Be a smarter trader/investor with CI Markets. Learn more: https://completeintel.com/markets

In this episode of “The Week Ahead,” Tony Nash hosts guests Doomberg and Albert Marko to discuss two key topics: stagflation in 2024 and the ongoing clash between Binance and the SEC.

Tony highlights the survey results showing significant concern among respondents regarding stagflation. Albert discusses the impact of economic and political policies on persistent inflation and believes that the stagflation argument may be more of a “stagflation light” scenario due to the resilience of the service industry and ongoing market rallies. Tony adds additional points, including the IBD economic optimism index remaining below expectations and signs of cracks in the middle-class economy. They acknowledge that inflationary pressures, rising prices, and elevated interest rates contribute to declining optimism and a challenging economic landscape.

Doomberg provides insights into the counterintuitive inflationary effects of rapid interest rate hikes and discusses potential impacts on oil prices due to changes in the US shale industry and rising housing costs. He suggests that global stagflation in regions like China and Europe could have a spill-over effect on the US economy.

The conversation also covers arguments against deflation, with Albert highlighting wage inflation as a factor preventing deflation. They discuss the challenges of US debt, the impact of inflation on household costs, and potential signs of deflation in the commercial real estate sector.

Shifting to the energy sector, they discuss the potential impact of stagflation on energy, mentioning challenges faced by the oil industry if prices fall below $65. They highlight the tight supply of oil and gasoline, contradicting claims of low demand, and discuss the role of electric vehicles and the divergence between physical and paper markets.

In the cryptocurrency industry segment, Tony and Doomberg address the legal issues surrounding Binance and Coinbase. They discuss accusations of unregistered securities and criminal activities by these platforms. They emphasize the potential consequences of disregarding rules in the cryptocurrency industry and the need for stronger regulatory action.

The discussion concludes with a focus on the recent actions of the SEC in relation to the cryptocurrency market. They discuss the challenges of regulation, the susceptibility of the regulatory apparatus to corruption and political forces, and the erosion of trust in the SEC. They also highlight the need to address pump-and-dump schemes and the potential expansion of investigations into the venture capital space.

Key themes:

1. Stagflation in 2024

2. Binance & the SEC

This is the 68th episode of The Week Ahead, where experts talk about the week that just happened and what will most likely happen in the coming week.

Follow The Week Ahead panel on Twitter:

Tony: https://twitter.com/TonyNashNerd

Albert: https://twitter.com/amlivemon

Doomberg: https://twitter.com/DoombergT

Transcript

Tony

Hi, everyone. Thank you for joining us on the Week Ahead. Today, we’ve got a couple of great guests. Today, we’ve got Doomberg. We’re going to talk in detail about crypto and Binance and a lot of the crackdown from the SEC. We’ve got Albert Marko. We’re going to talk about Stagflation and expectations for 2024.

Tony

So, guys, thanks for joining us. I think we’re going to go a little deeper into these two areas than we normally do on our topics.

Tony

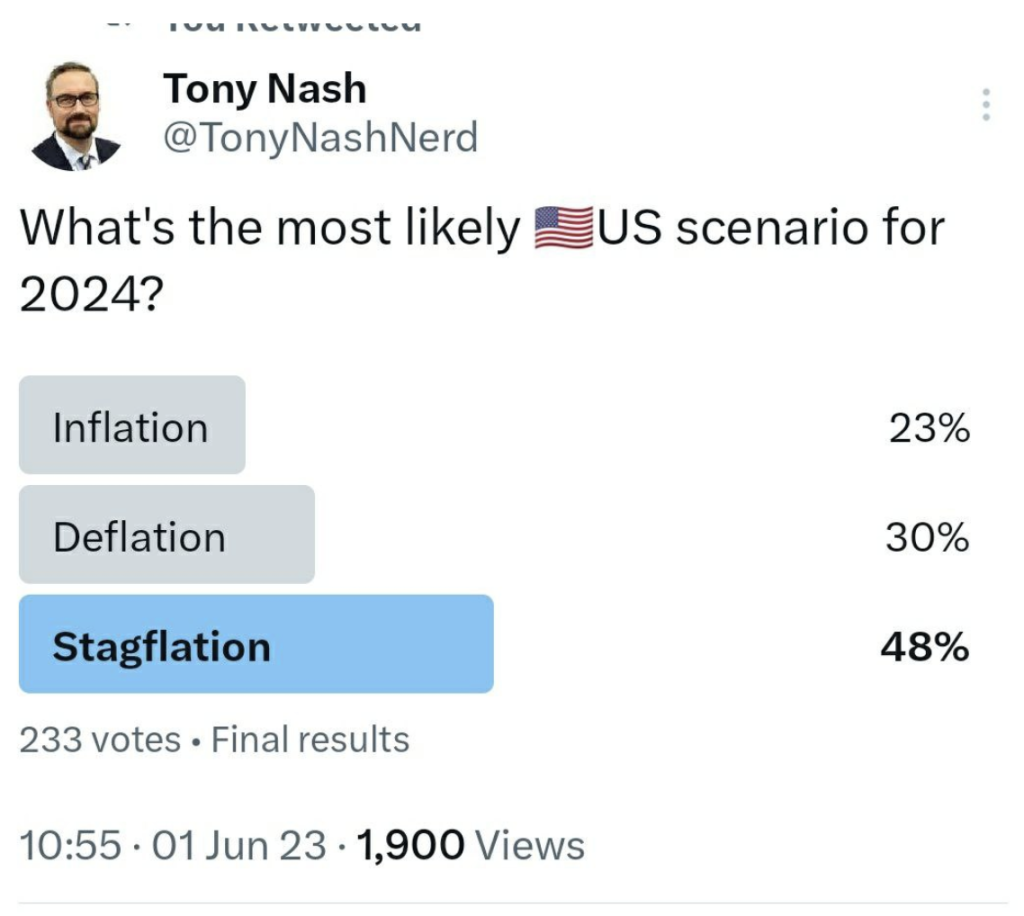

So, Albert, let’s start with you for Stagflation in 2024. I ran a quick survey last week and I know this isn’t super scientific and whatever, but I was really surprised that Stagflation had such a large showing in the responses.

Can you just help us understand why people are thinking that? And what is your view on Stagflation inflation deflation in, say, late 2023, going into 2024?

Albert

Well, I’ve been a proponent of inflation being sticky and staying elevated for quite a long time. I mean, the political policies, economic policies, have not fixed anything in the past two years. So, in my view, inflation just will stay elevated for quite probably next two, three years. The problem with the Stagflation argument I have, it’s more like Stagflation light, in my opinion, that we’re going into late 2023 and into 2024. The issue is unemployment. Sure, we can discuss the BLS manipulation of unemployment and job numbers and so on and so forth. However, the service industry is just banging hot still. It’s not coming down. It’s partly affecting inflation. Dewensberg is also going to throw in there some inflation comments, but the problem is now we have the treasury and the Fed shifting from tech stocks to growth stocks and pushing that up. And they’re pushing inflation and they’re pushing the market to rally. It’s hard to have a full Stagflation argument going forward when just unemployment is just not anywhere where we need it to be to see an actual recession.

Tony

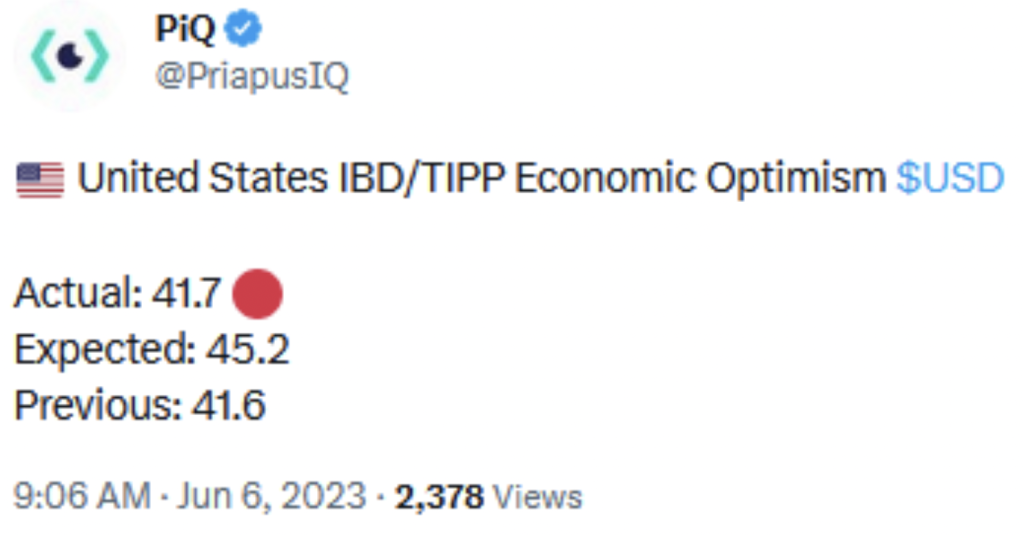

Yeah, those are good points. Let me throw a couple of other things at you. We have this IBD economic optimism index that came out this week, showing the optimism is well below expectation. It’s at 41.7. Of course, that’s an arbitrary index, right? But on a relative basis, it’s not picking up.

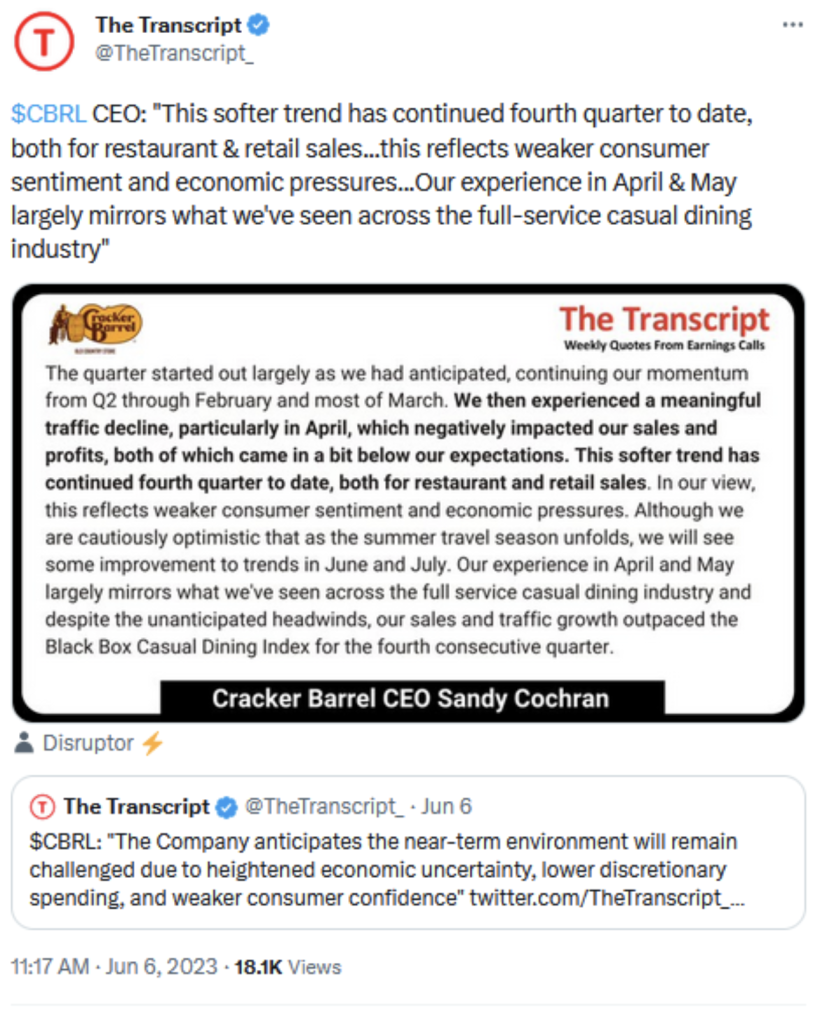

So we’re seeing employment officially looking pretty good, but we’re seeing optimism kind of flatline, even as other things kind of we see interest rates come up, we see the banking crisis hopefully getting resolved, all this other stuff, but we don’t really see optimism picking up, even as wages have continued to rise at least slightly. We also see Cracker Barrel, which we’ve talked about several times here.

And Albert, I just want to acknowledge you’ve been very persistent on your view of inflation, even when it really wasn’t popular. You’ve been very persistent on that. But Cracker Barrel is a pretty good bellwether for what’s happening in the heartland of the US. So for people not in the US. This is kind of working class, middle class place that people go to eat and cracker. Bell had a lot of pricing power over the past, say, 18 months, when wage pressure, when when direct cost pressure and other things would really hit them, they would add that to their costs and they had double digit price rises in 2022 and it really didn’t impact their volume.

Tony

But now, based on their most recent quarterly report, they’re saying they’re seeing a meaningful traffic decline which negatively impacted their sales and profits. And they talk about their traffic being down as well. I hear what you’re saying about jobs, but I do think we’re starting to see some cracks in the middle of America where we just didn’t see that before. Say two months ago, the middle of America appeared to be super strong and we’re seeing some of these telltale signs that there are some cracks.

Albert

Yeah, of course. Inflation is such a headwind right now for normal people, you’re still paying 20, 30% more for items. On top of that, wage inflation is forcing companies to increase prices on products continuously. And let’s be real, once you increase product prices, you’re not bringing them down. You might bring them down 5% to be competitive, but they’re never coming back down to pre COVID levels. That’s just the fantasy. It’s simply not going to happen. So that’s most likely why we’re looking at this optimism trending down and on top of that is like the rate, the rate staying elevated, which I still think we’re going to go to 6%. Fed fund rate is also inflationary.

Tony

Yeah. Doomberg, what’s your thought on this?

Doomberg

Yeah, I think if you think about counterintuitively, and I should say in full disclosure, I first came across this concept reading Luke Roman’s work, great stuff at Force for the Trees. And he, of course, was quoting others. And that’s the way content works. You consume a bunch of it and distill it and create your own thoughts. But there are actually three reasons why the speed and heights with which interest rates have been risen to are actually counterintuitively pretty inflationary. One, we’ve never raised rates at this speed with this much debt before, and so the interest payments are actually just a different form of fiscal stimulus. Now. That stimulus goes to a different audience, wealthy investors, upper middle class and beyond. But still, with $32 trillion in debt and another couple of tens of trillions to be added in the next few years, a post debt ceiling deal, when you are at 5% interest, that becomes a pretty big slug of fiscal dollars going out the door into the economy. And that in and of itself is pretty inflationary, especially if you don’t trigger sort of the economic slowdown that you would want in order to beat back the forces of inflation.

Doomberg

The second reason why elevated inflation interest rates is actually pro inflation is the oil patch. So we all know that easy money and low interest rates caused a lot of sort of uneconomic projects to be funded in the US shale and shale has been responsible for 90% of the world’s growth in supply in the past decade and a half, and that’s coming to an end. And if we see production, particularly in the Permian Basin, begin to roll over as the best fields get exploited and there’s not as much cheap easy money to fund the incremental drilling project, we could see upward pressure in oil prices despite a potentially slowing economy. And then the third is actually this impact on housing. So you have all these people sitting on mortgages that are really attractive and so they’re not going to sell their home. If you’re sitting in Florida and you have a 3% 30 year fixed mortgage, you’re not putting that house on the market with mortgage rates at 7%, which means the incremental supply of housing is just not there. And so home builders and new housing costs are just skyrocketing. And that’s a big measurement into inflation as well.

Doomberg

And the only other thing I would add is this talk about whether the economy is slowing. Is this sort of the US. Participates in a global market and and the US. Might be doing well because of its relative energy advantages. But if you look at places like China and Europe, we are seeing pretty significant slides of stagflation on the global scale. And at least some of that will leak back into the US. As well. So that’s the only thing I would add to the great points that Albert was making.

AI

With CI Markets, you can access AIpowered market forecasting for as low as $20 a month. Get 94.7% market forecast accuracy for over 1200 assets across stocks, commodities, currencies, equity indices and economics with weekly updates and one month and three month error rates, you can rely on CI Markets to help you make informed decisions. Join a growing number of satisfied users who already transform the way they invest and trade with CI Markets. Don’t miss on another opportunity. Start forecasting with confidence today for as low as $20 a month. Visit completeintel.com markets to learn more.

Tony

Okay, so guys, why are we not hearing more? Like, why do you think deflation is not going to happen? Help me understand the arguments against deflation.

Albert

I go right back to wage inflation. I just can’t see as long as wages are coming down and unemployment isn’t really skyrocketing, I don’t think we even have a chance of disinflation or deflation or whatever, any kind of negative inflation. To go back to what I’ve said previously before, it’s like, hey, to get back to pre COVID levels, we need negative CPI prints.

Doomberg

That is simply not happening.

Albert

We’re nowhere near such a thing. So, I mean, all these CPI perks that are ongoing, just like Doomberg said about the housing market. And as I was pointing out towards unemployment, where do we see deflation even coming here. I can’t even make an argument for it.

Doomberg

Yeah. The only thing I would add is you would need a real substantial slowdown in the economy and perhaps even a popping of the everything bubble. But even then, imagine a world where the Fed has to monetize all the incremental debt. Like, we just look at the spending and the interest payments on the debt and the entitlements alone. We’re getting to the point where if we weren’t the reserve currency, you’d be sort of staring in the face of a typical emerging economy debt spiral. At some point, when you’re spending hundreds of billions of dollars a year just in interest payments, and then you have all these programmed entitlement increases that are tied to inflation, a lot of these promises aren’t monetary. They’re actually like the physical delivery of goods, these entitlement spending. And so it’s a real I don’t know how we get out of it.

Albert

Yeah. The benefit that we have being a reserve currency, there’s absolutely no competition in the world to hold us accountable for our misgivings. They can do whatever they want. It’s bad in the long run, but I don’t think that any of us will be alive to see it. But at some point, just like you said, the chickens have to come home to roost.

Tony

Okay. And again, I’m sorry to push on this, but if we take that from the national, say, accounting and monetary level down to, say, a household, okay, we have inflation that’s really risen, what, 20% over the past two years. Right. Things are generally is that fair to say, Albert? Say 20% higher over the last two years?

Albert

Yeah, absolutely.

Tony

Some cases more, but on average, probably 20% higher than two years ago. We haven’t really seen 20% pay rises across the board, necessarily, although we’ve seen some decent pay rises in pockets. We have household costs. Like the cost of buying a house is at. These interest rates are pretty expensive for, say, middle class and entry level people buying their first house. I hear the argument many times that people who are locked into a low interest rate, so they’re not going to move unless they have to. Right. But if people are so leveraged up, will we not see people refinance in order to tap that equity and that will cycle into higher interest rates or higher mortgage rates for those people? Do we see that as happening as a way for people to tap more equity to alleviate some of the short term credit?

Albert

No, I don’t think we’re going to see that only because I think the Fed and the treasury made it explicitly clear to a lot of the banks to stop doing stop lending. The credit tightening cycle is certainly upon us, and they’re really wise to that little game.

Tony

Okay. And then I saw an interview with somebody, I can’t remember who it was, saying that, really, housing has a lot of room to run given where interest rates are. Is that realistic or is that a silly argument? I mean, I just you know, I live in Texas where housing is doing continuing to do really, really well. I know on the coasts housing has taken a significant hit, but it’s relatively small in terms of the run up that it’s taken over the past couple of years. So is there room to run in housing in the center of the US or maybe in Florida?

Albert

I don’t think so. I live in Florida myself and the cash buyers are starting to disappear. Without cash buyers, I don’t think this housing market really has too much more run on. Just the interest rates are astronomical. I mean, I went to go buy a lot close to my house and they were asking for like 9.2% interest rate and I just simply not going to do that.

Tony

Right. What do you see?

Doomberg

Well, back to this. Where could we potentially see signs of deflation as long as we’re talking about real estate? I think if we look into the commercial real estate sector, it’s a completely different story. And as people are working from home and they’re not going back to the office, there’s a wave, and I mean a wave trillions of commercial real estate loans that need to be rolled over that are basically underwater. The equity tranche is effectively wiped out even if they haven’t marked it yet. And this is going to put a lot of stress on regional banks in particular because they do most of the heavy lifting in this sector. And so if you’re looking for the seeds of a potential deflationary crisis, once we get through this pulse of inflation, I think a good place to start would not be in the housing market, but in the commercial real estate market. And this has obviously been on everybody’s radar for a long time. And so then one wonders, maybe it won’t be that bad because if everybody knows it, it can’t be important. But at the same time, it does sort of have that feel of between Bear Stearns and Lehman Brothers back in the day.

Doomberg

That was an awfully long time in hindsight, and it feels like it was a week when you look back a decade plus later. But the pin on this CRE grenade has been pulled and one wonders whether that grenade is a daughter alive.

Tony

Yeah, so let’s talk that through. So, CRE, you say regional banks will be hit, but who does most of the investing in commercial real estate?

Doomberg

Well, I mean, where does the potato end up? Right? And so a lot of these things are securitized and so on, but people are chasing yields. So it’s pensions, it’s the Blackstones Fund, which has obviously been gating, was a real sign. It’s been gating outflows for several quarters now. And the trot on the bank, as one would say, it doesn’t seem to be abating anytime soon, the whole consequences of Zerp has to be manifested somewhere. And when you take Zerp plus COVID lockdown, plus a complete reorientation in the way the vast majority of America works, then you have because this is a really big part of the sector. And so I think something like 55% of all CRE loans in the country are underwritten by regional and community banks. And this is really the role they were meant to play in our society. We wrote a piece on this several months ago called Regional Fallout. And if we lose the regional banks, which is why this little mini crisis that we’ve gone through was so brought with peril, in our view, for the US economy and potential source of sort of a deflationary type recession.

Doomberg

If small banks stop lending, the economy stops working. It’s just that simple. Like, JPMorgan Chase is not doing the hard work underwriting risk assessment that small businesses need. We have a banker for the Doomberg Project. This person exists. They’ve come to our office before we launched. They understand the timing, the flow, and the size of the cash that’s coming in from our business. They’ve done their personal know your customer AML. We would never get that with JPMorgan Chase. We would be sent to a call center or an algorithm would randomly shut our account down without any appeal. And if you take away, like, the local car wash, the construction company, the plumber, the electrician that needs to finance some working capital, they’re not going to get the attention from a JPMorgan Chase that they will get from their local community credit union, for example. And if all of these smaller regional banks are on the hook for these loans that the old expression I first heard from Kyle Bass was a rolling loan collects no loss. If they can’t roll these loans, they can’t refinance these buildings, these construction projects, and they have to take the hit.

Doomberg

These leveraged regional and community banks could be in a world of hurt.

Tony

Okay, so that’s what happens then potentially is a credit crunch based on community banks, right? And then that hits small businesses and they’re the major employers and then correct, have to reduce headcount. And that’s the fall on of the CRE debacle right now, just to add.

Albert

A little bit to the regional bank issues, a lot of them issued out SBA loans for COVID, and those loans are now starting to start to get paid back. But these small businesses can’t pay those back because I mean, they’re talking about up to $2 million piece. Those come as a wave and start defaulting. The community banks even have a bigger problem to deal with.

Tony

Okay, so that’s interesting. So the impact on small businesses could actually be CRE to regional banks, to small businesses could actually be a trigger that could start the stagflation wave.

Doomberg

This is why we keep a close eye on the Blackstone B REIT or whatever they call it. We wrote a piece on that a while ago and Blackstone came out and made all the typical sort of denials that you would see, of course. And we have great properties and the market just doesn’t understand us. And yada yada. I think the market understands exactly what’s embedded in that portfolio. And they did again, they marketed this retail with and it has pretty severe lockup and people see the losses coming and are trying to get out. And so quarter after quarter you’re seeing these redemptions. This feels like two Bear Stearns hedge funds has a certain feel pattern repeating itself in eight here and we shall see. I don’t know what the solution to that is. I mean, there’s an awful lot of dead money walking in that space, an awful lot of hesitancy to mark to market the true value of the underlying cash flows corrected for probability of default. Big city politics. Not to get political, but a lot of people just aren’t going to San Francisco offices anymore. They don’t want to run the gauntlet of homelessness and mental health issues that you have to see every day when you go from your home to the office.

Doomberg

And why would you when you could do all your work from home? And so this is a real sea change and we’ve not yet swallowed that pill and we don’t really have a good recent history of taking the L at the national level. We extend and pretend everything. We just keep sticking fingers and holes in the dike and trying to keep all the water back and at some point something’s going to break.

Albert

Yeah, speaking of that, one of my base cases is another economic back coming in the fall. So I would look to probably see Congress address this issue before it gets out of control.

Tony

So you think there could be another package in the fall?

Albert

Oh, yeah.

Tony

So commercial real estate hits regional banks hits small businesses, and then there’s another commercial package in the fall to alleviate some of that problem, which then becomes.

Doomberg

Really inflationary because it’s very clear to the market then that we will just print our way through everything and we will basically go through the self default route of inflating away our debts.

Tony

So we have the Stagflation blueprint. To me that sounds like the Stagflation blueprint right there.

Doomberg

Yeah. So the counter is we had 40 year epic bull run in bonds. Right. And that was pretty deflationary. We went around the world and found cheap labor and we financialized everything and we hollowed out US manufacturing and the US military has decided that that’s probably not good for national security. And so if that 40 year run is over and we are going to do a lot of reshoring or safe shoring or moving things to allies out of the sort of cheaper labor, that in itself is both inflationary but not necessarily sort of feeding the recession narrative. And so you have to sort of balance the flows here, like the different forces and the flows. And I do think that you could see significant inflation without necessarily a strong US recession if the forces of reshoring outweigh any sort of crises that we might be able to paper over in the regional banking sector. And so this is sort of the ultimate challenge with trying to analyze these things. Which of these forces will, when you square them all up, which one will be the sort of determining one? Because we are if you just look at the reshoring of manufacturing, the numbers are pretty strong in the US in the past 18 months, and that offsets some of the sort of the declining forces that might traditionally signal a recession.

Doomberg

A lot of these indicators that we’re looking at that we’re used to seeing, of course, were born and worked in a different regime. And if that 40 year regime truly is over, then some of these indicators might not work.

Tony

Yeah. So I would recommend, if you guys haven’t read it, and if yours haven’t read it, there’s a book called The Price of Time by Edward Chancellor. It was recommended to me by somebody who is really knowledgeable. I’m about two thirds of the way through it. It is a fascinating book, and this time is never different, and that’s the main lesson. And we see central banks go in, try to intervene, try to alleviate things, and there’s always some sort of fallout. So, Dubric, as you say, if this is the end of the 40 year cycle, there’s going to be pain. And if CRE is acute enough so let’s say 30% of the value has fallen out of CRE, that’s acute enough to cause some real pain, right?

Doomberg

Yeah, just to give that chance for a plug. Actually, I heard him on the Grant Williams podcast discussing that book. It was a really great episode. And I agree wholeheartedly. It’s a fantastic book to read.

Tony

Great. Maybe I’ll see if he’ll come on our little podcast. That would be amazing. Albert, can you talk us through a little bit of the impact on energy? If we’re in a stagflationary US economy, what do we see with energy?

Albert

Energy is complex, Tony. It’s really complex. I mean, under $65 becomes problematic for the oil industry in the United States. They’re not going to produce. And that, again puts the oil back, parts of oil back up over $80, which is where the Saudis want it. But of course, the United States, the Biden administration, certainly doesn’t want to see that because it’s inflationary. It’s really a tough call with the energy sector in this. It really is. I mean, I could see this going to stay in here at 60, $70 for six months, or I could see it going to $100 pretty quickly.

Tony

Yeah. And what’s also interesting is the refining activity in the US. Refineries that are almost 96% capacity utilization tracy talked about that this week earlier. And so we have some of these refineries down for maintenance, but going into potentially hurricane season at 96% utilization, there’s really not a lot of movement or flexibility there for gasoline and other distillates. Right. So we had our first tropical storm of the season off of Florida this week. So if that turns into a hurricane, or if something soon turns into a hurricane hits Louisiana and Texas, we could have some real spikes in gasoline in the US. That could really aggravate at least the perceptions of inflation, if not inflation itself.

Albert

Yeah, the oil and gasoline supply is so tight. I have an oil brokerage firm, and we’ve been running around the globe to try to find supply, and it’s tight. Forget about what people are trying to tell you about the Saudis or the OPEC is hurting because demand is not there. That is absolutely not the case. The demand is extremely high and the supply is very tight.

Tony

Yeah. Jimberg, what are your thoughts on energy and stagflation?

Doomberg

Yeah, I would say the world was saved from an energy catastrophe with the unusually warm winter in the Northern Hemisphere, and in particular in Western Europe. And I don’t know how the weather patterns with Al Nino foretell what the next winter will be like, but it does seem like our leaders, especially in Europe, are learning all the wrong lessons. They’re confusing good fortune with good strategy. Prices are really low right now. The wind is at their sails, pun intended. They certainly seem to be heading into this winter with far more confidence than we think the facts on the ground would warrant. To the question about refiners, we wrote a piece one of the big ironies, of course, is that a lot of this Russian oil is flowing to India, which then gets refined into gasoline and distillates and finds its way to the US. And relieve much of the diesel crisis in the Northeast, for example, that was beginning to break out. US. Refining capacity at 96% is mostly testimony to the fact that we’ve not built a new major one in 40 years. You just can’t get them done anymore. And so we’re going to rely more and more on imports.

Doomberg

I would say just back to this whole concept of electric vehicles putting oil out of business and such nonsense. I mean, that gasoline is just one important cut of a barrel of oil. But we’re still going to need diesel, we’re still going to need jet fuel. And ultimately, this is byproduct economics. And so if the price of diesel skyrockets, and that makes the price of gasoline cheap because refiners have to keep operating, then somebody will pick up that gasoline in a developing world. It’s a global market. It trades, and it’ll all be used. And so every drop of oil needs to be used. That’s why our roads are paved with asphalt. That’s all byproduct economics, and ultimately we’re not going to be kicking our oil habit anytime soon. So as it pertains to Stagflation, I think the move by the Saudis was interesting. Proactively cutting a million barrels a day of production. One wonders whether their fields just don’t need a rest anyway. A lot of OPEC has been stretched to their main capacity here, and they’ve never really been able to operate at their allocated production levels anyway. But I do think there is a big divergence growing between the tightness in the physical markets that Albert’s referring to and then the complete pessimism in the paper markets.

Doomberg

Gold investors are rolling their eyes and seeing this play out again. And now you have to be careful that you don’t need to look for conspiracies everywhere in the market. But the Saudis are certainly convinced that the price of oil needs to be higher. Well, they needed to be higher for their own internal domestic needs. And in fact, I would say the equilibrium price that keeps the shale patch doing well and Saudis and OPEC happy is around $85. Brent 82, $83. WTI we’re about $10 below that today. Again, as I would say, the shale patch has gotten more disciplined. They’re not chasing growth for growth sake, they’re focused on cash. And so I do think that there’s sort of a natural range bound sort of sweet spot for oil in that with, with a median around 80. And that’s probably where we’ll end up.

Tony

Very good. Okay. Still higher than today. So it doesn’t help that stagflationary discussion. Okay, good to know, guys. Thank you very much. Let’s move on to Binance. I know there was a lot of movement in crypto this week with, you know, Binance and Coinbase and, and other things happening from the SEC Doomberg, you put out an intentionally seemingly nonspecific tweet about Binance, and I’m curious what your thought is about Binance, about the CEO, Zhao Chungpeng or CZ. Can you tell us kind of what’s happened there?

Doomberg

Sure.

Tony

Dig a little bit more into Binance and Coinbase. It doesn’t really seem like they’re exactly the same issue. I want to understand some of the accusations that they’re operating as an illegal exchange, this sort of thing. Let’s really dig into that and figure out what’s really happening there.

Doomberg

Sure. Let’s partition the discussion into sort of two categories. One, the whole question around whether crypto tokens are in fact unregistered securities. And then two, beyond that, Binance and FTX are being accused of basically running what amount to criminal enterprises where they’re commingling customer funds, enriching themselves, lying about their internal controls, and so on and so on. I would say Coinbase is not accused of doing any of those things. Right. Coinbase is a US based exchange that trades in the public stock market. We have no position in Coinbase, just FYI, but they do stand accused of trafficking in unregistered securities. And we’re putting out a piece on this on Friday. It’s pretty. Clear cut if you read the filings and so I wouldn’t commingle the fraud. The Sam Bankman freed CZ accusations of fraud which make the accusations of them trafficking and unregistered securities almost quaint in comparison. But the unregistered securities question is a life or death situation for Coinbase. And I do think when you read the filings these things don’t. How we test would indicate that Salona is a security like money was raised in exchange for tokens. The value of those tokens depends on the work of others.

Doomberg

It’s a common enterprise. They illegally, I think, listed them on these exchanges both domestically at Coinbase and offshore on FTX and Binance and pick your favorite. And these coins were picked up by venture capitalists for twelve cents and twenty five cents and they sold them out at $250 to unsuspecting retail. When it comes to the SEC, the brightest of their red lines is you do not sell unregistered securities to unaccredited investors. They stand at the gateway between the private and the public markets. And anybody who spend any time in venture capital knows that you don’t get to monetize on the back of retail without running the gauntlet of the registration process of the SEC. And they cleverly figured out that they thought that they’d invented the cheat code. We’ll call it a token even though it acts an awful lot like a stock and we’ll have a lockup period, but it’ll be a year. It’ll be this simple agreement for future tokens. Matt Levine put out a great column on Wednesday. These are stocks. They’re essentially very much analogous to the equity tranche in a company and a bunch of vents of capital, including a bunch of very high profile ones, not only dumped these tokens for thousandfold returns on the backs of retails, they went and filmed themselves on podcasts bragging about it and laughing about it.

Doomberg

It’s really amazing to me and I do think the thrust of our piece is venture capitalists should know better, they should have known better, they knew what they were doing. The SEC has been paying very careful attention and now that look, you have a motivated enforcement agency that is being openly disrespected all over FinTwit, all over YouTube, all over social media. They have the power of the subpoena. Sure, maybe there’s a few Republicans have been bought off to sing for the industry and even a commissioner or two, but Gary Gensler knows the crypto space well and we have, so we call it the Doomberg test. Is the underlying activity legally dubious? Check. Are you making a stupid amount of money off it? Check. And is the government therefore going to be paying attention to you? Of course, like you don’t get to cross that red line. In my mind the how we test is definitive and Bitcoin is not a security ether. Different story. But the rest of these tokens that basically found lawyers to advise them on how they could technically not make it the same as an initial Coin offering, but in reality, they really didn’t change that much.

Doomberg

They invested in a common enterprise in the hopes of making a profit on the work of others. That is a security. All of these tokens are securities. Coinbase for listing them, I believe, is in big trouble. There’s also another thing here. It’s not just a question of securities itself. These exchanges were actually operating as exchanges, custodians and clearing houses all at the same time. And that’s a big no no in the US. And so there’s far more legal jeopardy here than the market is pricing. And it’s shocking to me. The most shocking price on my screen today on my Bloomberg, is Coinbase bonds. I can understand equity, I can understand the reddit crowd and trying to generate a short squeeze. Coinbase is the most highly shorted stock on interactive brokers. That’s all fine. If AMC can go to where it went, then Coinbase can stay here. Even though their entire business model has been effectively declared illegal by the SEC. Why the bonds aren’t acting is a real mystery to me. These things are still priced at a pretty reasonable 15% yield is distressed, but you would think that the bond market would be sniffing out that the SEC is serious about this.

Doomberg

People just don’t read the complaints. Like, if you read the Binance complaint, it’s not like it’s 130 pages. It’s a bit of a heavy ask in today’s hyper short attention span environment. But just go and find the Binance complaint and read pages 88 to 92, four pages on why Salona is a security. It’s just so clearly a security. And they listed them knowing that the SEC was basically telling them, hey, guys, you got to clean this up. These things are securities. And so it is a real mess. And I think it’s going to become political, it’s going to become ugly. But again, the bifurcation here between the question of what’s the security and the question of fraud, I want to be very clear. There are serious accusations, compelling accusations of fraud at Binance that don’t exist at Coinbase. But Coinbase’s entire business model has effectively been declared illegal by the SEC. And to us, that should matter.

Tony

Yes. So everything you’re saying, I think both Albert and I, probably through different processes, but have been very vocal about this for the past couple of years. My biggest question or biggest statement has been, this is not a currency. These things are called currencies. They’re assets and they’re securities. Right. And so I haven’t understood it from the I feel like I’ve understood it, but I haven’t really understood how people could call them currencies or tokens when in fact they really are Securitized assets. Right. And so that seems very simple to me and I’m just surprised how long it’s taken the SEC to get here. But they’re a bureaucracy. It takes some time. This all makes sense. I don’t understand how they got securities lawyers to sign off on this.

Doomberg

Well, it’s a funny thing about lawyers. So in my corporate experience, we come at this from the corporate side, not the finance side. And I had a couple of decades in corporate America in various roles and a couple of expressions that were always near and dear to me, to my heart. Lawyers advise and leaders decide. But the second is there’s a vast difference between having a case and having an argument. And the lawyer will tell you you have a case right up until trial, at which point it magically becomes, oh, we have a pretty good argument. And look, lawyers are in the billing business and so they will give you advice and they’re fully protected by their own sort of insurance and they’re just doing their best as professionals. But if you could find a lawyer to basically tell you just about anything and it’s amazing to me, it’s just again, the Doomberg test is it probably illegal and are you making a ton of money at it? You got a problem to brag about making a billion dollars like who did on what podcast? It’s just really amazing to me that people would be so and just.

Doomberg

Even the CEO, brian Armstrong. Let’s circle back to Coinbase here. Their stance towards the SEC boggles the mind. They’re going to walk into the SEC and dictate to them how they need to change their regulatory framework to make Coinbase work. When the SEC again, I’m old enough to remember when people were afraid of the SEC, like getting a subpoena from the SEC was a BFD. If the SEC doesn’t drop the full hammer and looks like they are on these people, we need to see DOJ raids at this point in my mind, or else people are just not going to respect the SEC and we’re going to basically have a free for all.

Albert

Why should they respect them when Elon Musk is out there?

Doomberg

Ridiculous. It all starts with SEC middle words, Elon. In my view, that was the moment Jay Clayton really said all this in action and Gary Genzler is trying to sort of close the barn door. But yeah, like pumping dogecoin. Everybody knows what’s going on when he changes the Twitter to the doge. Right. The Winklevoss twins. Like all this mania that we saw, we all know what we’ve all been around. We’ve been around market cycles. And the reason we can avoid such traps is because there’s nothing of economic value occurring at the center of these things that would justify anywhere near the types of prices that we saw on the screen. And people should know better, right? And look at this. It matters. The reason why the US has deeply liquid really well functioning markets is because the world assumes the rules will be enforced. If we’re going to dissolve into a casino where how much money you spend coinbase literally threatened the SEC in a response by saying, if you sue us, you will face a well resourced adversary that will fight you all the way to the Supreme Court. Can you imagine the stones it would take?

Doomberg

And by the way, when Coinbase became public, they didn’t do an IPO in the traditional sense. They did a direct listing. And it was basically insiders selling in to create the float. And Brian Armstrong owns $130,000,000 home. Like, he’s not a sympathetic defendant here. And why the government took so long and why they don’t take the steamroller out and just make examples of some of these people is baffling to me. Maybe it’s coming, but, man, like, when I was in corporate America, you got a note from the SEC, the hair on your back stood up. Everybody stood at attention. You stood in line and you did what they told you because the two otherwise was the end of your career. And you could look at jail time. I mean, selling unregistered securities to millions of US investors is the brightest of red lines at the SEC. Everybody knows it could be. It should be. And we’ll see if Gary Genzle has the political wherewithal to see this through. If he doesn’t, the other side of it is going to be pretty ugly.

Tony

Doom do you think the SEC is just trying to give people time to get out? I’m baffled by why this took so long, but do you think they’re just trying to signal to markets, hey, you really need to get out of this. You really need to get out of.

Doomberg

This, or is the market’s not listening? Right? I would say let’s put this in the proper political context. The amount of money that FTX and others in the industry have spread around Washington, DC, is really one of the challenges with our political system. Like, you can become too big to regulate who’s going to step up to Elon Musk in this environment. One of the reasons he bought Twitter, I believe, is to become politically unregulable. He can’t regulate the man. He’s got the giant megaphone and he’s doing some things well. It’s not a conversation about elon, but the regulatory apparatus in the US is susceptible to corruption, is susceptible to political forces.

Tony

This is new information.

Doomberg

Doom this is, yes, breaking news, the more corrupt Washington becomes. But there’s a cost to that. Again, the US markets are the US markets for a reason, which is compared to all the others. The SEC was a cop on the beat that people trusted. And if that erodes away, imagine a world where the definition of security is so stretched and abused that something like a crypto token is not a security man. All bets are off, right? I don’t know. The investor protections are a key part of the efficiency of the US capital markets. The US capital markets are a key part of the reason why the US economy was as strong as it was for many decades. We are really eroding the core here. If we let huxters and fraudsters take over the reins and run the show.

Tony

Yeah. So I remember running around China in the late, early teens, 2000s, early teens, and I’d go into all the brokerage houses. They would say, hey, we want you to teach us about financial innovation. And it was just shocking to me. Like, they weren’t even trying to build credible markets. They wanted to incorporate some of the things that the US was doing before the financial crisis and then even after. And what it makes me think of, and I’m curious of your thoughts on this anybody who talks about, say, doing an ICO or something related to, say, finance like activity, they immediately start talking about Singapore, and they immediately talk about the regime in Singapore and the financial innovation in Singapore, these sorts of things. What do you think about those types of jurisdictions where this stuff is really encouraged and they’re trying to cultivate these types of securities?

Doomberg

There are no financial innovations. First of all, every scam is as old as history. And look, financial innovation is a euphemism for “let me launder money.”

Tony

Absolutely, yes.

Doomberg

That’s basically what it comes down to. Kycaml exists. And look, we’ve been critical of the US Treasury and the if Soren and Ben Hunt’s model on that, and they do go too far sometimes. But you’re talking about places like Dubai. Okay, what’s going on in Dubai? I wonder? Why is Dubai suddenly the headquarters of crypto Singapore? The amount of money, illicit money, flowing around the world is huge. It’s staggering. And our friend Markahotis would say the rise of these offshore crypto exchanges came in the aftermath of the collapse of wirecard, which was facilitating an awful lot of money laundering. He would say crypto is a money laundering scandal with a crypto wrapper. And we would tend to agree. It’s just undeniable that trillions of dollars of illicit money flow around the economy today. And crypto was a convenient way for a lot of that money to be moved instantaneously. I mean, there is no real innovation in trying to hide money from governments. You might use a bit of technology and put a technical wrapper on it to add fuel to the pump and dump fire, but money is money. Money laundering is money laundering.

Doomberg

I could create a really fast-growing financial services company, just give away easy terms. There is no new tricks in the finance world. There is no such thing as financial innovation. They’re just new tools and tricks to circumvent the rules that everybody knows and should be playing by.

Albert

This is all music to my ears as I’ve been screaming at the top of my lungs for years about these pump-and-dump. I have taken so much flak from people with the “stay poor” comments. This is just absurd. I mean, everything that’s happening in the crypto space is absolutely absurd. Newsroom is right. It’s like the SEC has to drop the hammer here. They got to really hammer some people and throw them in jail. Take their money, throw them in jail, just take their firms, collapse their firms. Something’s got to happen.

Tony

That’s a good point. Albert, how far do you think this goes? I mean, do you have high-profile billionaires who get ensnared in this without naming names? No, you don’t get high profile billionaire. So do you get celebrities who’ve been ensnared in this? I think that’s already happened a bit. But does that become more widespread?

Doomberg

Yeah, sure.

Albert

You’re going to have some scapegoats out there, a couple of middle management guys, some Shaquille O’Neill and whoever else is in trouble with the FTX pumping and dumping advertisements. Yeah, you’re going to have those people. But the guy sitting at the top lined Washington’s pocketbooks and campaign finances, and they’re not going anywhere. Simple as that, right. They get tipped off. They get protection from the DOJ, Biden’s DOJ. The Democratic donors are fine. It’s as simple as it is. The Republican donors just didn’t play this game at the moment, so they really don’t have that much to worry about. But everybody else, they’ll be fine in Santrope and San Barts and whatever.

Tony

So, as usual, it’s the second 3rd, 4th tier of people. Of course you go to jail.

Albert

Of course.

Tony

And if you’re not American, it helps to facilitate that as well.

Albert

Of course. Living in Singapore, Dubai, Monaco, all these other areas. Gibraltar. Name your small little enclave of financial services providers.

Tony

Doomberg, what do you think about that? How far does this go?

Doomberg

I don’t know. We’ll see. That’s the piece we’re putting out. I think it’s very possible that it goes into venture capital.

Tony

I hope so.

Doomberg

And there’s some big names and some big firms. They all knew what they were doing. They did. And if that money wasn’t coming in from VC, none of this would have grown to this level. And so I think exchanges are just the first domino. It depends on the politics of it. Venture Capital. Silicon Valley bank collapsed. A lot of their behavior over that weekend is also being scrutinized, I think. And of course they’re trying to blame it all on short sellers. But in reality, we all know what really happened. And so it’s no coincidence in our mind that Silicon Valley Bank was among the early failures here because they were, of course, knee-deep in all of this crypto financing on the venture capital side, signature and silvergate coming thereafter too. So we shall see that the piece we’re putting out is sort of planting a flag that this could spread to the VC space. And if I was in the VC space and had participated in these, I’d be lowering up.

Tony

Oh, absolutely. And donating.

Doomberg

Yeah, well.

Albert

Throw some money around, right?

Tony

Exactly. Protect yourself. Albert, thank you so much for this. This has been really informative, guys. Please look out for Dunberg’s piece. And there’s a lot more to come on this, so thanks, guys. Thanks so much for your time, and have a great weekend and a great week ahead. Thank you.

Doomberg

Thank you.