkin

I’m ranked number one in that. I was ranked number one in the first quarter. I’m up about 16%. That’s market neutral. So the point I’m not boasting. Boasting tends…

Tony Nash

To- Boast. That’s good.

Michael Belkin

Look out when you boast, something comes out of left field and destroys you. But the point is it’s long, short. There’s opportunity to be things like long energy, short tech. And I’m even buying things in their American AT&T, Telephone, Verizon, these are really depressed stocks, defensive, high yielding stocks, out of favor. Maybe not huge absolute gains, but huge outperformance possible, and even gold stocks. So gold stocks are almost there in the forecast. I’m just about ready to push the button on gold stocks, which is a defensive group which outperforms. That’s it.

Tony Nash

No, that’s not it, Michael. There’s one other thing. You mentioned the EMs, you mentioned some of the previous discussions. I want to ask you quickly about China. When we spoke last time, you were a little bit positive about China, and it hasn’t seemed to go well. Is there a chance that we see a resurgence in China or is the opportunity passed?

Michael Belkin

Good question. Yeah, that one I’ve been wrong on. I think I attribute it to their reluctance to go full-bazooka on stimulus. If ever there was a time and a place where it’s appropriate for huge monetary and fiscal stimulus, it’s now. But I am… He’s saying he’s afraid to do fiscal stimulus because it’s going to make the consumers, Chinese consumers, weak. I think they’ll be forced into massive stimulus eventually by how bad things are. But I’m standing aside there now in the Apple news, this is really economic warfare. So everybody knows this by now. They’re not allowing anybody in the government or even state-owned enterprises to use Apple phones at work. So that’s a response to the restrictions the US has put on semiconductors. So there’s this tip for tap thing that makes me really nervous. And it could be that China is completely uninvestible. Right now, I just don’t know. If they go full tilt, bogey on stimulus at some point, then that market could start to go up just on money creation. We’re not there yet, so I’m standing aside for now.

Tony Nash

Great. Okay. Michael, thanks. That was very comprehensive. Really appreciate that.

Tracy Shuchart

I had a question for Michael really quickly. Actually, it’s about based on industrial metals, given this green transition, do you think that… Are we just waiting on China, demanding that they’re the world’s largest commodity buyer for this take-off? We have LME inventories at Lowe’s, but yet we’re seeing prices at Lowe’s as well. I don’t know if you had any thoughts on that sector.

Michael Belkin

Yeah. So base metals, neutral. I agree with you. They’re very low and they’re enticing. If you just look, you want to buy low, they look interesting and you think nickel is going to be in batteries and everything. I’m not getting a signal on those at all right now. So I think the economy is going to head down. And a lot of these EV stocks, the things, the battery makers and things, I just think if the economy goes down, the whole rationale for owning these things is going to get pulled. And so, for instance, in Europe, autos are one of my biggest shorts there. So it’s towards the middle. The top short is tech. So Mercedes, BMW, Porsche, all these VW, all these companies. I just think the economy goes down, auto sales are going to go down and there’s going to be… The demand scenario might not be as strong as people are anticipating for now, for a down cycle in the economy. So no, I’m not bullish on base metals at the moment.

Tony Nash

Okay. I also, on your auto comment, I think is that the volume or is that the pricing power? Do you see fewer cars being purchased or do you see those automakers losing the pricing power they’ve had over the past few years because of supply shortages, or is it both?

Michael Belkin

Both.

Tony Nash

Okay.

Michael Belkin

The economy tanks… Basically, Germany is a big auto manufacturing plant and export. That’s what they do. The stocks are extremely popular with international investors. They’ve been dogs and they’re just starting down. So direction, position, intensity, we’re only second, third, and down. Basically, the model doesn’t say, it doesn’t answer your question precisely, but it gives the implication that car sales are going to… The economy is going to go down, people are going to have less money to spend. They’re not going to be buying new cars so much. They’re too expensive anyways at the moment. You know how that works in an economic cycle? That’s what causes a recession. So the sales fall, companies start cutting production, they start laying people off, canceling orders, suppliers orders go down, et cetera, et cetera, inventories go up. That’s what we’re headed into, I think, inventory correction of classic economic recession.

Tony Nash

Very interesting. It’ll be interesting to see. Thanks for that, Michael. Tracy, let’s move on to some of your comments about LNG and EVs this week. Everyone’s mentioned EVs so far, so I can’t wait to dig into that a little bit. You made this post about LNG in Asia this week talking about Asia’s growing dependence on LNG being the largest importing region and doubling by 2050. Being from Texas, that’s great for us. You also mentioned how gas is likely to outperform wind, solar, batteries, which is interesting to me given that China is pushing green tech so heavily. Can you talk us through the importance of global gas demand as well as the adoption of things like electric vehicles in Asia?

Tracy Shuchart

Well, I think first of all, if you’re talking about Asian markets and we can lump Africa into this as well, even though it’s not Asia. We’re looking at the LNG market. It makes sense that you would make the transition from coal to LNG and then perhaps to renewables because they still need cheap energy. It’s clean energy. It makes sense for that jump to happen. You’re not going to jump from coal to wind. It’s just not a natural technology evolution. It makes sense that the LNG market would grow specifically in those areas. We’re seeing that it actually grow in Europe as well too. Or if you look at Germany, they’re going backwards and investing in coal again. But aside from that, so it’s a natural transition. There was just a big gas tech symposium in Singapore this week. It was everybody from the LNG industry. If you look at really the supply demands and what those orders are looking like for some of those larger LNG companies, particularly many in the US, that just makes sense. As we in the West are talking about cutting off, we want to end fossil fuels by 2050. Whether or not you can actually do that or not, it’s a totally different question, but that is the stated goal at this point.

Tracy Shuchart

We’re really going to see, especially in these emerging markets, fossil fuels grow as they move out of coal and into things like LNG, just as here in the West, how that naturally happened.

Tony Nash

Okay. As they raise their dependence on gas, so India, China particularly have huge dependence on coal right now. Not a small portion of their economy is focused on mining coal. Indian coal miners, Chinese coal miners, that thing. But as they transition to more LNG, are there gas sources in Asia outside of, say, Indonesia, Malaysia, a little bit of say, Myanmar and so on. But are there large gas sources and gas fields in Asia?

Tracy Shuchart

I mean, there are some, and a lot of that is coming from Russia as well. They have the Siberia-1 pipeline, they’re building the Siberian-2 pipeline. You also have large gas sources in Africa, so to speak. There’s a lot of natural resources that are still stuck in the ground at this point. If we’re talking about gas, it’s very abundant in the West as well. Obviously, Europe doesn’t tract, and so we don’t see that coming out of European markets, but certainly in the US, it’s a big abundant energy source.

Tony Nash

Okay, so let’s also talk through EVs because you mentioned that in this tweet as well, and we’ve talked about it with Anas and Michael. With the transition to gas, will those grids have the, say, feedstock and capacity to power the EVs that are expected to come online across Asia in the next, say, decade, two, three decades?

Tracy Shuchart

Well, expected is the key word here at this point, which you mentioned because we’ve seen a lot of these very aggressive goals from, say, the IEA, which puts out what they think this is going to be. But in reality, we have to understand that right now, as far as energy is a concern, we’re in higher for longer. We have energy scarcity right now instead of energy abundance. I think it’s going to be higher for longer. Does that mean it’s going to be $100 oil from here on out? No, I’m not saying that. But it’s certainly not going to be… We’re probably… We’re not going to see $20 oil for any length of time, probably well within our lifetimes. I just think it’s higher for longer. It’s scarcity is concerned. I think this is going to be a very big problem when it comes to EV and EV production, which requires a lot of fossil fuels. You have to mine for all these metals. You have to charge these cars. Most grids are still based on some fossil fuels, and renewable energy mix is still a very small portion of that, and not to mention the problems with interminence.

Tony Nash

Isn’t it strange, though? I don’t mean this to sound as cynical as it’s going to come off. But we’ve had a push for alternative energy for the last, say, 20 years. I mean, trillions of dollars of subsidies with solar and wind and other stuff. But we still have supply constraints. We still have a deficit of energy and fossil fuel. There’s been this massive push to have more of the feedstock as these alternative feedstocks, but we still don’t have enough fossil fuels. Why is that?

Tracy Shuchart

Well, I mean, because we have these green transition goals. The West is really pushing for this. Whether they’re realistic or not, that’s up to debates. But at this juncture, when you’re telling oil and gas companies, We want to phase you out in the next 10, 15, 20 years. How much CaPEx are you going to throw at that? You’re just not. We’re seeing that. We’ve seen the same lack of CaPEx in the metals industry. This includes mining for cobalt, nickel, and all the things that you need for EV batteries, which is also going to be a challenge. I think combining this scarcity factor in metals and mining and in oil mining, we’re going to have a big problem as far as how much EVs cost. When you’re talking about these emerging markets and you’re talking about EVs that are suddenly 40, 50, 60, these people can’t afford those vehicles. It’s just completely unrealistic at this point. I think although these goals seem idealistic, they’re just in practice are not, and we’re going to suffer the consequences of this over the next 20 years because of the scarcity this is creating and the things that we need to make these changes.

Tony Nash

Right. With EVs and both you and I know Anas has written a lot about EVs. We have a subsidy for the EV manufacturer. We have a subsidy for the battery manufacturer. We have a subsidy for the consumer purchaser. What is the true cost of an EV? That’s what I don’t understand because there are subsidies at every… It seems to me at every step in that value chain. Absolutely. What am I missing? I’ve got those three subsidies. What other subsidies am I missing?

Tracy Shuchart

I think that if you look at the Inflation Reduction Act, it’s where do you source your materials? There’s a lot of embedded subsidies within green infrastructure or green transition renewables, not just EVs, but also wind and solar, depending on where are you sourcing this? Are you using American made parts? There’s a lot of embedded subsidies, which a lot of the babies don’t even actually can even capitalize on because a lot of those materials are not sourced within the United States. Those were incentives to get people to drill for those materials here in the United States. But then you look at our permitting process, which takes 10 years, and so that adds a whole other problem.

Dr. Anas Alhajji

Sorry. Add to that that the Department of Energy, the Biden administration is giving GM $12 billion for it to build its factory. That’s something on the side. The other related issues is all the research that’s been done free for them at the Department of Energy.

Tony Nash

Yeah. I’m not anti EV. I just want to be clear. I don’t have an issue with EVs as just an object. I just want to understand what is the true cost of that? Because if we’re supposed to see this EV adoption in Asia, particularly, which is largely in emerging markets, who’s going to pay for that? Because the countries themselves, let’s say in Indonesia, they can’t necessarily pay for all these subsidies. Are we necessarily going to see the grid impacts that we’ve seen in places, say in Europe and the US and other places, not in a place like Indonesia?

Tracy Shuchart

No. That doesn’t even include the cost of the overhaul of the grids. You have to completely overhaul your grid for this. Electricity, people think electricity comes from your socket. No. Electricity comes from burning fossil fuels generally in those countries, whether they be coal or natural gas or crude oil. There are a lot of things that are very altruistic about it. What I think, especially if you’re looking in, and I’m just going to throw this out there, especially if you’re looking in DM markets with the United States and all these people that want to go to these EVs, really, I think hybrid vehicles are a missed and overlooked niche market here. Nobody’s really talking about hybrids, but that solves a lot of the in-term problem. Again, they’re not inexpensive, so I’m talking for DM markets, but it’s incredible to me that people really are looking at hybrids more, especially because we don’t have charging infrastructure in the United States. You know that. You can’t drive across the country probably and make it on an EV alone.

Tony Nash

Yeah. Hybrids aren’t cool anymore, Tracy. They were cool in 2005. They’re just not cool anymore. It’s not cool anymore. Okay, guys, this has been a great show. Thank you so much for all that you’ve contributed, all the amazing thoughts you have. I appreciate all of that. Have a great weekend and have a great week ahead. Thank you so much.

Dr. Anas Alhajji

You too. Thank you.

Tracy Shuchart

Thank you.

Dr. Anas Alhajji

Thanks, Michael. Tracey, bye.

AI

That’s it for this week’s episode of The Week Ahead. Please don’t forget to rate us and review on whatever platform you are watching or listening to this. Thank you.