AI-powered market forecasts with CI Markets: https://completeintel.com/markets

In this Week Ahead episode, Tony Nash, Michael Belkin, Tracy Shuchart, and Albert Marko discuss various investment opportunities and market trends.

Michael emphasizes the importance of sentiment and positioning in the market, predicting a sentiment reversal and a potential liquidation squeeze out of tech stocks and into energy, financials, and China. He also highlights the under-owned nature of the energy sector and suggests investment opportunities in energy stocks, particularly at the point of maximum pessimism.

Michael draws parallels to Sir John Templeton’s advice on buying at the point of maximum pessimism and selling at the point of maximum optimism. The conversation also touches on the Federal Reserve’s interest rate decisions and inflation concerns.

Albert agrees with Michael’s assessment on tech stocks being overvalued and predicts a potential resurgent US dollar, albeit remaining range-bound. He discusses the impact of a stronger dollar on Europe and emerging markets.

Albert also expects a trend of contraction in money supply for another month or two, followed by an expansion. The discussion further explores potential investment opportunities in China’s large-cap sector, driven by efforts to ignite optimism among Chinese investors, while acknowledging the risk of the Taiwan-China conflict.

The speakers also touch on the potential for a rally in small caps, driven by rotation and the consensus being long on large-cap tech stocks.

Additionally, the episode highlights the impact of the dollar on commodities, particularly crude oil. Albert predicts a range-bound crude oil price between 75 and 85, unless a geopolitical issue arises.

Tracy discusses refinery margins and the strength of crack spreads, noting the strengthening diesel prices and the focus on refining diesel for better margins. She also emphasizes the importance of considering fundamentals in commodity prices and highlights the current high demand for oil, surpassing pre-pandemic levels.

Lastly, the conversation mentions OPEC’s voluntary cuts and their preference for a stable market with a price range of $80 to $90 for Brent crude. The group is seen as cohesive and unlikely to deviate from the cuts. The episode also briefly touches on the impact of Rhine River levels on manufacturing in Northern Europe, noting a recent return to normal levels that will take time to alleviate the backlog of products.

Key themes:

1. Forget AI. Real Equity Opportunities

2. Inflation, Fed & Treasury

3. More Crude Supply Cuts

This is the 74th episode of The Week Ahead, where experts talk about the week that just happened and what will most likely happen in the coming week.

Follow The Week Ahead panel on Twitter:

Tony: https://twitter.com/TonyNashNerd

Michael: https://twitter.com/BelkinReport

Albert: https://twitter.com/amlivemon

Tracy: https://twitter.com/chigrl

Transcript

Tony

Hi and welcome to the Week Ahead. I’m Tony Nash and today we’re joined by Michael Belkin. Michael runs the Belkin Report, which is the hedge fund advisory service. We’re also joined by Tracy Shuchart and Albert Marko. We’ve got a few key themes today. The first is a report that Michael just put out talking about forgetting AI and looking at some real equity opportunities. And we’ll go through some of those opportunities in detail. We’re also going to get some information from Albert on inflation, the Fed and treasury. So what direction are those going and what can we expect there? And finally, Tracy is going to round us out with some discussion about crude supply cuts and a few other issues there.

Tony

Before we get started, I’d like to let you know about a promotion we’re doing for CI Markets, our forecasting platform for stocks, ETFs, indices, commodities, currencies, Forex, and economics. For the next two weeks, we’ll buy the first month of CI Markets for you. Go to the link to find out more. At checkout, use the code 25OFF. That’s the number 2, the number two number 5, and the letters O, F, F. This will give you the first month free when you subscribe to our $20 or $25 a month plans. Get fresh market forecasts every week, accountable forecasts where CI discloses our error rates and a growing set of capabilities. We’ve just launched the top 50 US ETFs Nasdaq 100, Nikkei 100, FTSE 100, and so on. Check out CI Markets today and use the promo code 25off. Thank you.

Tony

Guys, thanks so much for joining us. I know you guys are busy all week long and I always appreciate this recap at the end of the week and the look forward. Michael, thanks for joining us for the first time. Last week you issued a report titled Forget AI, the Real Opportunity is in Energy and China. So as an AI company, I won’t take offense, that’s totally okay. But we’re going to dig into this. Before we get into some of your predictions, can you walk us through your set up? What are you seeing in recent months that have really brought you to some of these predictive conclusions?

Michael

Okay, thanks for having me. My background, I came out of UC Berkeley Business School and I studied statistics there. My main drive is forecasting. I use a form of time series analysis, proprietary algorithm that I developed based on my studies. It’s similar to foray or box Jenkins ARIMA models. I was in proprietary trading at Solomon Brothers and my model gives a 12 period forecast weekly data that’s the next three months. My time horizon is three months, most of the time, can be longer or shorter. But the model gives direction, position, intensity, direction, up, down, or neutral position, beginning, middle, end, and intensity or confidence interval. I’m looking for the strongest signals and try to get in at the beginning. And most of the time, the model will be buying stuff that’s down and selling stuff that’s up. Buy low, sell high is what you’re supposed to do, right? But that can be relative. That’s not just the market indexes. So the indexes are obviously high up here after this big rally. But okay, that’s what I do now. It’s really effective on sector rotation. And just to give you a little bit of background, I was really bullish on tech and the market starting last October, October 17th.

Michael

So October through March, really bullish on tech. I was totally wrong in Q2. It overshot to the upside. My favorite stocks were the FAang stocks, and then they overshot and went three months higher. But that didn’t change the forecast, so it’s really gotten stronger. So right now, the model forecast direction for tech down, direction for energy up. That’s relative in absolute terms. So just to flesh that out, in July, the USO crude oil ETF was up 15 %, OIH Energy Service was up 20 %. The model has a similar forecast for China, by the way. M y strongest long ideas are energy and China. In terms of the position, remember, the model gives direction, position. I think of it in terms of innings, we’re probably like second, third inning of a relative and absolute move up in energy and China, both relatively depressed. Turn that around on tech. Tech just looks terrible to me, really overowned. Direction down, intensity strong, position early, just starting. And to flesh that out, just to finish up on this little idea. This week, the tech sector is down 3 %, XLK, and the energy sector, XLE, is up 3 %.

Michael

So I ran that chart a few weeks ago in the report. Long energy, short tech, that’s the trade. That’s what hedge funds do. You’re supposed to be market neutral, have longs and shorts. That spread is up 6 % this week.

Tony

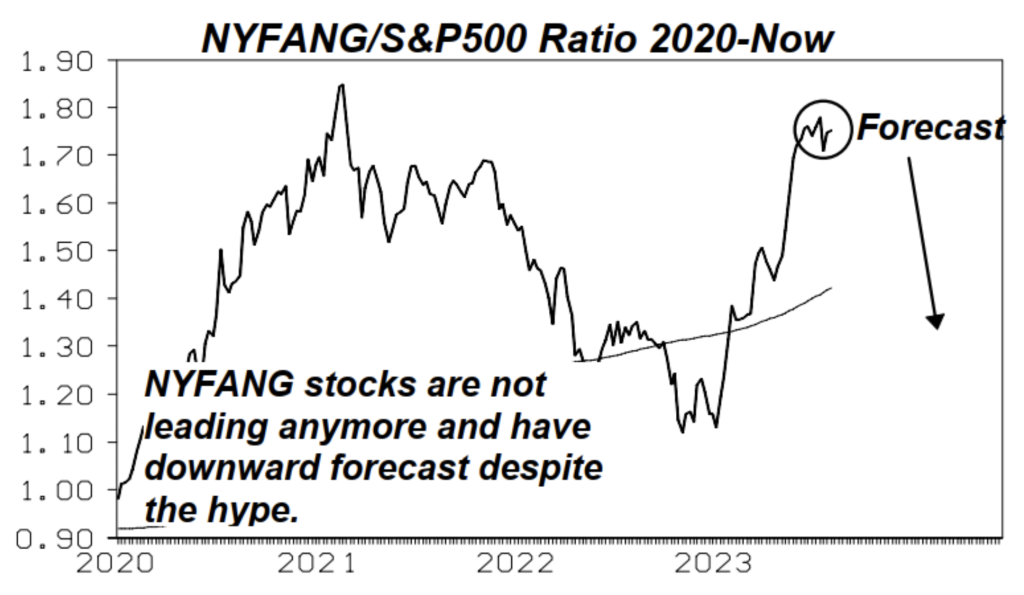

Fantastic. Very good. Can you walk us through, Michael, some specifics? Let’s look first at tech. You have this chart on the New York Fang to S&P 500 ratio.

I know you give us a little bit of background on what’s happened in July, but can you talk us through your forecast and what you’re expecting in the coming months there?

Michael

Okay. So as far as the black box forecasting thing, which I do, I also wear investment strategist hat. The investment strategist hat is how do the pieces of the puzzle fit together, what’s going on out there. And I’ve been doing the Bellcon Report. I left Solomon 1992, so I’ve been doing this for what, 31 years now? Egads. Anyways, sentiment is really important. Sentiment and positioning. And this is one of those times where people have just been squeezed into this stuff. One of one of my clients is a alpha capture fund. They run my stuff, have 50 positions. And I talked to the guy yesterday and he told me everybody has long fang stocks. I mean, that’s just anecdotal, but they have 180 contributors sell side by side. And he said something like, well, you got to tell your investors at the end of the quarter. If you’re not invested in the video, they’re going to want to know why. So all these people, there’s this huge squeeze. People are over positioned. They’ve been squeezed into this stuff because it’s work, but it’s yesterday’s story. I think we’re set up for a sentiment reversal. Nobody likes energy.

Michael

By the way, tech is 29 % of the S&P 500. Communication services, 9 %. So both tech. That’s 38 % of the index. I’m not particularly bullish on the indexes. S&p, Nasdaq, there’s too much tech in it. Energy sector is only 4 % of the index. Financials, I’m also bullish on financials. Financials are 12 %, so that only amounts to 16 % %. So you’ve got 38 % that wants to go down and only 16 % that wants to go up. So it’s not particularly bullish scenario, but mainly it’s sentiment. So I think there’s a huge pain trade ahead. People got squeezed into these stocks Now they’re rolling over. They’re not going up anymore. Look at Apple, it was down. I mean, it was only up 1 % in July. It’s down on the day. Amazon’s up. But these things are turning into a big pain trade, basically. So I think there’ll be liquidation squeeze out of tech, out of Fang, into this other stuff, energy and financials and China.

Tony

Michael, I’m hearing more about unannounced layoffs in tech coming. So what I’m hearing would me hear what you’re expecting. So it feels like there is some pain in those companies that really isn’t being talked about, or at least some expected pain.

Michael

Yeah, true. So you’ve got AI now. I’m not a Luddite, right? I use Kwan. I use this stuff. I mess around with these chat things, but they give me hallucinatory answers, some of these. But if you go down beyond Fung, a lot of tech stocks… So the Bellcon Report covers all the different groups, computers, software, communications services, cybersecurity, all these things. And I run the groups relative the index and the sector, and then the stocks relative to the groups. And there’s a lot of stocks that have been acting like crap, even while the Fung stocks have held up. So AMD is supposed to be one of the leaders, right? They came out with okay earnings, and then they opened up on the high and reverse sharply yesterday. So I think that’s a pattern. And as you suggest, a lot of the stocks that are not the headline super large cap ones, they’re not doing so great. And it’s not like a tech collapse yet, but again, second, third ending. It reminds me a little bit of the height of the TMT bubble, 2000, if you were around back then. A lot of stocks acted better after that.

Michael

In 2000, March 2000 was the top. Tech stocks started trading down big time. The internet was a thing then. It wasn’t going away. But a lot of the companies turned out to be not frauds, but they just didn’t last. The stocks went down 90 %, they just didn’t hang up.

Tony

They didn’t survive. Is a thing, but a lot of these companies are… We’ve talked about this before with Albert, a lot of these companies, AI may not necessarily be the main thing, but it’s a thing. It’s a real thing. Ai is not going away, like you said, the internet is not going away.

Michael

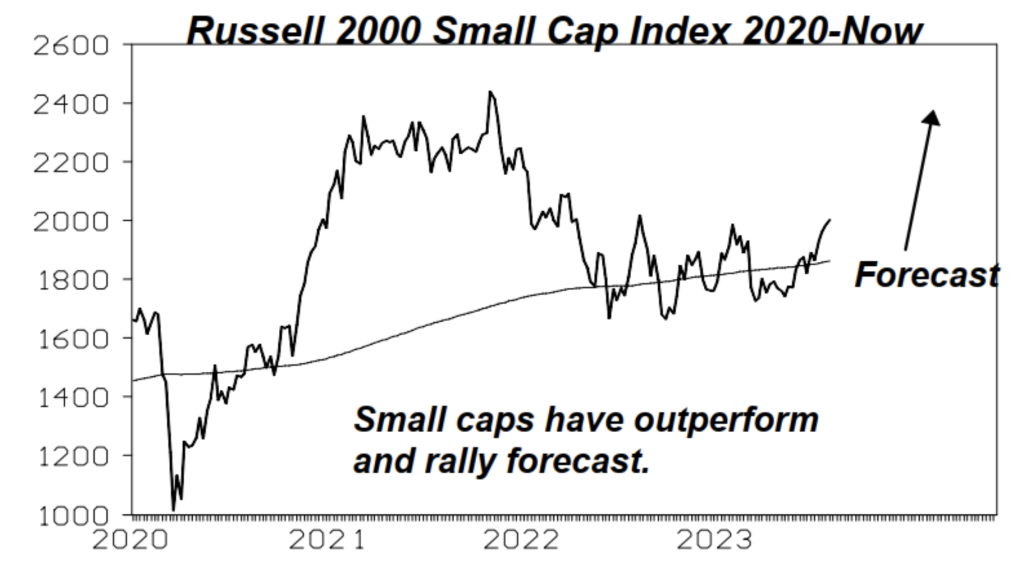

Right. Microsoft back then was the headline stock, and that certainly survived. But the stock went down 80 % or something over the next couple of three years from the high end. I’m not predicting anything that dramatic. I don’t know. I only look three months through here at the moment. But generally, it just makes me nervous on the market. I’m bullish. We’re going to talk in a minute about the Russell. Russell 2000, no tech stocks in it, no FAang. I mean, it’s got some smaller tech stocks, but it doesn’t have the weight of the FAQ stocks. So that looks like it wants to outperform, even though a lot of the companies there, they’re not doing so great. But just in terms of flows and what happens, it’s like there’s a squeeze out of big tech into other stuff.

AI

Great news, traders and investors. CI Markets has expanded its coverage to include stocks from the S&P 500, Nasdaq, Nike, FTSE 100, and the top 50 ETFs. With more than 1,500 forecasted assets, our AI-powered platform provides highly accurate forecasts. Join our community of successful investors who rely on CI Market’s insights to make informed decisions. Subscribe now for as low as $20 per month and unlock the power of comprehensive forecasting. To learn more or book a demo, visit completeintel.com markets.

Tony

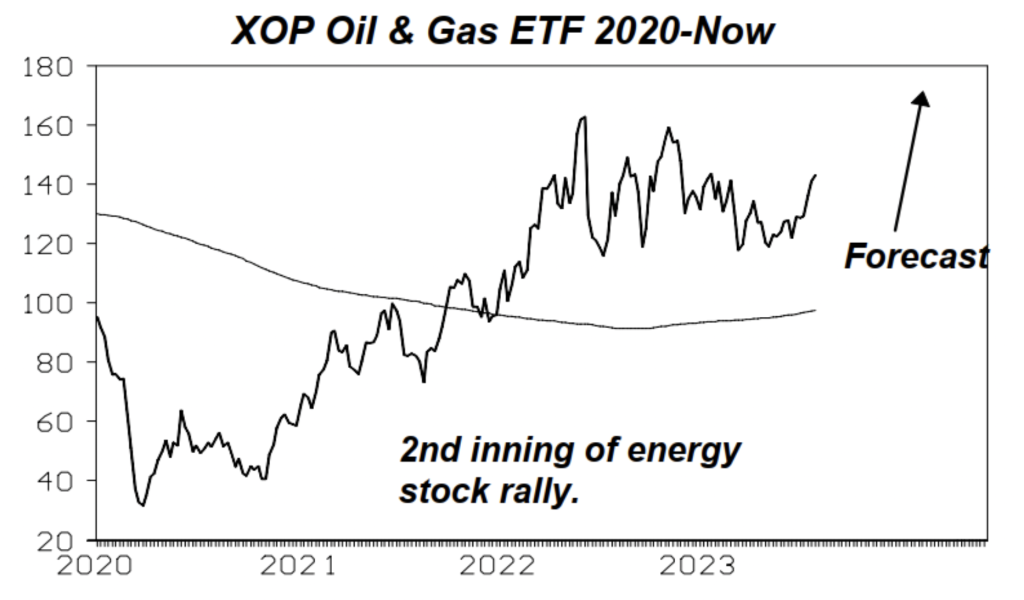

Let’s speak about other stuff. Let’s talk about energy. You have a chart of XOP oil and gas ETF. Can we talk about that? Energy is pretty unloved or has been pretty unloved. Let’s talk through that a little bit here. I’ll look on XOP. Okay.

Michael

By the way, so I talked to my Alpha capture guy. By the way, I’m ranked number two in that out of 180. I’m up 15 % market neutral in Q3. So that’s after a month. And the point is, I talked to him and I said, Is anybody… He doesn’t tell you what other people are doing exactly, but he just gives you an overall view. So it’s a good picture of how people are positioned. I said, Is anybody long energy stocks? He said.

Michael

Long tech stocks. I think people are not in this ESG. You’re not supposed to own this thing. It’s not green. It’s carbon capture. It’s the end of the world. We know we’re all going to be living on windmills and solar. I’m into this. I have a geothermal heating system in my house. Again, I’m not a Luddite. But just in terms of investment opportunities, it’s underowned XOP. Again, second, third inning. It’s been definitely quiet on my end. I’ve been pushing this for a couple of months. It’s been working. Do I get calls about it? No. So I think people are still like… A lot of my clients have been with me for a long time. They don’t call me. I know they pay attention to what I say. But in general, I just think… Remember Sir John Templeton, right? He said the time to buy is at the point of maximum pessimism and the time to sell is at the point of maximum optimism. And that really holds true. I think energy point of maximum pessimism, maybe we’re a little bit past that. We’re only a couple of innings past that. Tech, if you get a point of maximum optimism. So from Sir John Templeton’s perspective, it’s time to buy energy and sell tech.

Tony

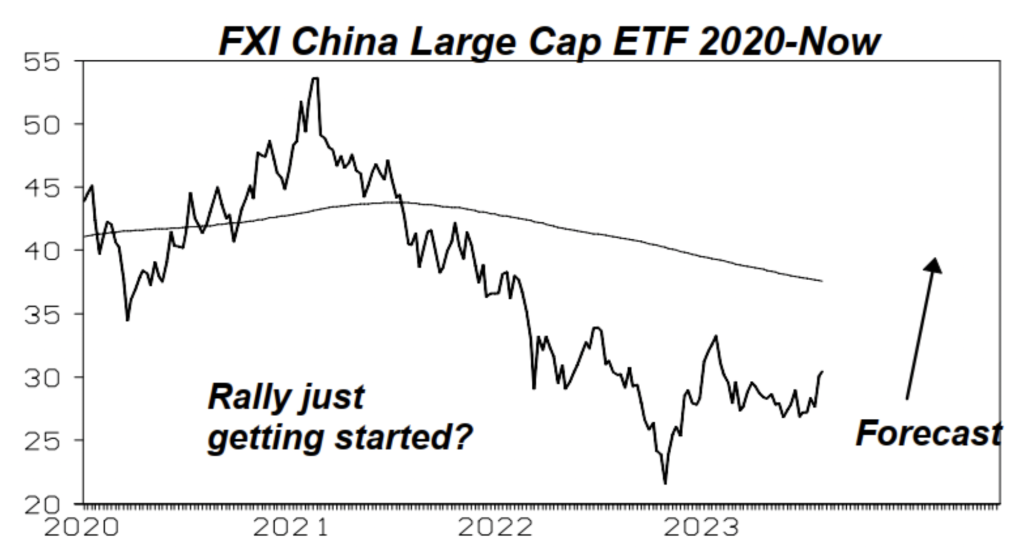

That’s great. I can hear. Yeah. Tracy has been saying this for a while, and we just continue to see headwinds there. But like you say, the performance over the past couple of months has been really good. Let’s also talk about another unloved sector is China large caps. For political reasons, for economic reasons, for failure to launch reasons after COVID, China equities remain unloved. So can you talk us through why do you see some upside in China?

Michael

Okay. Again, direction, position, intensity, the model just turned me on to China about a month or two ago. Really looked bottomy, had a few zigs and zags. Then it started to go up. It’s not up this week. It’s underperform. Fxi is the ETF down 2 % this week. But again, it looks very similar to energy in the forecast. Second, third ending up. And then investment strategist hat looking for a catalyst. What’s going to make… Let’s talk about catalyst for a second. One for China. So all of a sudden it’s stimulus, stimulus, stimulus, and they’re not running out the baz, right? It’s like little… But it’s something every day. The authorities in China are talking to the brokers saying, What do we need to do to make people more optimistic on the market? By the way, Chinese investors, the Chinese, the CSI 300 and Chinesex, they’ve been dogs. And the Chinese investors have lost hope in their market, which to me, from a sentiment perspective, is positive because then you get squeezed into it. So they’re trying to ignite optimism among Chinese investors. Foreign investors, Tiger Global blew up on Chinese stocks. Now they came out with a news story.

Michael

Tiger Global’s Long Apollo. They’ve turned away from Chinese tech stocks and they’re into financials, which is okay. But I’m just saying anecdotally, there’s room for people to get squeezed back into China. Of course, the risk there is the Taiwan Chinese conflict. I watch that very closely. You never know if something’s going to come out of left field. I’m sure that makes people little nervous. But by the way, I want to mention one other thing about catalyst for energy. The Biden administration Energy Department was selling the Strategic Petroleum Reserve, SPR. They’ve been draining it by like, forget how much, 20 million barrels a week, I think on average over the last three months. That ended about three or four weeks ago. They were using it for a cookie jar to depress gasoline prices for political reasons. I don’t want to go there, but that’s not what it’s for. If you go to the ESPR, it says it’s for severe disruptions in energy supply, of which there hasn’t been any. So anyways, they emptied the thing as far as they can take it. And now that was an artificial depressant on the crude oil price that kept crude oil.

Michael

The model was short previously earlier in the year, but that’s over. So there’s a catalyst now. So now they’re in an arm wrestle with OPEC, OPEX, and Russia’s cutting production. So I think there’s a a catalyst for energy in terms of the end of the SPR drain, and there’s a catalyst for China in terms of fiscal stimulus coming out of the Chinese Politburo. Everything over there.

Tony

Great. So all of this talk about fiscal stimulus that we saw in the first six months of the year post opening that was hollow, we’re starting to see some traction there from the NDRC in China, from the PBOC. What are your thoughts on a DVal? Do you look at C&Y? Do you have any thoughts on whether we’ll see a C&Y DVal?

Michael

Yeah. So I’m neutral on the dollar at the moment. The direction, position, intensity, remember, sometimes position, direction is neutral. So I don’t have a strong opinion on the dollar at the moment. So that could be coming up, but I don’t have a firm answer from the model for you. I’m just standing aside in the currencies. So that doesn’t factor into my China view at the moment.

Tony

Okay, good. Yeah, neither do we. We’re not seeing strong either way in the dollar. So I definitely agree with you there. Let’s close out with small caps.

You mentioned some things about the Russell 2000, but I want to go into that a little bit more detail. So you’re showing small caps out performing and forecasting a rally. And so help us understand why. Is that just on a relative rotation basis or what does that look like?

Michael

Yeah, it’s a rotation thing. So again, squeezed. So like I said, I’ve been doing this for 30 something years now, right? My original clients were what I call the hedge fund mafia, the tigers and steinhearts of the world. I have clients all over the world. And by the way, if you have international viewers, there’s nine innings in a US baseball game. I get questions about this when I say you’re in the second or third inning, they say, Well, how many innings are there? But anyways, I’ve seen over the years, I’ve seen this consensus get squeezed into stuff short at the bottom and long at the top. I’ve seen it over and over and over. And it’s them reversing that causes these major inflections in sector and index rotation. So right now, I think unequivocally, these guys are long, large cap tech stocks. I don’t want to mention any names, but I shudder some of my clients who are, again, just household names, big guys. I see them saying, Oh, yeah, we’re long fang stocks. We’re long in the video. And I just shudder because I know I’ve seen this before. I’ve seen this movie. It’s just like play the movie over again.

Michael

What happens, it turns into a dump. So it starts going down. They’re overloaded. Loaded on it. They have to sell and they say, What do I buy? So getting back to the Russell 2000, they’re not in that. You know what I mean? It’s not a thing for them. So just from a rotation perspective, again, I’m not a bubble person. I don’t think this lasts forever. So where are we now? Beginning of August, right? So I’ve got the indexes look like they’re a long hold, barely. S&p, again, they’ve got so much tech in them, going up into maybe late September, sometime September, October. That’s when I start getting nervous. The Russell looks fine. And by the way, one little observation on that. So I run all these groups and stocks. That’s why I spend my weekend doing 12 hours a day, Friday through Monday. And I still see a lot of stocks that want to go up. Cyclical stocks stocks, chemical stocks, basic resources stocks. In Europe, there’s a lot of China plays. So basic resource sector in Europe. I do sector rotation in Europe. It’s really depressed, it looks like. And these are stocks that are related to Chinese demand, base metals, things like that, want to rally based on the China recovery.

Michael

And it’s not like a complete… I wouldn’t say it’s not like one of the previous huge stimulus packages in China. It’s more like a mini bubble. But we’re setting up for China rally that could feed into energy small caps in the US for another couple of three months. That’s as far as my forecast runs right now.

Tony

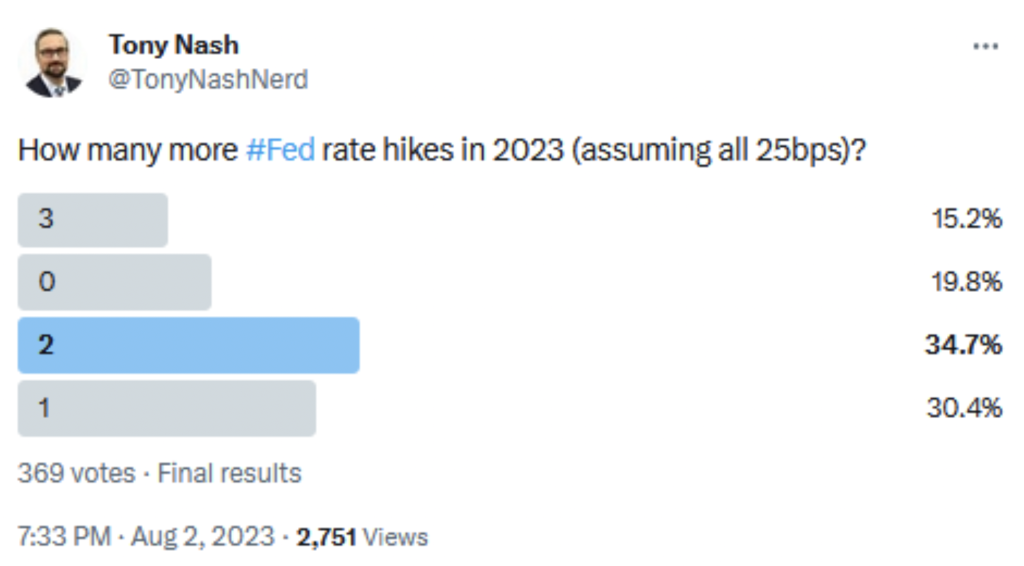

Great. That’s great, Michael. I appreciate your openness on, Hey, this is a rotation thing. It’s not necessarily a long term rotation. And to Russell, I appreciate your openness on that because I think that really helps people understand the basis of why you’re looking at these things. So thank you so much for that. Albert, can you help us look at a little bit more the macro situation? You’ve been saying for months that the Fed will likely raise to 6 %. So I put up a little survey this week to see what people thought. It’s interesting to see that 80 % of people see at least one more hike, and 50 % see at least two more hikes this year in 2023. So do you still think we’ll be at 6 %?

Albert

At 6 % or just below it. I mean, what does it matter at that point if we’re at 5.75 % or 6 %? And I would like to say that Michael is pretty much exactly right on the whole tech thing being overvalued at the moment. I’ve been saying that for quite a while now. As they pump this market using those magnificent seventh tech stocks that the liquidity just pours into commodities now and rallying the market just is an inflationary problem. And for the past few months, you can look at the headline of inflation at 4 % and 3 % handle. But you look at core, it’s not going anywhere but staying steady in the 5 % range. And I think that the next CPI report is probably going to surprise to the upside. I mean, we continue with the wage inflationary. We continue with the TGA being used by treasury for liquidity inflationary. I mean, we look at these policies going into an election year and all of it looks inflationary to me. I don’t see anything where the Fed or the treasury is acting where they really want to combat inflation. And I have to question why at the moment.

Albert

The only thing that we can look at is the US dollar at this point because they’re not going to go over 6, 7 %, 8 % or some people saying double digit rates right now. That’s just silly. I mean, that would be catastrophic for the US economy in the market overall. So from that point, I want to see what the US dollar is going to do in the next three months.

Tony

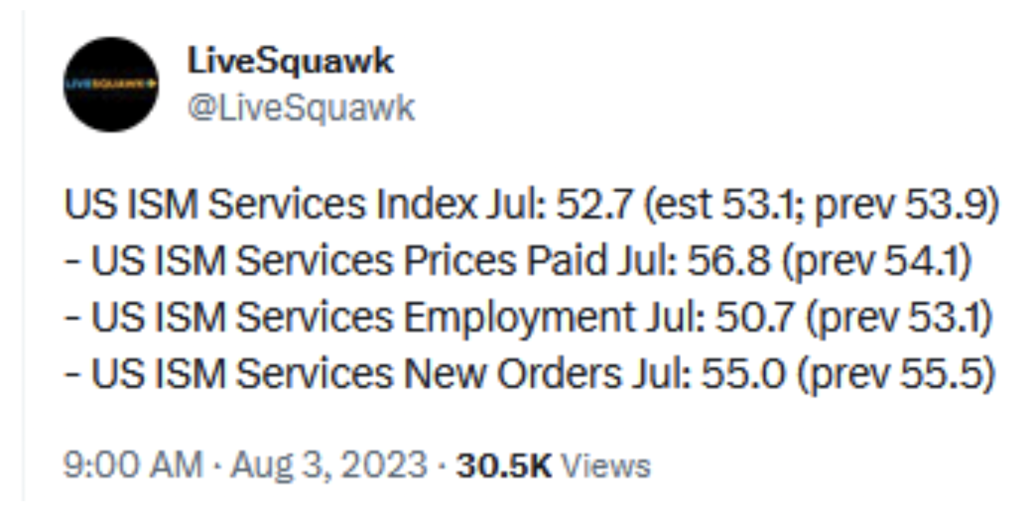

Okay. So in terms of inflation, we had the services PMI coming on Thursday. And I think a lot of people want to believe that we’ve defeated inflation. And we saw the ISM services prices paid at 56.8 %, which is relatively higher than it was in the previous month. So you’ve been on this persistent inflation message for over a year. So this doesn’t surprise you.

Will we see a resurgent US dollar, or are we in the ballpark rk? And what factors would play into that?

Albert

I think that the US dollar is probably going to be the range bound between 100 and 110 on the tick seat, only because starting to get over the 110 range into 115 is problematic for Europe. I mean, they’re already having problems as it is. I mean, you talk about a 115 dollar, 120 dollar and emerging markets, which Europe is in reality is going to be problematic.

Tony

Especially as they’re buying so much net gas from the US, right?

Albert

Yeah, of course. Course, because they’re not allowed to buy from Russia. We won’t talk about those tankers going in the Rotterdam, but that’s for a different conversation.

Tony

Right, exactly. What’s your view on money supply? I was doing some calculations earlier this week. We’re still $2.1 trillion dollars over what our, say, Feb 2020 money supply growth rate was. We grew at 5 % a month for, I think, four months in 2020, and then it’s ratcheted down bit by bit. But we’re still 2.1 trillion dollars over where we would have been had that not happened. So I know what’s happening with the TGA, but do you believe we’re going to see a continued drawdown of M2? Obviously, we’ve seen negative, we’ve seen a contraction of money supply for several months. We’ve had the odd positive month, but do you think we’re going to see a focus on M 2 contraction from the Fed as interest rates are, say, continue to be elevated?

Albert

No. I think it’ll trend down for another month or two. But coming into 2024, I think that they’ll just expand it once again.

Tony

Okay. So rather than lower rates, you think they’ll just continue expanding money supply?

Albert

Absolutely.

Tony

Okay.

Albert

And lower rates is a problem. Lower rates is going to be a problem for inflation, for their inflation fight. They start lowering rates and cutting rates back to 3 % or 2 %. You’re talking about CPIs again in the 7 8 9 handles.

Tony

Right. So this higher for longer narrative, you think rates will stay pretty consistent through ’24?

Albert

Oh, yes. It’s certainly gearing up for higher for longer. I think Andy Koston or Bob Woodward was talking about higher for longer forever now. The pivot and the pause crowd have been so loud over the past 12 months that it’s drowned out guys like that. But they’re absolutely right. It’s certainly higher for longer at the moment.

Tony

Okay. And so going back to Michael’s talk about outlook on tech, obviously, elevated rates, say, contracting money supply for the next few months, that definitely is not bullish tech. That’s not a bullish tech environment, right?

Albert

No, it’s not a bullish tech environment. We should even be here in the first place. It’s only because the S&P, like Michael pointed out, is heavy with tech names, and that’s what they’ve used to rally this market and rally the S&P. It’s absolutely silly that we’re even here. At some point, physics takes over and the numbers and fundamentals take over, and I think we’re close to that point at the moment.

Tony

Okay. Then with your dollar outlook, how do you think that impacts commodities? We ve seen commodities really up and down over the past couple of weeks as the dollars figured out where it wants to be. If we see the dollar trading in your range, do we see crude where it is now or what happens with things like crude and base metals?

Albert

Well, the crude, with the range that I pointed out of 100 to 110 on the Dixie, I think crude sticks in the 75 to 85, maybe 90 range at the moment. I don’t think that they even want… They won’t let it go up higher. They’ll just get into the futures market and start selling it down with brokers.

Tony

Okay. So we may be touching on 90.

Albert

In the next three months.

Albert

Maybe touching on 90. Obviously, it can’t count. Can’t sit there and speculate what geopolitical problem pops up out of the Middle East or the Black Sea or so on and so forth. But just on a numbers basis, I think we’re still going to stick between 75 and 85.

Tony

Okay. And that flows through Tracy to refiners and expiration companies and oil and gas companies along with Michael’s XOP thesis, right?

Tracy

Yeah, absolutely.

Tony

Okay. So do you expect refinery margins to start coming back more or are they good where they are? They just need some stability and higher base prices for a while.

Tracy

Is this question for me?

Tony

Yes, ma’am. Yeah.

Tracy

I mean, we are seeing those crack spreads start to gain strength once again. And so things are looking good for refiners. What I’m seeing is we’re seeing diesel prices strengthen not only in Asia, but in Europe and in the United States. So what I think will be happening is when we start to get to, say, the fall, where gasoline demand teters off as a seasonality thing, you’re going to have refiners go and start refining diesel because there’s just better margins on it.

Tony

Okay. And then what’s your view? If Albert’s dollar thesis remains and we see, say, over $100 between, say, 105 or so, how much does that impact dollar based crude prices and commodity’s prices? Well, it.

Tracy

Does and it doesn’t. I mean, everybody, there’s not a one to one correlation with crude oil and a dollar. If you look at it over the long term, it’s just not a one to one correlation. We have seen, for instance, last summer where we had USD prices completely divorced from crude prices, and they both went up together. And that’s happened often in the past before. And so it really depends on, for me, for the fundamentals. And then if we start to talk about the fundamentals, let’s talk about some demand numbers here for a little bit.

Tony

Let’s do that. And then let’s get into supply cuts as well.

Tracy

Right. So what we’ve seen, right, so we’ve had from China, India, and the United States, which are basically the biggest buyers this year. In H 1, we’ve seen about a 3 million barrel a day increase in demand from those three countries combined. Now, H 2 is forecast to see an additional 2 million barrels a day from just China and India alone. I think we’re over 20 million barrels a day. That’s pretty much I think where we’re going to stay for the rest of the year. And so although 2022 demand was not completely all the way up to 2019 demand, we have this year surpassed 2019 demand. Now, we’ve had a lot of negative sentiment on oil because everybody’s scared of this recession that’s just not here yet. And so there was a lot of negativity on that. That said, we haven’t seen demand can’t calm down at all. And I could argue also that demand is relatively inelastic. Even when you had, say, 2008, and 2020 is a different story because the whole global economy shut down. But you look at 2008, the last recession we had, global oil demand came back fairly quickly compared to everything else.

Tracy

But going back to where we’re at right now. So that’s where we’re at as far as demand numbers are. We’re over 2019 levels. We’re at literally all time highs in demand. And then you still have OPEC with their voluntary cuts. And as we just saw earlier this week that Saudi Arabia decided to extend their million dollar voluntary cut to September, which is not really a big surprise.

If you have studied Saudi Arabia, they like to do things in three months. So that’s their M. O. So going into the fall, we could have a serious problem with the market. Now, will OPEC react? Yeah, they can. But you have to realize that once they react, it takes a couple of months for that to actually filter into the market. In fact, we’re only just now seeing, as far as exports and things of that nature, the May cuts come in, not even the June and July cuts. Those haven’t even factored in. Even if they respond and we see oil prices kick up because the fundamentals actually kick in and people care about the market again and actually care about fundamentals, then they can react and I do think they will.

Tracy

They don’t want a spike in oil prices either. They would rather have oil prices steady and manage the market. They don’t really want to see the 130 spike that we saw February of 2022 after the invasion of Ukraine. That’s not really a stabilized market because then it becomes an issue for emerging markets and it hurts other economies. Then they stop buying your product. I think that $80 to $90 range for OPEC, for Brent is a good place for them to be right now.

Tony

Will we see other OPEC or OPEC countries follow suit with Saudi Arabia?

Tracy

It’s a very cohesive group. I’ve been saying this since the 2020 debacle that out of that catastrophe emerged a very strong cohesive group where we were used to seeing a lot of infighting, a lot of cheating, and things of that nature. And everybody just assumed that’s going to be the way that it’s going to be. But since 2020, we haven’t seen that.

Tony

Okay. So Saudi is the only one that will continue cutting. Everyone else will stay based.

Tracy

On the black and white. Yeah. There are cuts between… It’s not Saudi Arabia. Saudi Arabia is shouldering the burden of the cuts, but there are other six other countries that have the voluntary cuts to the end of the year. So we still have that 2.5 million cuts. And then this extra million was Saudi Arabia’s alone decision to do this. And it was just supposed to be for the month of July and August, and they now put that out for one more month. So it will include September as well.

Tony

Interesting. Okay, very good. Now, Tracy, I want to go back to something we talked about a couple of months ago, and I think we covered it again last month is Rhine River levels. And we talked about how there was drought in Northern Europe, and the Rhine River had fallen to levels where manufacturers upstream couldn’t receive the commodities they need to manufacture and so on. Can you walk us through some of the impact that’s had? And then you had this tweet earlier this week talking about how Rhine River levels are back to normal levels. Will we see an immediate impact or will that take some time for, say, German manufacturing to get back to normal?

Tracy

Yeah, that’ll definitely take some time just because of the backup that has happened because what was happening is what you have to do is you have to split your load because your vessel is too heavy to transverse the river. So you have to split your loads, which obviously takes a lot of time. So there’s a lot of product backed up still that needs to be shipped out. So it’s going to be a few weeks before I think we will really start seeing some allevi there. But it’s good, obviously, it’s very good news. And you can see the prices of some of these commodities that were very affected start to come down, particularly the softs and things of that nature.

Tony

Very good. So that’s good news for Northern Europe. So guys, thank you so much. This has been a great overview. Thank you, Michael, for your outlooks. Please check out the Belkin Report, guys. Michael’s got a lot more forecasting there and really solid. Michael, thank you. Albert, Tracy, thank you so much and have a great weekend.